The increase in prices over time, which is inflation, in an economy experiencing growth is inevitable. Furthermore, it is accepted by most economists that a moderate rate of inflation is positive for the economy. In this regard, central banks try to control inflation to be kept within certain limits in order to exploit the positive effects of inflation and reduce the impact of negative effects. In this sense, monetary authorities maintain a constant struggle to control inflation and other monetary forces affecting the economy.

Increases in interest rates

Increasing interest rates is one of the main measures taken by central banks to reduce inflationary pressure when this is high. Moreover, it is easy to apply strategy whose effects are usually seen reflected faster in the economy in comparison with the effects of other methods. By raising interest rates, the central bank raise the benchmark interest rate at which commercial banks will look when granting loans to their clients.

Generally, investors seek a high rate of return combined with low risk. Investors in the Forex market look exactly the same. Therefore, when a central bank decides to increase the interest rate, you can be sure that the demand for its currency will rise. Consequently, if the interest rate of the central bank of a currency A is higher than the interest rate of another currency B, it is expected that the exchange rate of the currency pair A/B rise due to an increase in demand of currency A over demand of currency B.

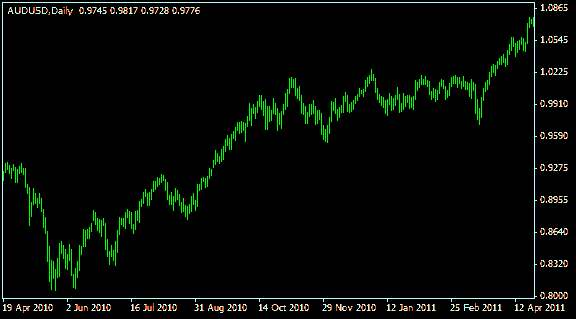

For example, the Australian economy experienced a relatively rapid growth compared to the global economic recession that began in 2008. In this regard, the Reserve Bank of Australia was forced to reduce inflationary pressure, which tends to increase when economic growth is experienced. From late 2009 to early 2011, the Reserve Bank of Australia raised interest rates several times, by 25 basis points each time, as the US economy was still with a slower growth and the Federal Reserve kept interest rates very low. This caused an appreciation of the AUD against the USD, which was reflected in the rise in the exchange rate of AUD/USD since June 2010.

Increase in reserve requirements of banks

The increase in reserve requirements of banks is a strategy to fight inflation as effective as the rise in interest rates. When a central bank increases the requirements of monetary reserves that banks must maintain, in short what it does is reduce and limit monetary resources in the economic system because it reduces the money that a bank can let out. This restriction causes a slowing of price increases because with less money in the system to buy the same goods, is expected a fall in demand.

The decision to increase the reserve requirements of banks often leads to an increase in value of the country’s currency against other foreign currencies as a result, mostly, of speculative operations. This is mainly due to the fact that an increase of these requirements often come not isolated and frequently more rises are produced; therefore acquire a currency whose availability will decrease is seen as an opportunity by investors.

Open Market Operations

With the aim of regulating the monetary resources and controlling inflation, central banks also make operations in the market. These transactions consist primarily of the purchase/sale of its own currency, typically through agreements with inter bank merchants in which a right to re-purchase by the central bank is set to temporarily reduce monetary resources in the system or conversely, to increase these resources, according to the aim pursued. Obviously, these operations have a high impact on the foreign exchange market.

These operations are usually carried out as support to other strategies, for example, if a central bank increases interest rates to reduce the monetary resources in the system, can make a massive purchase of its own currency in the market to support the reduction of monetary resources persecuted.

Currency appreciation

Another strategy used by central banks to fight inflation is the appreciation of its currency. This strategy is much less generally used, because it is used only by fixed currency systems (currencies with a fixed exchange rate) whose exchange rate is controlled by the authorities. The effectiveness of this measure is due to the fact that by having a stronger (appreciated) currency, the costs of production and raw materials tend to decrease, leading to lower prices to the consumer.

With all these strategies central banks can control and fight inflation. Usually such decisions are announced and made public and thus be aware of monetary policy changes can be a source of opportunities for investors in the Forex market since the implementation of these measures usually have a high impact on exchange rates.