- In past periods, the maturity of Bitcoin CME futures resulted in price movements

- CME recorded record volumes in the month of May, moving more than 33,000 contracts.

On Friday, May 24, some 2,710 contracts expired for the equivalent of 13,500 bitcoins settled by the CME. The maturity of these futures contracts increased the volatility of prices in the Bitcoin market. Taking as reference the past values, it can be observed that in the days following this type of events, the prices of the cryptocurrency with the highest capitalization in the world begin to move.

The opening and maturity period of bitcoin CME futures contracts settled in cash from the Chicago Mercantile Exchange (CME), launched in 2017, has had a significant price impact throughout its operating cycle. The CME facilitates transactions for most derivative contracts in the world, allowing traders to have a degree of exposure to other financial assets without requiring their physical purchase, just as it has done with bitcoin.

At the beginning of April, the CME recorded the highest notional volume in a single day in its BTC futures products, exceeding USD 1.3 billion for a total of 33,677 contracts traded. In addition, volatility increased dramatically after the renewal of the most recent quarterly contract at the end of March, so similar actions should be expected later this month.

Since the end of the first quarter and in the course of the second, the US company specializing in derivatives, based in Chicago, has seen two consecutive months of sustained increases in its volumes, trading around USD 4.8 billion in April and some USD 6.6 billion in May, with an average daily volume of 14,000 contracts in this last month. This represents a growth close to 40%.

CME operates with trading periods ranging from quarterly to half-yearly, with the former having the greatest volatility load in the days following maturity. While it is true that the CME uses cash settlement, which would not have a direct impact on BTC cash volumes, the maturities of such futures tend to have a marked impact on Bitcoin and other crypto markets.

Next key area for Bitcoin CME futures

The next key area for the increase in volatility according to the maturities of the CME futures contracts, is associated with the expiration of the contracts from February 25 to May 31, when it is expected that some 2,710 contracts will expire for a total of 13,000 BTC. Although the price direction can not be determined with this event, it is likely that those trading volumes set the tone for the next substantial movement in Bitcoin.

Since its launch in December 2017, more than 1.6 million bitcoin CME futures contracts have been traded for an equivalent of 8 million bitcoins that represent more than USD 50 billion in notional value (USD 4.2 billion per month). With a downtrend that is now nearing completion, according to some analysts, and a large part of the traders thinking in the long term, it will be interesting to know how BTC will continue to act against CME futures.

New bitcoin maximum in 2019 – BTC exceeded USD 8,900

- Bitcoin retakes values from a year ago and recovers 173% from the December 2018 minimum.

- Its market capitalization increased by USD 15 billion in the last hours.

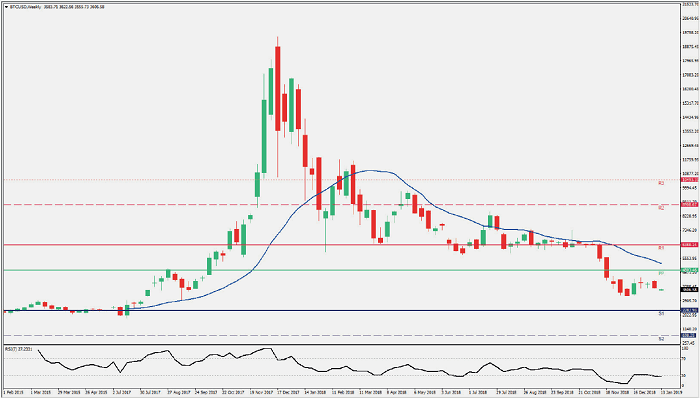

Bitcoin reached this Sunday a new maximum in 2019, of USD 8,933, a level that the most famous crypto did not reach since May 10, 2018. According to TradingView figures, the maximum price of BTC was registered at 9:00 pm (UTC-4), then it retraces back to the vicinity of USD 8,750.

This maximum value represented a boom of 11.4% compared to the price of USD 8.012 that Bitcoin had before the rally this Sunday, which led the cryptocurrency to increase its capitalization value from USD 142 billion to USD 157 billion. The market as a whole also reached its maximum of this year, USD 272 billion, which is equivalent to a dominance of BTC in the crypto-market of 57.7%.

When reaching this new maximum in 2019, the formation of a valley in the evolution of the price of BTC is verified, whose minimum of USD 3,265 occurred on December 15, 2018. There is then a significant price recovery of more than 170% in less than 6 months

The evolution of the market as a whole is quite similar to that of BTC in the last year, with a recovery of USD 104 billion from mid-December 2018 to USD 268.3 today, representing a boom of 158 %.