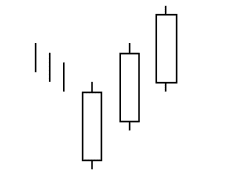

- The current trend should be bearish as it is a reversal formation which indicates a possible change from bearish to bullish trend.

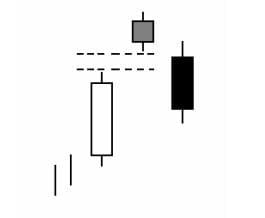

- First, the price forms a long a candle that can be bullish (white) or bearish (black).

- Subsequently, the price forms a smaller candle inside the candle of the previous period (a candle is enclosed within the range of the larger candle), which can be bullish or bearish.

Pattern Interpretation

Bullish Harami formation is the opposite to the Engulfing Bullish pattern, in which a large candle envelopes a smaller candle preceding it, whereas in the case of this candlestick pattern, the large candle envelopes a smaller candle that follows it.

The Japanese traders claim that after a fall in the market, prices are more “restrained” or careful before continuing its advance in the same downward direction.

This pattern can be formed by two bearish candlesticks, a bearish and a bullish candle, a bullish and bearish candle or two bullish candles. In this case, the varieties with higher upside potential of this pattern are those in which the first candle is white (bullish) for obvious reasons, as any large white candle is a pretty strong sign of a bull market. In order of importance are the Bullish Harami formed by a black candle followed by one white candle as the spinning top is the one that indicates indecision in the market.

The Bullish Harami with more reliability and effect as reversal pattern are those in which the second candle has a small body, have small tails and is located within the previous large candle (candle is enveloped by the previous candle) in the this center.

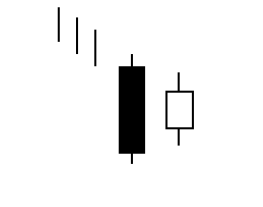

If in the next period after a Bullish Harami occurs, the price closes below the second candlestick, this is a signal that tells the trader that it is very likely that the market will not really change its trend and so prices are going to continue the downward trend. In other words, it is a condition that invalidates the pattern.

Real Example of a Bullish Harami