The carry trade is a strategy in which an investor sells a certain currency with a relatively low interest rate and buy another currency with a higher interest rate. The aim of this strategy is to get as profit the difference between the two interest rates, a benefit that may become attractive depending on the amount of leverage used. As the profit comes from the interest rate differential, you can make a profit even if the price of the currency does not change a single pip.

Although the Forex market operates 24 hours, is taken by consensus UTC 0 hours as the end and beginning of a new trading day. In Forex trading, at the end of each day is credited or charged to the account of the trader the spread between the interest rates of the two currencies of the currency pair in which the trader have open positions at this time (this is known as Rollover).

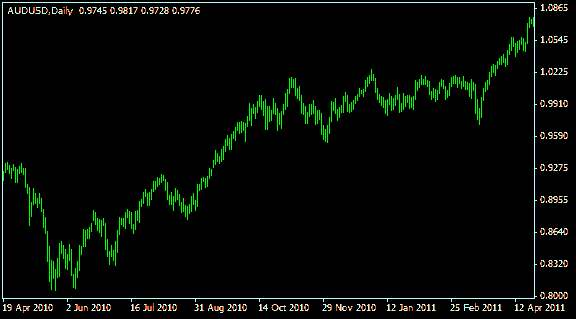

In the recent past in the Forex market, were very common the carry trade operations in which a trader sold yen (JPY) and bought a currency with a higher interest rate as the Australian dollar (AUD), New Zealand dollar (NZD) and sterling (GBP). For example, if we open a long position (a buy position in the market) in the AUD/JPY, what we are doing is selling yen and buying Australian dollars. Suppose that the yen remains with an interest rate of 0.5% per year and the Australian dollar with and interest rate of 6.5 % per year. If we hold this position after one year we would receive about 6% of annual profit (6.5% – 0.5%). I say approximately because interest rates will not remain the same throughout the year but often vary, usually the interest rates vary little so the annual profit will depend on the volatility in the variation of these interest rates that the Central Bank of each country decide over time.

The main risk of carry trade is precisely the uncertainty in maintaining the interest rates in each currency. For example, in the example given above, if the Central Bank of Australia decides to lower the interest rates for any reason, the trader runs the risk of losing money. Furthermore, it is usual that carry trades are made with high leverage, so a small change in interest rates can result in significant losses, unless the trader covers properly the open position.

eToro is the #1 forex broker for novice and full-time traders.