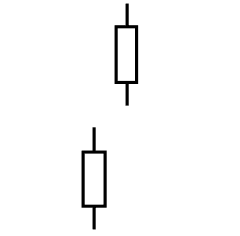

The Rising Window candlestick pattern is a highly reliable formation presented in uptrends which indicates that the current upward trend is likely to continue higher. This pattern can be identified as follows:

- The previous trend should be upward.

- There is a gap between the high of the first candle and low of the next candle.

Candlestick Pattern Interpretation

When the Rising Window pattern appears is a clear sign of strength in the current uptrend, so it is an indication that this trend is highly likely to continue in the same direction.

With respect to this formation, the Japanese used the saying “The reaction will come to the window”, which means that any reaction (downward correction in the price) will reach the gap which act as limit for that movement. If the price falls and reaches the gap, it is good time for the trader to open a buy position.

Not only that, the gap will act as support whenever the price falls and reach it.

In case that during the correction the price not close below the maximum of the previous candle, this is an indication that there is a high probability that the price will return to its previous trend (which as mentioned at the beginning is bullish). Conversely, if the price closes below the maximum of the previous period, this is a sign that the previous trend has been compromised and therefore there is a possibility that the bullish trend reverse its direction.

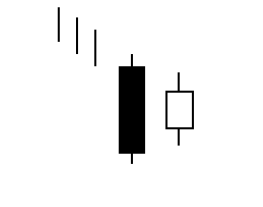

If this formation shows great strength along with a big white candle, it is called “Running Window“, which is characterized by showing the full power of Rising Windows candlestick patterns.

One of the most important aspects to consider regarding the Rising Window is its strength and reliability over other formations. If after a Rising Window occur and independently of its confirmation, a reversal candlestick pattern is formed, the Rising Window will have priority above the other pattern.

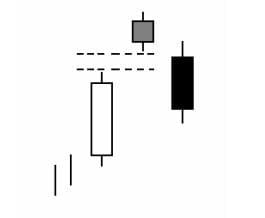

Another important point about this formation is the presence of a Doji after the Rising Window. Normally the appearance of a Doji on an uptrend is a sign of a possible change in the direction of the market that needs further confirmation, but if the Doji is formed after a Rising Window (in this case we also need confirmation), is a pretty strong indication of continuation in the upward price movement.

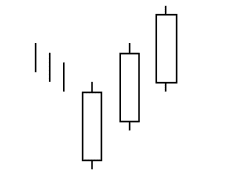

Example of Candlestick Pattern Rising Window