We continue with our article series on the XTB online broker. In this article, we will show step by step (in detail and with screenshots) how to open an account in XTB, the steps to complete the registration form, and the documents that the company requests to verify an account.

We will start by opening a live account and completing the verification process. In a later article, we will make a deposit to be able to trade. After performing a real trade, in the last article in the series, we will show the process to withdraw funds.

What is XTB?

XTB is an online broker licensed and regulated by the UK’s FCA (Financial Conduct Authority). It offers its clients more than 1500 different financial instruments for trading purposes as currency pairs, commodities, metals, energy commodities, and a good number of CFDs on stocks of international companies, indices, crypto, and more.

It offers 2 trading platforms: its own platform called xStation5, quite powerful, easy to use, and in web format, and the well-known MetaTrader 4 for those traders who are used to working with this trading software or who use automated trading systems (expert advisors).

The spreads on XTB are quite low (from 0.9 pips for Standard accounts and from 0.28 pips with commission per lot traded for Pro accounts).

You can get more information about the Forex and CFD broker XTB and its brokerage services in the following guide about this broker: Review of XTB

How to open an account in the XTB broker?

These are the steps to follow to open an account with XTB:

First of all the trader must enter the XTB website and register, by clicking on the “Create Account” button, as shown in the following image:

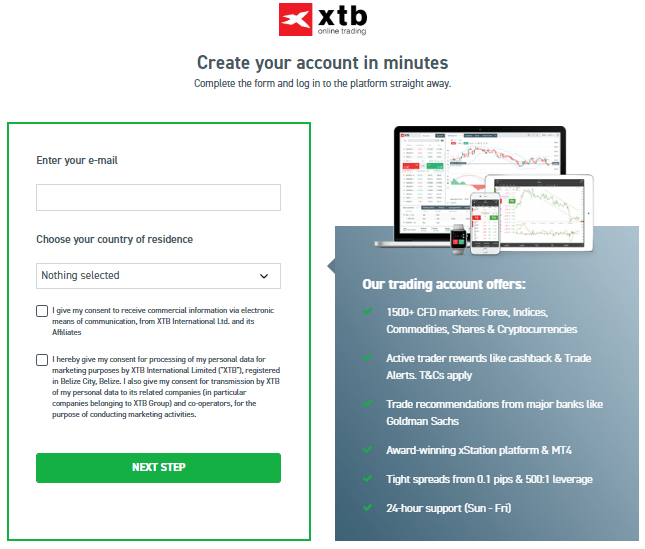

From here, the process to register a real account with XTB is as follows:

1-) To register your XTB account click here.

The first step is to indicate your email address and country of residence and click on the box in which you give your consent to be contacted by the broker:

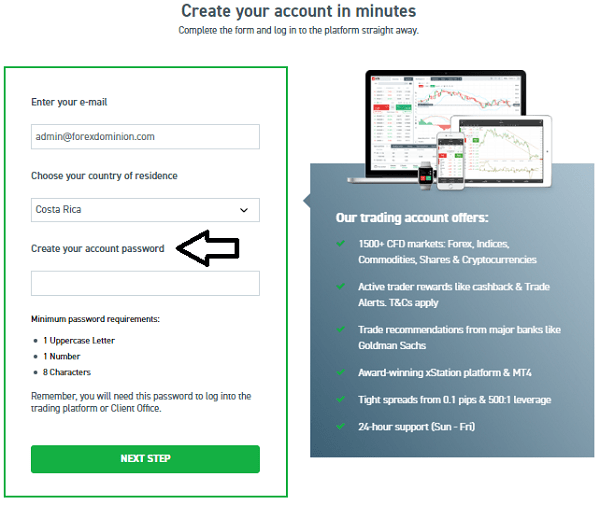

After clicking on the “Next Step” button, the XTB website displays a box to create a password with which you can access your trading account. After entering the password, click on the “Next Step” button again.

2– Next, the trader must fill out the registration form with the information requested by the XTB broker. These data are practically the same that is requested by any other online broker that is properly regulated. If you have never opened a trading account, it may be strange for you to be asked for information about your financial situation or your previous trading experience, but this is a requirement of the regulatory bodies to guarantee the adequate categorization and protection of clients and comply with regulations. against money laundering.

As we can see, here we must enter personal data such as the full name, mobile phone number, date of birth and country of nationality. In addition, we must indicate whether we are US citizens or not since XTB cannot offer services to people from the United States. When we complete this form we click Next.

3– In the next block, you must specify your address and click on the “Next Step” button again.

4– In the next point you must select several important characteristics of the account:

A) – The trading platform you want to use: If you already have experience trading with MetaTrader 4 you can select this option or opt for xStation which is XTB’s own web format platform. xStation is quite fast and easy to use, specially designed for beginners or traders looking for a simple platform where they can have everything they need without complications.

B) – The type of account: At the time of this review, the XTB broker offers 2 types of main trading accounts. The “Standard” accounts without commissions with spreads from 0.9 pips and the “Pro” accounts for traders that handle a greater trading volume, with lower spreads than the Standard accounts (from 0.28 pips) but with commission per lot traded.

C) – The currency of your account: You can choose between the available options such as EUR, USD or GBP.

In our case, we have opted for the xStation platform, the Standard A account, and the United States dollar (USD) currency. Finally, we click once more on the “Next Step” button.

Note: It is important to keep in mind that XTB actually offers two account types whose characteristics depend on the number of funds deposited by the client and the chosen trading platform. For example, if you deposit less than $ 15000 you will be trading with a Standard account, which does not charge commissions but has higher spreads from 1.6 pips. But if you deposit $15000 or more in the account, you will be trading with a Pro account, which offers better trading conditions, including low spreads from 0.28 pips but charges a commission of $4 USD per lot.

With this, the trading account is almost ready and we only have to indicate that we accept all XTB’s policies and agreements regarding the brokerage services it offers. At this point, we recommend reading all of these agreements. Although XTB is a regulated broker and has no reputation for getting its clients to sign unfair and compromising agreements, there may be something we don’t like and should be aware of.

After we have checked all the “I accept” boxes indicating that we accept XTB’s policies and agreements, we click Next.

Once we finish this step, our account is created in a few seconds and we can immediately access it on the following screen:

Account Verification

As soon as you access the “Customer Office”, you will see a screen like the one below that indicates that your account is still inactive and asks you for the necessary documents to activate it permanently.

Due also to the requirements of the regulatory bodies that supervise XTB, it is necessary that in order to trade with your account, you send them a proof that shows your identity and another proof that shows your current address:

– Identity document: You must send a copy of your ID, passport, or driving license. It must be an official document in which your identity is clearly visible and is in force (the document sent cannot be expired). You can scan any of these documents and send it in PDF, JPG and GIF or take a photo with your mobile if it is more comfortable for you. In any case, the image must have good quality and be completely readable, otherwise, it can be rejected by XTB.

– Proof of address: The client must send a document that shows his current address. For example, you can send a recent utility bill (not exceeding 3 months) for electricity, water, gas, landline, or the Internet (many brokers do not accept, for example, mobile phone bills). You can scan the document and send it in PDF, JPG, or GIF format or take a photo with your mobile. Like the previous document, all the data must be legible and have sufficient quality.

At this point in the XTB customer office, you can attach the corresponding files. If you have any problem proving your identity or address, it is best to contact the broker to see what alternatives they can offer you.

After attaching the files, they must be manually reviewed and verified by XTB. You will receive the following message:

In our case, the account has been validated and activated in approximately 15 minutes since we attached the documents (really fast, the fastest broker we have analyzed so far). Keep in mind that this verification period is quite variable and will depend on the day and time you send the documents. If it is a working day and within the working hours of the team that is in charge of this task, the process will surely be very fast as in our case, otherwise it may take a little longer.

If the validation of the documents is negative, carefully review all the requirements that we discussed above and if you have any questions, you can contact the customer support of XTB by online chat, phone, or email.

As soon as the verification of the documentation you have provided is positive, you will receive an email indicating that your account has been activated and is ready for trading.

After completing the previous steps you will have your XTB account open and active. In the following article (of this series of 3 articles) of our real experience testing this broker, we will explain how to deposit funds in the trading account to start investing.

| XTB | -STP broker from Europe specialized in Forex and CFD -Regulated by organizations such as the FCA -Tight spreads and low commissions | Visit Broker Website |