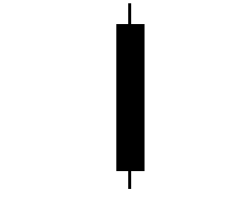

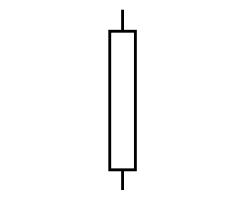

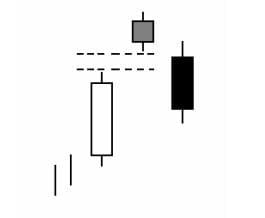

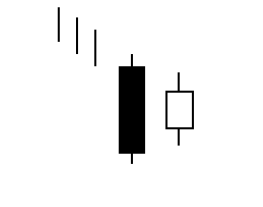

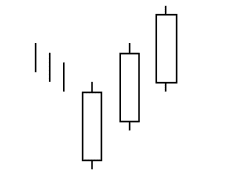

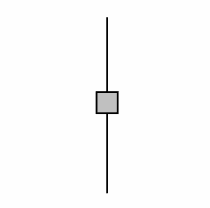

This is an indicator for candlestick charts designed for Metatrader 4 which is based on the recognition of various types of patterns commonly used by many traders to open and close positions in the market. As you know, the Japanese candles usually form easily recognizable chart patterns which are indicative of possible future price behavior in the form of drops, rises, a continuation of the current trend, and trend changes. Logically, these patterns do not have a 100% percent reliable, but in some cases, this is quite high.

Logically, these patterns are not 100% reliable so sometimes produce false signals but are usually quite accurate. The problem is that it takes hours of practice and dedication to analyze price charts to detect these patterns, therefore only the most experienced traders effectively dominate its use to open and close positions in the market. That’s where this indicator is useful because it identifies 10 major candlestick patterns both in bullish and bearish trends and other minor patterns that often occur with some regularity. The result is that the trader can take advantage of any interesting opportunity such as a possible trend change indicated by one of these chart patterns.

Read more