ETFs stand out as financial products capable of introducing digital assets to traditional investment markets

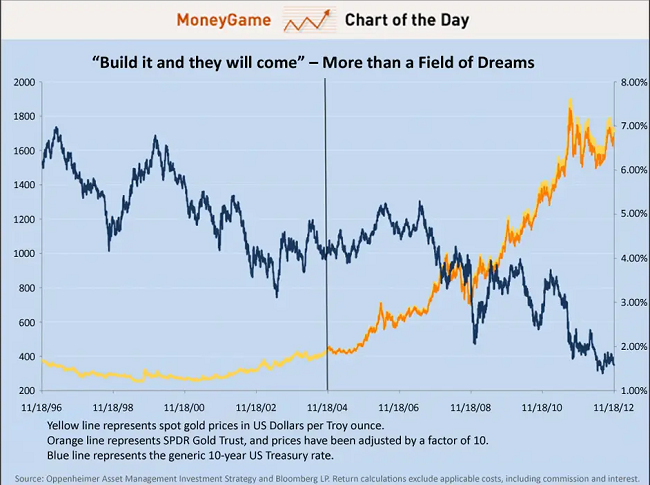

Exchange-Traded Funds (ETFs) are investment funds that are traded and marketed in the same way as a corporate stock on traditional exchanges such as Nasdaq or NYSE. These funds are designed to track the price of the assets they comprise, forming a unit of value. This unit can be composed of various types of assets (such as bonds, stocks, or other securities) or just one, as is the case with SPDR Gold Shares, the world’s largest gold-backed ETF. With the inclusion of digital assets in the financial market, Bitcoin and cryptocurrencies like Ether (ETH) have become additional assets capable of forming an ETF.

- ETFs offer greater liquidity and lower fees to traditional investors.

- With a Bitcoin ETF, companies aim to popularize its trading on stock exchanges.

- The U.S. has approved Bitcoin futures ETFs, but requests for spot ETFs are still pending.

- ETFs are investment tools regulated by the government.

- Investors in an ETF can make money with Bitcoin without needing to acquire the asset.

While experts consider ETFs to be hybrid financial tools, they are also recognized as traditional financial products. This refers to their trading being regulated by government authorities, such as the Securities and Exchange Commission (SEC) in the United States or the financial entities of each country. Similarly, another noteworthy characteristic is that exchange-traded funds are inclusive traditional financial products. Despite attracting the attention of large companies and accredited investors, ETFs do not require special credentials or substantial amounts of capital for users to trade them.

In the case of Bitcoin and cryptocurrencies, two distinct types of ETFs are of particular interest. These are spot or spot ETFs and futures ETFs, both of which have been registered on various exchanges worldwide. However, as of 2023, there is still market anticipation for the approval of one of these spot financial products in the United States, which could dramatically alter the market dynamics, given the magnitude of potential investments (according to the Investment Company Institute, by the end of 2022, the ETF market in the United States represented 6.5 trillion dollars).

Why has the term ETF become so popular?

The acronym ETF has gained popularity in the bitcoin and cryptocurrency slang due to a historical and political context that has hindered the regulatory approval of these financial products. To understand the complexity of the matter, we must travel back in time to a decade ago, in the year 2013.

Back then, two men of great importance to the Bitcoin market in the United States, Cameron and Tyler Winklevoss, founders of the Gemini exchange, submitted an official request to create a bitcoin ETF that year. It was the first attempt to have Satoshi Nakamoto’s invention debut on the exchanges in the United States, transformed into a financial tool that had been generating a lot of discussion since the 1990s.

Despite the Winklevoss brothers’ attempt, their ETF was rejected by the United States Securities and Exchange Commission (commonly known as the SEC), who argued that the Bitcoin market was too risky. This becomes the first of many proposals to create a bitcoin ETF that ends up being rejected by U.S. authorities. 2018, without a doubt, was the toughest and most controversial year for ETFs in this sector. In a single day, the SEC rejected a total of nine proposals to create these products in the U.S. financial market. At that time, the organization was led by regulator Jay Clayton, who claimed that cryptocurrency markets were susceptible to manipulation.

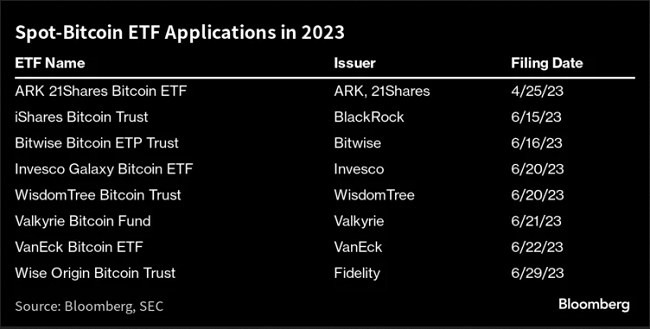

With the approval of this ETF, other companies also launched their own products, while firms interested in having a Bitcoin spot ETF are exploring the possibility of SEC approval for this asset. These companies include Ark Invest, Blackrock, Grayscale, Fidelity, and VanEck, among others.Currently, there are more than eight proposals before the SEC for the approval of a Bitcoin spot ETF, as well as several others aiming to launch an ETF for Ethereum’s cryptocurrency, ether (ETH). However, the future of these proposals is uncertain, as the SEC has consistently delayed the final decision.

How do Bitcoin ETFs work?

ETFs are funds that operate like corporate stocks. The ETF providers are responsible for creating and safeguarding all underlying assets that make up their fund, and they are the sole owners of the assets held there. In the case of bitcoin, companies may hold futures contracts for bitcoin or buy BTC to safeguard it with a third party, such as Coinbase’s custody services.

The provider is also responsible for designing the ETF with the ability to track the price of the assets under its custody. For example, a Bitcoin ETF monitors the cryptocurrency’s price changes minute by minute, replicating that value in its own fund. Likewise, they determine how many shares they will create, under what regime they will be distributed, and how they can be acquired. These decisions vary from company to company, so each investor must compare different ETFs to find the one that suits them best.

Formation of the BlackRock ETF

BlackRock, one of the entities interested in creating a Bitcoin spot ETF, has disclosed some basic features of its product. For example, they state that they will create a total of 40,000 shares (or multiples of this figure) each day they accept new orders based on investors’ purchase intentions. This package of shares is referred to as a ‘basket’ and is traded on the exchange to registered brokers with BlackRock. Additionally, they note that the share price is determined based on the price of bitcoin for that day, as well as the value at which the ETF is trading on Nasdaq.

Among the general characteristics of how a Bitcoin ETF operates, it is important to consider that these financial products have their own market prices. In other words, despite tracking the market for bitcoin, futures contract indices, or other related assets, their value is not the same as that of a BTC. Each ETF creates a unique value over time, based on the supply and demand of its own market, which may be more expensive or cheaper than the asset to which it is anchored.

Supply and demand are key

Every asset, including bitcoin and ETFs, builds its value based on the principles of supply and demand. Sellers propose a value, while buyers negotiate that price. When an asset is highly sought after, buyers are willing to pay large sums for it, reaching a point where they consider it overvalued. On the other hand, when there is little interest in the asset, prices tend to drop because sellers accept less money per unit to sell the property.

Another aspect to consider with ETFs is that, similar to bonds and stocks, they operate based on the concept of ownership. The company that creates the product issues certificates verifying that a particular investor owns shares in the fund, entitling them to receive gains from fluctuations in the price of the underlying asset. The buyer, upon acquiring the ETF, is essentially paying for a fractional ownership of that fund.

Regarding buying and selling, it will depend on which market the ETF is in. If it is in the U.S. market, it will be on exchanges such as NYSE or NASDAQ. In other places, like Canada, for example, they are listed on the TSX, the Toronto Stock Exchange.

When traded on stock exchanges, ETFs follow a trading session. For example, in the U.S. market, it opens every morning and closes around five in the afternoon. Similarly, weekends are non-working days, so no buying or selling activities take place. This structure is quite different from the direct purchase of bitcoin and cryptocurrencies, which can be done 24 hours a day, 7 days a week, all year round.

ETF trading involves various costs: operating expense ratio, covering the annual expenses of operating the fund; trading commission, incurred each time an ETF is bought or sold on the exchange; and the spread, which is the difference between the buying and selling prices and depends heavily on the fund’s liquidity. Of course, as these are not products traded on Bitcoin or a blockchain network, there are no commissions to be paid to miners.

BTC Futures ETF vs BTC SPOT ETF

As we have mentioned earlier, there are two different types of ETFs offered in the Bitcoin market. On one hand, there are futures ETFs, which are numerous in the U.S. market, and on the other hand, there are spot ETFs, which are already operational in regions such as Europe and Canada.

But, what are their differences? Well, the name gives us a clue. The first type of ETF is related to futures contracts, a derivative with which bitcoin and other assets are traded at an agreed-upon price and date by both parties. This contract allows investors to speculate on the future prices of a currency, commodity, or stock.

A futures ETF does not have direct exposure to bitcoin. In other words, the company issuing this financial product does not acquire BTC to hold in reserve; instead, it holds open futures contracts in various markets as part of the underlying asset of its fund.

In the case of spot ETFs, the exposure is direct, and the company is responsible for buying bitcoin to hold in reserve. Whenever an investor buys shares in the fund, the issuer uses that money to purchase bitcoin on the spot. The company can manage this money itself, owning the private keys. Alternatively, it can entrust the custody of these assets to a trusted third party.

This is why the prices of spot and futures ETFs differ, even though they are based on the same asset, such as bitcoin. The former creates its own price based on investors’ future bets, while the latter bases its price on an index that has a direct correlation with the asset’s price. Some indices commonly used for Bitcoin spot ETFs include the XBT index from the Bitmex exchange, the Nasdaq Bitcoin Reference Price Settlement Index (NQBTCS), or the Nasdaq Ether Reference Price Settlement Index (NQETHS) for Ethereum.

What are Bitcoin ETFs used for?

One of the main objectives pursued with the creation of Bitcoin and cryptocurrency ETFs is to provide traditional investors with the opportunity to invest in this market through instruments they are already familiar with.

Traders who are experienced in buying and selling stocks, derivatives, and bonds but not in digital assets may feel much more comfortable gaining exposure without the need to learn the technical and practical concepts of Bitcoin.

This can be particularly convenient for large companies looking to diversify their investments. Since the custody of a fortune in bitcoins may be a new and complex concept for those accustomed to the banking market, by acquiring ownership of a fund, they don’t have to self-custody bitcoins or other assets.

An ETF’s fund can contain more than one asset, providing greater diversification for portfolios than directly acquiring bitcoin. These ETFs can offer a basket that combines cryptocurrency holdings, tech stocks, bonds, and even market positions that can cushion market price fluctuations in a single investment.

Another aspect that makes ETFs highly attractive is tax and legal regulation. As these are assets operating in regulated markets, authorities monitor them continuously, analyze their pros and cons, and provide some coverage in case of incidents. Similarly, major investors will have a better understanding of how gains are declared to relevant entities, introducing greater clarity in tax payments.

As we can see, ETFs are a financial tool with a very specific target audience: large investment firms, institutional investors, and large companies/families diversifying their wealth. Although it is not an exclusive market, its benefits are better suited for individuals who need legal clarity and are not interested in committing to the Bitcoin community.

What are the most popular Bitcoin and cryptocurrency ETFs?

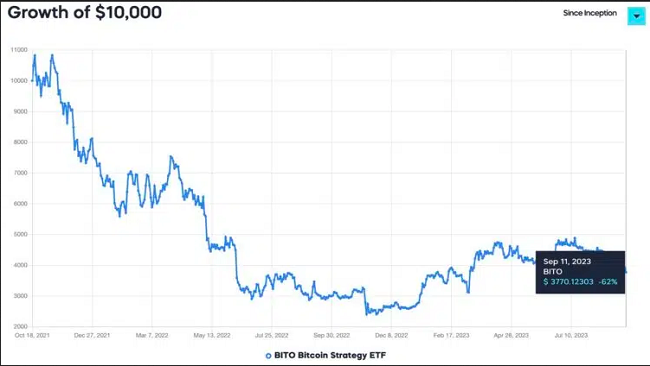

ProShares Bitcoin Strategy ETF (BITO)

Known for being the first Bitcoin ETF in the United States, BITO leads the list of the most popular among institutional investors. Issued by ProShares in 2021, it specializes in the bitcoin futures market. As of September 2023, BITO has over $800 million in assets under management.

ProShares Short Bitcoin ETF (BITI)

Also issued under the ProShares brand but in June 2022, BITI is an ETF that distributes profits to its owners daily. Like BITO, it is anchored to bitcoin futures and, as of September 2023, has a total of $23 million under custody.

VanEck Strategy Bitcoin ETF (XBTF)

XBTF is another bitcoin ETF currently in the U.S. stock market since November 2021. Issued by VanEck, it is a futures-contract-based ETF that, as of the third quarter of 2023, accumulates $41 million in assets under management.

Purpose Bitcoin ETF (BTCC)

When it comes to bitcoin spot ETFs, BTCC, issued by Purpose Investments in Canada, has been one of the most recognized since February 2021. It is considered the first of its kind in history, as it directly acquires BTC units for its reserve. As of mid-September 2023, the company holds a total of 23,500 BTC, equivalent to $610 million.

Purpose Ether ETF (ETHH)

Also circulating in the Canadian stock markets since November 2022, ETHH from Purpose Investments allows investors to participate in the Ethereum market by investing in the native cryptocurrency, ether (ETH). The ETHH fund holds around 98,000 ETH, equivalent to $157 million, as of September 2023.

Jacobi Bitcoin ETF (BCOIN)

The newest kid on the block, BCOIN is the latest Bitcoin spot ETF launched in August 2023 on the Amsterdam Stock Exchange and the first in Europe. Issued by Jacobi Asset Management in London, BCOIN is traded for U.S. dollars. By September, this young ETF has already accumulated $1.1 million under management.