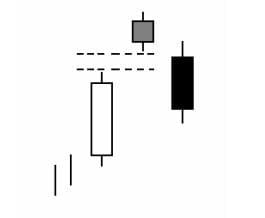

- In this pattern the market trend is not important.

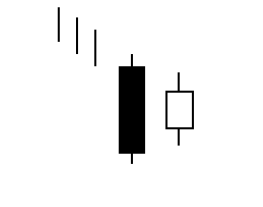

- The first candlestick of the formation consists of a Black Marabozu.

- The second candlestick consists of a white Marabozu with a gap (hole) upwards with respect to the first candlestick.

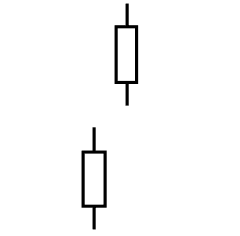

Candlestick Pattern Interpretation

We can say that this formation basically consists of a Black Marabozu followed by a White Marabozu. After the Black Marobozu is formed, an upward gap is produced in which opens the White Marabozu without producing a minimum below the opening, iwhich means that the candlestick opens and closes above the gap.

This pattern is characterized by showing how the price of the instrument is is strongly driven upward. In this case the previous trend of the market is irrelevant, contrary to what happens in other reversal chart formations In the Kicking Bullish the price starts to rise sharply and is likely to continue in the same direction during some periods.

Along with the own strength of the Marobozu, part of the strength of this information comes from the consistency provided by the upward gap (Refer to the formation Rising Window).

However, it is important to take care that both candles have no tails or at least that these tails are very small (we must remember at all times that these candlesticks are Marobozus). The gap acts as a very strong support of high reliability against the market pull-backs.