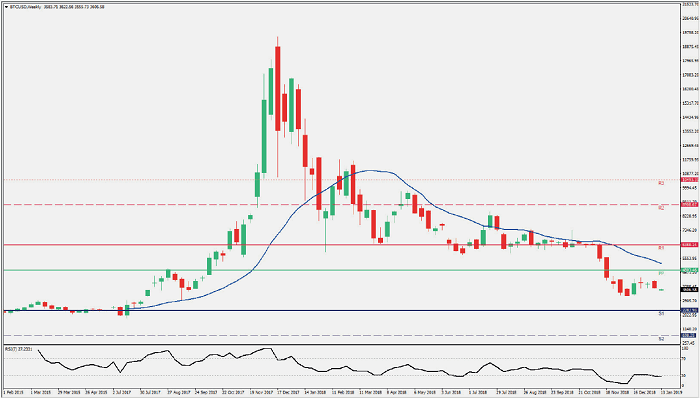

As proven in 2017, Bitcoin markets are overly sensitive in their reactions. In 2017, Bitcoin price soared by 1,800% to peak at over $19,000 and generated a market capitalization of over $250 billion. In contrast to 2017’s movement, the turmoil during 2018 led cryptocurrencies into a great crash. Bitcoin had a total market capitalization of around $65 billion by the end of 2018, reversing 70% of its 2017 market value in a year marked by volatility and higher volumes.

Bitcoin markets started the year on a smooth downwards swing. The hacking of the Japanese exchange Coincheck at the end of January, China’s talks regarding cryptocurrency banning and Facebook’s ban on cryptocurrency and ICO advertisements were some of the factors that added pressure on Bitcoin’s price. Certainly, it has not been a good period for the most famous cryptocurrency and the sector in general.

The US Securities and Exchange Commission (SEC) also had a negative effect on Bitcoin markets after rejecting BTC ETFs. A further drop was seen in September, which is believed to have been caused by a single wallet discharging nearly $1 billion of BTC into the market.

Lastly, November, the worst-performing month in 7 years for Bitcoin, was the highlight of the year, as $70 billion was struck out of all major cryptocurrencies’ capitalization when the Bitcoin price collapsed after the forking of Bitcoin Cash into Bitcoin ABC and SV. The market was anticipating the minting of new coins in November, and therefore the Bitcoin Cash news created a high level of uncertainty for investors. The Bitcoin price bottomed at $3,218 in December.

The enthusiasm for a potential upswing in cryptocurrencies has been muted by 2018’s performance, despite it recording greater volumes than 2017. Therefore, the big question is whether Bitcoin is able to recover this sell-off in 2019. As history has taught us, markets move to the upside, to the downside and sideways, in a repetitive pattern. Bitcoin’s history, but more precisely its characteristics, make it an extremely volatile asset and therefore difficult to predict.

Like last year, the key issues surrounding BTC and the wider cryptocurrency assets of security and regulation will persist and will need to be addressed if there is to be a stable and liquid market. In addition to these, institutional investment along with a potential US recession could define Bitcoin’s future in 2019.

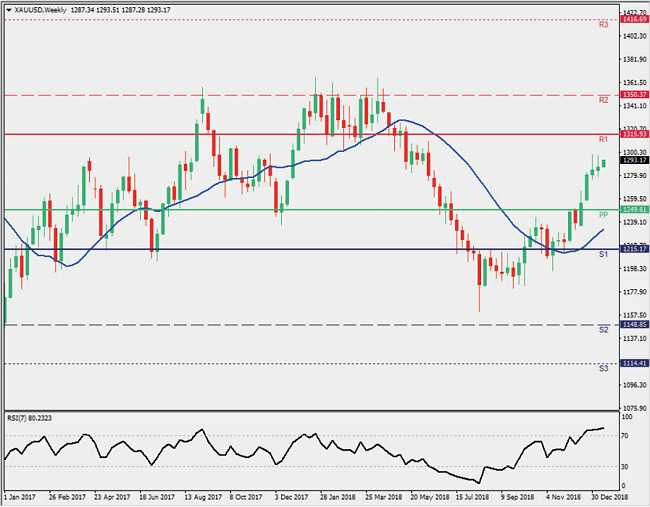

Outlook for Cryptocurrency (BTC)

– Technically Bearish

– Pivot Point – 4,800

– Support – 2,300, 700, and 300

– Resistance – 6,400, 8,900 and 10,500

Bitcoin Markets Review

– Crypto currency markets were on a roller-coaster ride in 2018, although this ride could herald both opportunities and risks. As a trading asset with no correlation to any other asset and not driven by fundamental news it appears to be driven by fear, greed and emotions.

– The key factors affecting the crypto direction is any decision allowing regulated ICOs by the SEC, potentially raised demand from a US slowdown, or any further rejections of Bitcoin ETFs. 2019 may see the continuation of rising volatility combined with a slower rise in price.

Source: