- Bitcoin has depreciated 1% every day for the last month, highlights Glassnode.

- Analysts agree that demand is likely to continue to decline due to current market fundamentals.

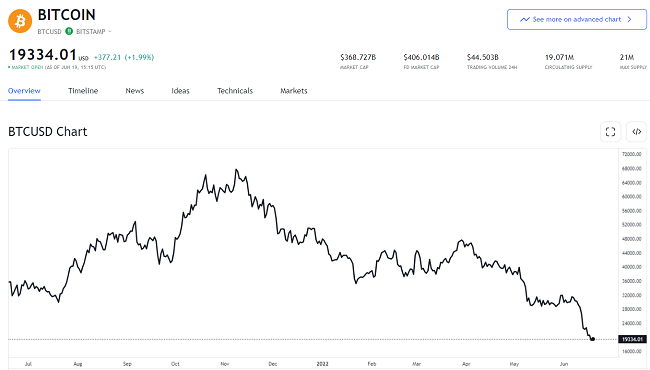

Bitcoin (BTC) turns ten days today without exceeding the USD 30,000 band, at the same time that its minimum price has been rising, behavior that shows that, although there is demand, it is not enough to make its value explode on the rise and we could be close to another fall.

In this period, the price of bitcoin has found temporary stability between the bands of USD 29,000 and USD 30,000. This calm reflects market consolidation after the industry sell-off following the collapse of LUNA and UST. An event that saw BTC hit $25,500 15 days ago, which was a low not seen since 2020.

However, the BTC support achieved at $29,000 could crumble if the demand force fails to get stronger to break above the prices it has settled at. According to financial analyst B. Ali, if bitcoin fails to break the $30,600 resistance level, it would fall further.

The specialist showed that in the last fifteen days a symmetrical triangle had been forming with the point to the right. That is, the price of bitcoin has gone to have smaller and smaller minimums and maximums, which shows weakness in supply and demand.

Specialists believe that bitcoin will fall in price soon

The failure of bitcoin to break above $30,000 could cause demand to lose even more steam and its price to drop. In this case, B. Ali expects the bulls to take a firm stance at support near $28,500 in the coming days.

Similarly, the latest report from Glassnode states that demand is likely to continue to see headwinds. For this reason, we could be seeing lower prices soon for bitcoin, something that has been in tune with its behavior lately.

Not only has bitcoin been down eight weeks in a row, but the study also indicates that it has lost 1% of its market value every day for a month. It points out that this type of behavior with “so mediocre” monthly returns is relatively rare. However, the study estimates that they are almost always associated with high-volatility drawdown events, such as the start and end of bear markets.

Along these same lines, the head of investment research at Valkyrie commented that this downward movement of bitcoin will bottom out in the third or fourth quarter of the year if it happens in 2022. Such a situation does not seem strange to many specialists who warn that BTC usually makes retracements of more than half of its price and then continues its uptrend.

Long-term bullish predictions for bitcoin continue

Cryptocurrency analyst Benjamin Cowen said, “If you look at previous moves and bear markets for bitcoin, the pullbacks have been less severe each time.” He recalled that the first was 94%, the second 87%, the third 84%, and the current one around 60%, going from almost USD 69,000 to USD 25,000.

“But if bitcoin were to drop more than 84%, then clearly the structure of the market is completely changing,” he added. However, like his colleague Jeffrey Ross, the managing director of Vailshire Capital, he maintains his long-term bullish view as he sees global interest in Bitcoin continue to rise.

Both noted that bitcoin has had the longest bull run in history, so stationary regression models may not necessarily hold as the macro environment changes.

In addition, they recognized that this is the first time that bitcoin is being impacted by the economic decisions of the United States Federal Reserve. Thus, he understands that his influence could prolong BTC’s rally as the market maintains a “risk-off” appetite.

Ross finished by saying that bitcoin could drop to $15,000 in a strong bear market. “But then there would be tons of people, myself included, backing the truck to buy as much as possible, so I don’t think it will last very long,” he concluded.