The candlestick formation Engulfing Bearish is a highly reliable trend change pattern that is formed in bull markets and indicates that there is a high probability that the market will change its direction from bullish to bearish. Sometimes it could be the beginning of a bearish trend. This pattern can be identified in the following way:

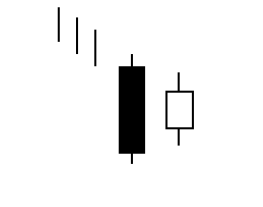

- First we have a candlestick with a small white real body, followed by a black candle with a long real body that encompasses in its entirety the white real body of the previous candle. In other words, the range of the first candlestick is within the range of the second candlestick.

- The previous trend of the market must be bullish.

Interpretation of the pattern

This price pattern is formed when an uptrend begins to lose its strength. After a strong bullish trend occurs in the market, a small candle with a white real body is produced, indicating that the buying forces are losing strength. In the following period, the buying forces still have enough strength and get the price to rise above the real white body of the previous candle, but the bearish forces achieve balance and in that period begin to recover ground. Thanks to this the price goes down and closes below the real body of the previous candle.

In this way, the bearish candle ends up enveloping the real body of the previous bullish candle.

Experts argue if in this candlestick patterb it is necessary that the black candle envelopes in its entirety only the white real body of the previous candle or if it should envelope all this candle, including its tails. It is evident that the more “enveloped” the bullish candle is by the black candle, the stronger and more reliable the pattern, however, it is sufficient that the real body of the black candle covers in its entirety the real body of the previous white candle so that the pattern is valid.

In addition, bearish engulfing patterns present greater reliability when they occur in or near the resistance zones, Fibonacci retracements or bearish trend lines. When these price formations occur at maximum levels, the reliability is lower, in which case the pattern would form a resistance.

In the event that the candlestick that forms after the enveloping bearish candlestick closes above this long black candle, the pattern would be invalidated, which means that the market will probably resume its upward trend.

The larger the engulfing black candlestick and the smaller the enveloped white candlestick, the more effective the pattern will be. For the pattern to be confirmed, it is necessary that the next candle closes below the closing price of the long black candle, since this would indicate the continuation of the bearish movement.

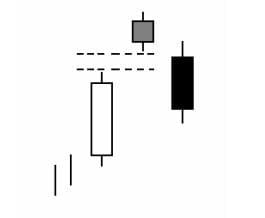

An important aspect regarding this candlestick formation is whether it is formed after a Doji candlestick. A doji will certainly give more validity to the bearish engulfing pattern, since it is a candlestick that indicates indecision in the market (Doji plus engulfing bearish pattern = highly bearish candlesticks combination).

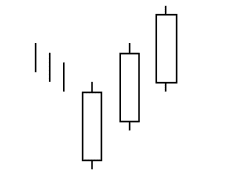

In the event that the upward trend forms a large long candlestick that surrounds a large white candle, this indicates that the bullish forces and bearish forces are equalized (in equilibrium), so that we may have congestion periods in the market without a clear trend in prices, after which the market would resume its previous uptrend. In this case, we would be talking about a market that entered a stage of congestion, where it accumulated strength to continue with the trend.

A price pattern that is not so well known but is also important (although it is not as reliable, should be taken into account), occurs when in an upward trend a black candle is formed with a small real body and in the following period a large white candle is formed with a large real body that surrounds the previous candle. This is a rare formation that is called “Last Engulfing Top“, which is confirmed if the candle that forms in the following period closes below the closing price of the large white candle that envelopes the small black candle that starts the pattern.

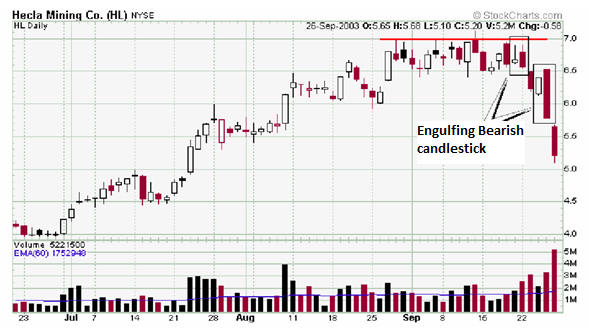

Real example of a Engulfing Bearish Pattern