The Fed, Federal Reserve System, is the central banking system of United States whose objectives, according to the documentation of the entity, is to make the monetary policy decisions of the country, supervise and regulate banking institutions, maintain the stability of the financial system and provide financial services to deposit institutions, the government of the United States and official foreign institutions.

In other words, it is the Central Bank of the United States. It was created in 1913 through the Federal Reserve Act, mainly as a response to a series of financial panics, especially the one of 1907.

Structure of the Fed System

Although the structure, functions and responsibilities of the Fed have been changing over time due mainly to events such as the Great Depression, the structure of the Fed consists of public and private components. It should be noted that it is not necessary for the Fed to have public funds and that it can make decisions without the approval of Congress or the President of the United States. The structural organs of the Fed are currently:

- Board of Governors, also known as the Federal Reserve Board.

- Federal Open Market Committee (FOMC)

- 12 Fed Banks

Board of Governors

The Board of Governors of the Fed is composed of 7 members. It is a federal agency and the main governing body of the Federal Reserve System. It is responsible for the supervision of the 12 Reserve Banks and the establishment of the national monetary policy. It also supervises and regulates the US banking system in general. The members of the Board of Governors are appointed by the President of the United States and confirmed by the Senate and may hold office for up to 14 years. The Board of Governors is required to submit an annual operations report to the President of the US House of Representatives.

The President and Vice President of the Board of Governors are proposed by the President of United States from among the 7 Governors previously appointed. Although they can be members of the Board of Governors for 14 years, the position of President and Vice President can be exercised for a maximum of 4 years.

Federal Open Market Committee (FOMC)

The Federal Open Market Committee (FOMC) is composed of 12 members, seven from the Board of Governors and 5 from the regional presidents of the Federal Reserve Banks. The FOMC supervises open market operations being this the main tool of the national monetary policy. These operations directly affect the amount of Federal Reserve balances available to deposit institutions, which influences the general terms of monetary resources and credit.

The FOMC also directs the operations carried out by the Federal Reserve in the currency market. The president of the Federal Reserve of New York, is a permanent member of the FOMC, while the rest of the banks presidents rotate in an interval of two to three years. All presidents of the Federal Reserve District Banks contribute to the evaluation of the economy and monetary policy options, but only the five presidents who are members of the FOMC have a vote in the political decisions.

The FOMC determines its own internal organization and, by tradition, elects the President of the Board of Governors as its president and the chairman of the New York Federal Reserve as its vice president. In any voting, no more than two FOMC members may disagree. Formal meetings are usually held eight times a year in Washington, DC, the presidents of the Federal Reserve Banks can participate but without the right to vote. They can make more meetings if necessary.

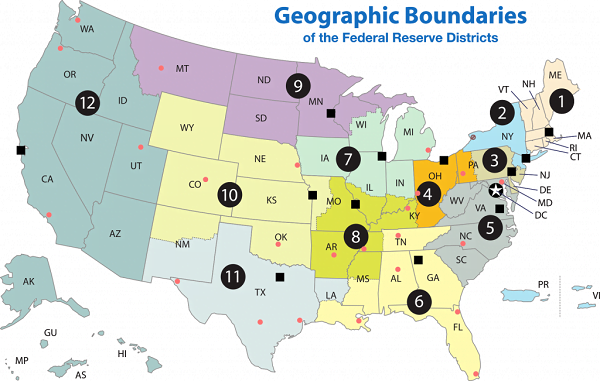

Federal Reserve Banks

There are 12 Federal Reserve Banks which are located in the following cities: Boston, New York, Philadelphia, Cleveland, Richmond, Atlanta, Chicago, St. Louis, Minneapolis, Kansas City, Dallas and San Francisco. Each Federal Reserve Bank is responsible for member banks located in its district. The size of each district was established based on the distribution of the population of the United States at the time of approval of the Federal Reserve Law. Each regional bank has a president, who is also the bank’s executive director. Each regional president of a Federal Reserve Bank is proposed by the Bank’s own board, but his appointment is subject to the approval of the Board of Governors. The Presidents of the Federal Reserve Banks can occupy the position for periods of 5 years although they can be re-elected.

The governing board of each regional bank consists of nine members, divided into three classes, A, B and C. In each class there are 3 members. The class A governors are elected by the Bank’s shareholders and their function is to represent the interests of the member banks of the same district. Those of class B are also chosen by the shareholders of the Bank but on behalf of the public. The class C governors are appointed by the Board of Governors and their function is to represent the interests of citizens.

A member bank of a Federal Reserve Bank is a private entity and holds shares in the Federal Reserve Bank. All national banks have shares in one of the Federal Reserve Banks. The amount of shares that a member bank can hold is equal to 3% of its combined capital and superavit. However, the shares of participation in a Federal Reserve bank is not like having shares in a exchange-traded company. These shares can not be sold or exchanged, and member banks do not control the Federal Reserve Bank since the Federal Reserve Bank is assumed to be a public body.

The organization of each Federal Reserve Bank is established by law and can not be altered by member banks. The member banks, however, elect six of the nine members of their boards of governors. From the benefits of a member Regional Bank, the bank itself receives a dividend equivalent to 6% of its shares. The rest is delivered to the Department of the Treasury of United States.

Legal status of the Federal Reserve Banks

Reserve Banks have an intermediate legal status, with some features of private enterprise and some characteristics of federal public agency. The United States has an interest in Federal Reserve Banks as tax-free instruments whose profits belong to the federal government, but this interest is not of property.

Objectives and Functions of the Federal Reserve

The main motivation for the creation of the Federal Reserve was to face bank panics. It has other objectives established in the Federal Reserve Law, among which are the provision of a flexible currency, the capacity to supply monetary resources when necessary, and the establishment of effective supervision of banking activity in the United States. Prior to the founding of the Federal Reserve, United States suffered several financial crises. A particularly serious crisis in 1907 that led Congress to enact the Federal Reserve Law in 1913. Today the Federal Reserve has broader responsibilities than just guaranteeing the stability of the financial system.

The current functions of the Federal Reserve are:

- Address the problem of bank panics

- Serve as the central bank of the United States

- Establish a balance between the private interests of banks and the responsibility of the central government: Supervise and regulate banking institutions while protecting the credit rights of consumers

- Management of the nation’s money supply through monetary policy in order to achieve the objectives of maximum employment, price stability (including the prevention of inflation and deflation) and moderate interest rates in the long term

- Maintain the stability of the financial system and contain systemic risk in financial markets

- Provide financial services to deposit institutions, the US government, and foreign official institutions. It includes the important role that the Federal Reserve has in the government’s payments system. In this sense, the Federal Reserve must facilitate the exchange of payments between the regions and respond to local liquidity needs.

- Strengthen the US position in the world economy

The monetary policy in the Federal Reserve

The term “monetary policy” refers to the actions carried out by a central bank, such as the Federal Reserve, to influence the availability and cost of money and credit in order to reach national economic objectives since the the cost of money affects the interest rates (cost of credit) and, therefore, the development of the economy. In the Federal Reserve Act of 1913, the Federal Reserve is given the authority and competence to establish the monetary policy of the United States.

Interbank loans

The performance of the Federal Reserve against interbank loans is the basis of the monetary policy of the Fed. The Federal Reserve sets monetary policy by influencing the interest rate of federal funds, which is the interest rate of interbank loans. The rate that banks charge each other for these loans is determined in the interbank market, but the Federal Reserve influences this interest rate through the three “tools” of monetary policy that will be described below: Open Market Operations, Discounts of interest rates and Requirements of Reserve Funds.

The interbank interest rate is decided by the FOMC and this, together with the rest of the policies, affects the economy through its effect on the number of reserves that commercial banks use to grant loans. Monetary policy actions that allow greater funds in banks will cause commercial loans to be made at lower interest rates while policies that deplete bank reserves will have the opposite effect. The objective of the Fed is to provide sufficient reserves and monetary resources based on demand, avoiding, on the one hand, the excess that may result in a lack of control of inflation and, on the other hand, the lack of resources that could slow down economic growth.

Main monetary policy tools of the Fed

Interest Rates and Open Market Operations

The Federal Reserve System applies the monetary policy largely through the federal funds rate. This is the rate that banks charge each other for one-day loans of federal funds, which are the reserves of Federal Reserve banks. This rate is actually determined by the market and is not the explicit mandate of the Federal Reserve. The Fed is therefore trying to align the effective rate of federal funds with the desired rate by adding or subtracting the money supply through open market operations. The Federal Reserve System usually adjusts to the federal funds rate target by 0.25% or 0.50% at a time.

Open market operations allow the Federal Reserve to increase or decrease the amount of money in the banking system as necessary to balance the dual mandate of the Federal Reserve. Open market operations are performed through the purchase and sale of US Treasury securities, sometimes called “Treasury bonds” or more informally “T-bills” or “Treasury.” The Federal Reserve buys Treasuries from its major distributors. The purchase of these securities affects the federal funds rate, since the primary operators have accounts in deposit institutions.

When the Fed buys financial instruments, it puts more money into circulation. With more money available, interest rates tend to decrease, and so more money is borrowed and spent. When the Fed sells financial instruments, it takes the money out of circulation, causing interest rates to rise, making loans more expensive and, therefore, less accessible.

Open market operations are the main instrument to regulate the supply of bank reserves. This tool is made up of purchases from the Federal Reserve and sale of financial instruments, usually securities issued by the US Treasury, federal agencies and government-sponsored companies. They are carried out by the internal dealing desk of the New York Federal Reserve under the direction of the FOMC. The transactions are carried out with the primary operators.

Economic variables and the Federal Reserve

The FED carries out the collection, organization and publication of data and statistics on the economy, some of them in the form of an economic indicator. Among these data we can highlight the following:

- Net worth of households and nonprofit organizations (published in the Flow of Fund report)

- Money Supply

- Personal consumption expenditures price index (abbreviated as PCE price Index). Important as a component of GDP and as a tool to meet inflation targets.

- Inflation

- Unemployment rate. Data collected by the Bureau of Labor Statistics used by the Fed as a thermometer of the economic situation and the success of its policies.

There are some web pages of the Fed where you can check the current and historical values for many data of the American economy.

Some criticisms of the Federal Reserve

Some economists from the Austrian School and the Chicago School want the Fed to disappear. The late Milton Friedman, leader of the Chicago School, in his interview with Peter Jaworski, argued that “although the Fed did not provoke the 1929 crisis, it made it worse by reducing the money supply at a time when more liquidity was needed”.

Economists of the Austrian School, like Ludwig von Mises, say that what has led to booms in the economic cycle in the last century has been the artificial manipulation of the money supply by the Fed. They also argue that the expansion of the money supply that the Fed did before the beginning of the 21st century, caused the money to be invested badly, resulting in the Great Depression.

A more recent criticism is the discretionality with which decisions are made. The meetings are held behind closed doors and the documents are revealed five years late. Even experts in policy analysis are unsure of the logic with which the Fed makes decisions. Critics argue that discretionality policies cause greater volatility in the market because the market must guess, most of the time with little information, about changes in policies.

Another criticism against the Fed, is that some presidents has not worked in private companies, and therefore should not be presidents. It is argued that despite their great academic achievements, many of their decisions are made not according to real life experience, but to the theory that is the basis of their careers.

There are also theories that accuse the Fed of manipulating the world since the beginning of the 20th century, when the Federal Reserve was founded, in collaboration with large multinationals and with the United States government itself. Most of these theories come together in a series of impact documentary films called Zeitgeist, by Peter Joseph, in The Money Is Debt and in the last two books by the economist John Perkins.