The win rate is a popular performance indicator used in Forex trading to measure the success of a trading system or strategy. The win rate is the percentage of winning trades compared to the total number of trades executed over a specified period. A high win rate is often considered an essential factor for profitable trading, but there are other factors to consider before concluding that a high win rate is the key to success.

It is essential to understand that the win rate alone does not guarantee profitability. A high win rate could still result in a net loss if the average loss per losing trade is greater than the average gain per winning trade. The average loss and gain are equally important to consider when assessing the effectiveness of a trading system or strategy. It is important to strive for a favorable risk-reward ratio, which refers to the ratio of the expected profit to the potential loss on a trade.

Another factor to consider is the trading frequency. A high win rate could result in a lower frequency of trades, leading to lower overall profitability. Conversely, a low win rate could be offset by a higher trading frequency, resulting in a higher overall profitability. Therefore, it is necessary to consider the frequency of trades along with the win rate to determine the effectiveness of a trading strategy.

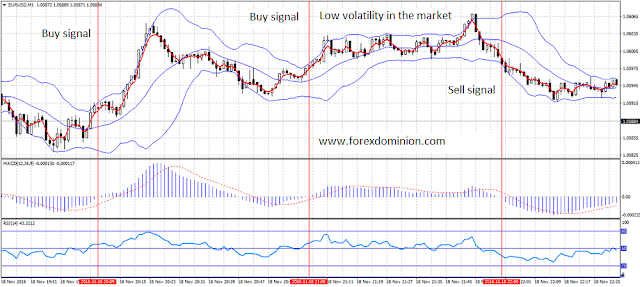

It is also essential to consider the market conditions when evaluating the win rate of a trading system. Market conditions can affect the win rate of a trading strategy, and the same strategy can produce different results under varying market conditions. For instance, a trend-following strategy could produce a high win rate in a trending market but could result in a low win rate or even losses in a sideways or range-bound market.

How is calculated the win rate?

The win rate is calculated by dividing the total number of winning trades by the total number of trades executed over a specified period and multiplying the result by 100 to get the percentage. The formula for calculating the win rate is as follows:

Win Rate = (Number of Winning Trades / Total Number of Trades) x 100

For example, if a trader executed 100 trades over a specified period and won 60 of them, the win rate would be calculated as follows:

Win Rate = (60 / 100) x 100 = 60%

In this example, the trader had a win rate of 60%, indicating that they won 60 out of 100 trades.

Interpretation of the win rate

A high win rate indicates that a trading system is good at picking winning trades, but the interpretation of the win rate should be done in the context of other performance metrics.

A high win rate alone does not guarantee profitability. For instance, a trading system with a 90% win rate could still produce a net loss if the average loss per losing trade is greater than the average gain per winning trade. Therefore, it is essential to consider other factors such as the average gain and loss per trade, risk-reward ratio, trading frequency, and market conditions when interpreting the win rate.

A low win rate may indicate that a trading system is not good at picking winning trades, but it could still be profitable if the average gain per winning trade is greater than the average loss per losing trade. For instance, a trading system with a 30% win rate could still be profitable if the average gain per winning trade is three times the average loss per losing trade.

Ultimately, traders should strive for a robust trading plan with a favorable risk-reward ratio that performs well across different market conditions for long-term success in Forex trading.

Drawbacks of the win rate

While the win rate is a popular performance metric used in Forex trading, it has several drawbacks that traders should be aware of when evaluating the effectiveness of a trading system or strategy. Some of the drawbacks of the win rate are as follows:

- Ignoring the average gain and loss per trade: The win rate alone does not provide a complete picture of a trading system’s profitability. A high win rate could still result in a net loss if the average loss per losing trade is greater than the average gain per winning trade. Therefore, traders should also consider the average gain and loss per trade and the risk-reward ratio when evaluating the effectiveness of a trading system.

- Ignoring trading frequency: A high win rate could result in a lower frequency of trades, leading to lower overall profitability. Conversely, a low win rate could be offset by a higher trading frequency, resulting in a higher overall profitability. Therefore, traders should also consider the trading frequency when evaluating the effectiveness of a trading system.

- Ignoring market conditions: Market conditions can affect the win rate of a trading system, and the same strategy can produce different results under varying market conditions. For instance, a trend-following strategy could produce a high win rate in a trending market but could result in a low win rate or even losses in a sideways or range-bound market.

- Focusing on short-term results: The win rate can fluctuate over time, and short-term results may not be indicative of long-term profitability. Therefore, traders should focus on the long-term performance of a trading system rather than short-term fluctuations in the win rate.

In summary, while the win rate is a useful performance metric, traders should be aware of its limitations and consider other performance metrics such as the average gain and loss per trade, risk-reward ratio, trading frequency, and market conditions when evaluating the effectiveness of a trading system or strategy.

Win rate vs. win-loss ratio

The win rate and win-loss ratio are two different performance metrics used in Forex trading to evaluate the effectiveness of a trading system or strategy. While both metrics are related to winning and losing trades, they have different meanings and interpretations.

The win rate is the percentage of winning trades compared to the total number of trades executed over a specified period. A high win rate indicates that a trading system is good at picking winning trades, but it does not provide information on the size of the gains or losses.

The win-loss ratio, on the other hand, is the average size of the gains compared to the average size of the losses. It indicates the size of the gains relative to the size of the losses and is a measure of the risk-reward ratio of a trading system. A high win-loss ratio indicates that a trading system produces larger gains than losses, making it more profitable.

Both the win rate and win-loss ratio are important performance metrics that traders use to evaluate the effectiveness of a trading system or strategy. However, traders should not focus on one metric alone but should consider a combination of metrics to get a more comprehensive view of the system’s performance.

For instance, a high win rate may indicate a good trading system, but it could still result in a net loss if the average loss per losing trade is greater than the average gain per winning trade. Conversely, a high win-loss ratio may indicate a profitable trading system, but it could still result in a low overall profitability if the win rate is low.

Therefore, traders should consider both the win rate and win-loss ratio along with other performance metrics such as the average gain and loss per trade, trading frequency, and market conditions when evaluating the effectiveness of a trading system or strategy. This approach provides a more comprehensive view of the system’s performance and helps traders make more informed trading decisions.

Conclusion

In conclusion, the win rate is a critical performance indicator that traders should consider when evaluating the effectiveness of a trading strategy. However, it is not the only factor to consider when assessing the profitability of a trading system. Traders should also consider the risk-reward ratio, trading frequency, and market conditions when evaluating the win rate. Traders should strive for a trading strategy that offers a favorable risk-reward ratio and performs well across different market conditions. Ultimately, a robust trading plan, coupled with sound risk management practices, is necessary for long-term success in Forex trading.