What is a position?

In the field of trading in financial markets, a position is a binding commitment to buy or sell a specific amount of financial instruments such as stocks, currencies, commodities or derivatives, to a certain price. The term “position” is also used in finance to describe the amount of assets held by a person, company or institution as well as the state of property of the investments of an individual or institution.

Do not confuse the meaning of “position” in the trading of financial instruments with the term “financial position”. The latter stands for “status” or “statement”, ie the balance sheet liabilities in a company to take charge of their debts and obligations.

The positions in the trading of financial instruments

In the trading of financial instruments and derivatives the concept of position is widely used. Every time a trader buy or sell an asset and the operation remains open is in an open position, with the net position being the balance between open buy and sale trades in the same instrument. There are two basic types of positions: long position and short position.

In the following examples is used the Forex trading to explain the main concepts related to the term position. The same principle can be applied to any asset and financial market.

Long positions

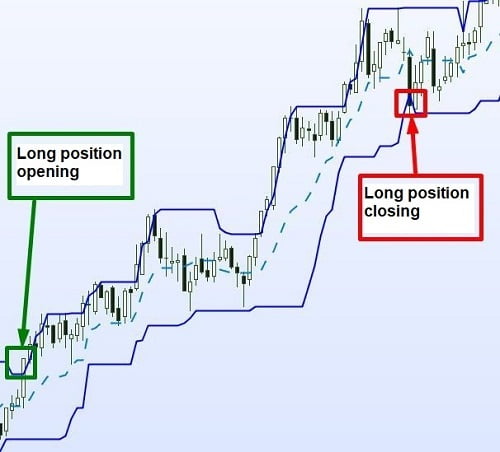

A long position in a asset of a financial market, like stocks or currencies, means that the investor who opens the position own the asset and get benefits if the price of this asset rises. That is, the investor buys the asset and take a buy position.

Going long is the action of taking a long position. Otherwise it is a short position, in which the investor will profit if the price drops.

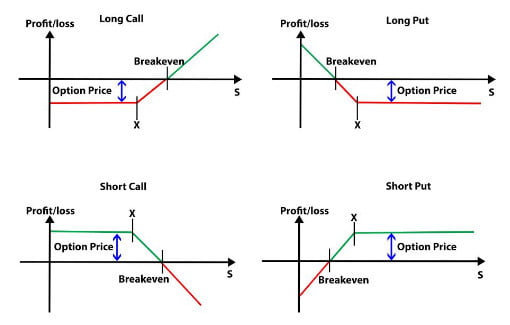

In the options market a long position is the purchasing of an option regardless of whether this is a Call option or a Put option.

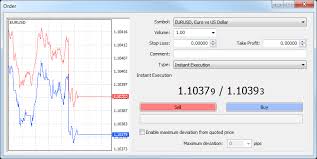

- If a trader buys 1 lot in EUR/USD and this position remain open, it is said the trader holds a long position open.

- If a trader now sells 1 lot in the pair EUR/USD (which had previously bought), we say that it has closed a long position.

- If a trader goes long, he will get benefit if the asset price increases and closes the position at a price higher than the opening price. The same trader lose if the price decreases.

Short positions

A short position in a asset of a financial market, like stocks or currencies, means that the investor who opens the position sell the asset and get benefits if the price of this asset falls. That is, the investor sells the asset and take a sell position.

Going short is the action of taking a short position. Otherwise it is a long position, in which the investor will profit if the price rises.

In the options market a short position is the selling of an option regardless of whether this is a Call option or a Put option.

- If a trader sells 1 lot in EUR/USD and this position remain open, it is said the trader holds a short position open.

- If a trader now buys 1 lot in the pair EUR/USD (which had previously sold), we say that it has closed a short position.

- If a trader goes short, he will get benefit if the asset price decreases and closes the position at a price lower than the opening price. The same trader lose if the price rises.

Net position