The Accumulation/Distribution Line is a technical analysis indicator that is used to measure the buying and selling pressure of a security. It is based on the concept that the volume of trading activity is a key indicator of market sentiment and that a change in volume often precedes a change in price.

The Accumulation/Distribution Line calculates the cumulative flow of money into or out of a security by taking into account both the price and the volume of trading activity. The indicator is calculated by multiplying the closing price of a security by the volume traded and then adding or subtracting that value from a running total based on whether the security closed up or down for the day.

When the Accumulation/Distribution Line is rising, it is an indication that more money is flowing into the security than out of it, which can be a bullish signal. Conversely, when the Accumulation/Distribution Line is falling, it is an indication that more money is flowing out of the security than into it, which can be a bearish signal.

Traders and investors often use the Accumulation/Distribution Line in conjunction with other technical indicators and analysis techniques to help inform their trading decisions.

How is calculated the Accumulation/Distribution Line?

The Accumulation/Distribution Line is calculated using the following formula:

ADL = Previous ADL + [(Current Close – Previous Close) / ((High – Low) * Current Volume)]

Where:

- ADL = Accumulation/Distribution Line

- Previous ADL = The ADL value for the previous period

- Current Close = The closing price for the current period

- Previous Close = The closing price for the previous period

- High = The highest price for the current period

- Low = The lowest price for the current period

- Current Volume = The volume of trading activity for the current period

The formula is essentially a measure of the flow of money into or out of a security based on the price and volume of trading activity. When the closing price is higher than the previous period, the ADL increases by a portion of the current period’s trading volume. Conversely, when the closing price is lower than the previous period, the ADL decreases by a portion of the current period’s trading volume.

The ADL is usually plotted as a line on a chart, with the direction of the line indicating whether there is more buying pressure (bullish) or selling pressure (bearish) in the market for the security. Traders and investors can use the ADL to identify potential trend reversals or confirm the strength of an existing trend.

Trading signals of Accumulation/Distribution Line

The Accumulation/Distribution Line (ADL) can generate a few different trading signals that traders and investors can use to inform their trading decisions. Here are some of the most common signals:

- Divergence: Divergence occurs when the price of a security is trending in one direction, but the ADL is trending in the opposite direction. For example, if the price of a security is rising, but the ADL is falling, this could be a bearish divergence signal indicating that the buying pressure behind the price trend is weakening and that a reversal may be imminent.

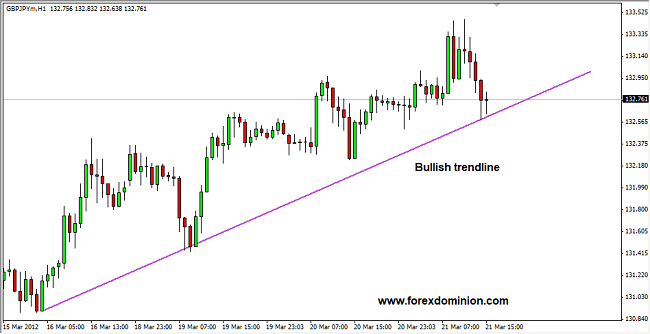

- Breakout/Breakdown: A breakout or breakdown occurs when the ADL breaks above or below a key level of support or resistance. For example, if the ADL breaks above a previous high, this could be a bullish signal indicating that buying pressure is increasing and that the price may continue to rise. Conversely, if the ADL breaks below a previous low, this could be a bearish signal indicating that selling pressure is increasing and that the price may continue to fall.

- Confirmation: When the ADL confirms the direction of the price trend, this can be a strong signal that the trend is likely to continue. For example, if the price of a security is rising, and the ADL is also rising, this is a bullish confirmation signal indicating that buying pressure is increasing and that the price trend is likely to continue.

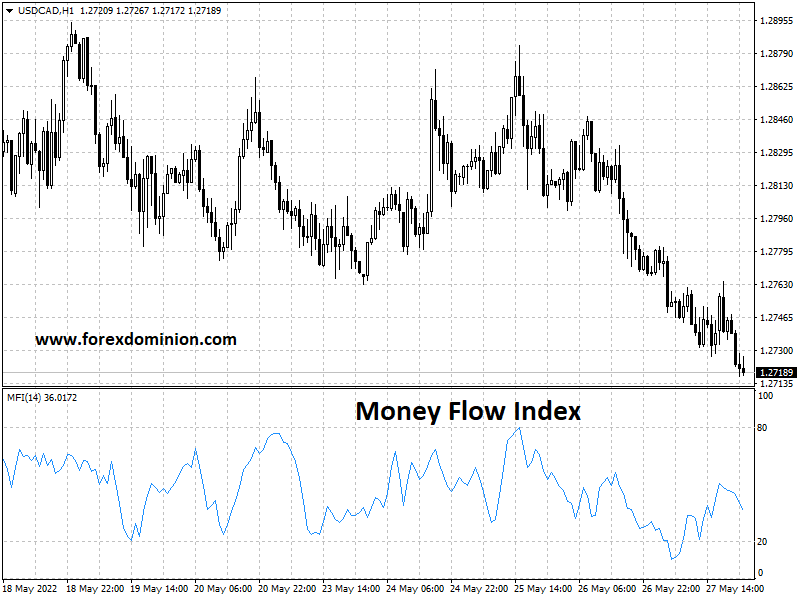

- Overbought/Oversold: The ADL can also be used to identify overbought and oversold conditions in the market. When the ADL reaches an extreme level, such as a high positive reading or a low negative reading, this can indicate that the security is either overbought (too many buyers) or oversold (too many sellers), and a reversal may be imminent.

It’s important to note that no single indicator should be used in isolation to make trading decisions. Traders and investors should always use multiple indicators and analysis techniques to confirm or contradict each other and make more informed trading decisions.

Accumulation/Distribution Line Analysis

The value of this factor varies between -1 and +1. In this case, if the closure is located in the upper half of the range, this means that the pressure on buyers is much greater than that exerted by the sellers and conversely, if the closure is in the lower half of the range, this indicates that the pressure of the sellers is greater than that produced by the buyers.

For a positive trend, if the indicator has a Money Flow Multiplier with a high positive value, along with a high transaction volume, this indicates that there is a great force behind this upward movement which is shown immediately in the value of the ADL.

In the case of a negative trend, if the indicator has a Money Flow Multiplier with a low negative value and with a high volume, this is a sign that there is enough force behind the downward movement.

It is precisely through the Volume Flow that this indicator confirms or contradicts the prevailing market trend. For example, when there is an increasing ADL while the asset price starts to drop, it indicates that the market is experiencing an increase in buying pressure. This is known as the bullish divergence between the indicator ADL and the price. This divergence often precedes a strong change in trend from bearish to bullish such as shown in the following example:

Accumulation/Distribution Line Advantages and Disadvantages

Advantages of the Accumulation/Distribution Line (ADL) include:

- Identifying buying and selling pressure: The ADL is a useful tool for identifying buying and selling pressure in the market. By tracking the flow of money into or out of a security, the ADL can provide insight into the strength of the current trend.

- Confirming price trends: When the ADL confirms the direction of the price trend, it can provide traders and investors with added confidence that the trend is likely to continue.

- Divergence signals: Divergence signals can be a powerful tool for identifying potential trend reversals or shifts in market sentiment.

- Volume-weighted: Unlike many other technical indicators, the ADL is volume-weighted, which means that it takes into account both price and volume of trading activity. This can provide a more accurate reflection of market sentiment.

However, there are also some disadvantages to using the ADL:

- False signals: Like any technical indicator, the ADL is not perfect and can sometimes generate false signals. Traders and investors should always use multiple indicators and analysis techniques to confirm or contradict each other and make more informed trading decisions.

- Lagging indicator: The ADL is a lagging indicator, which means that it may not provide signals until after a trend has already started or ended. Traders and investors should use the ADL in conjunction with other technical indicators and analysis techniques to provide a more complete picture of market conditions.

- Sensitivity to price movement: The ADL can be sensitive to price movements, which means that sudden spikes or drops in price can skew the indicator and make it difficult to interpret.

- Limited use in certain market conditions: The ADL is most useful in trending markets, where there is a clear directional bias. In choppy or range-bound markets, the ADL may not provide as much useful information.