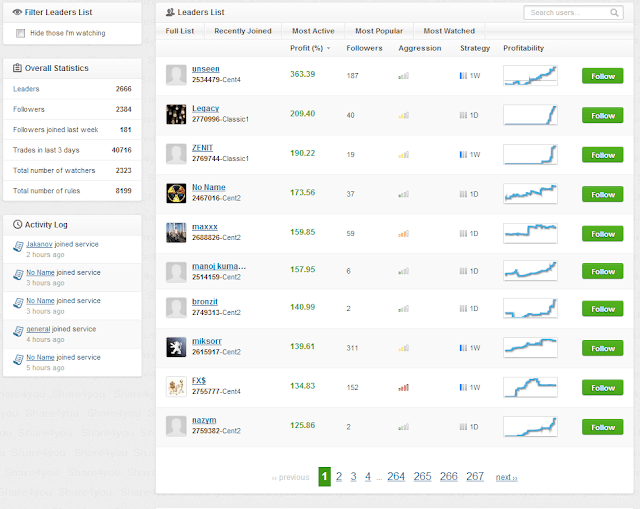

Zulutrade is one of the largest suppliers of automated Forex trading services which allows trading in the Forex market through trading signals generated by real traders. For many traders, Zulutrade offers an important opportunity to invest in this market, however, it is necessary to implement a number of precautions to prevent these signals end up destroying the trading capital generated by the investor because not all signal providers (traders) are adequate.

Because not all traders registered as signals providers in Zulutrade are professionals and experienced, we must choose only the best. To this end, the company has published a basic guide to avoiding unnecessary losses with its services.

The reason for publishing this guide is because on this site we promote the automated trading services of Zulutrade, and in several cases, I have observed as some referred clients make money quickly and lost it very easily due to a poor selection for the signal provider.

This guide is based on a provider called FX178 which had a performance at the start that it was at the top 10 but suddenly had a sudden drawdown that has led to massive losses. Based on this, we answer the following questions:

- How do avoid a drawdown so high?

- And how can we detect that something is wrong with a signal provider?

Now, let’s see how we can detect potential problems before suffering them in our account. In the next picture, we see the worst weekly operation. As we can see, the strategy of this trader never crossed the limit of 170 pips for the worst operation during the first 6 months. Soon, however, he began to risk a little more and its negative trades began to lose more as their appetite for risk started to increase. At the same time, the trader started to risk 200 pips or more in each trade, in contrast to the previous 6 months when he never did this.

It is obvious therefore that this trader changes the trading strategy. If he had used a stop loss equal to the average of the worst operations for the last 6 months, then the whole tragedy would have been prevented.

However, this practice does not work with signal providers employing tight stop loss such as Forextechno [EURUSD_LT]. In fact, it only works in most cases with signal providers that experience larger drawdowns than usual and expose their accounts and those of their followers under greater risk.

One of the best ways to choose the correct stop loss (we always recommended to use a stop loss as a safety net, which can be done by selecting the Safe option in the Advanced Settings section of the account) is to use the latest tools evaluation (backtesting) of Zulutrade, as shown in the image below. It can be accessed through the Backtest button, which is shown under the Settings section, which appears when we access the account. Through this function we can do the following:

- Determine the appropriate stop loss for each one of the selected signal providers, or we can decide to delete a provider of our account in the event that there is no stop loss to make his/her trading strategy viable. It is extremely important to apply this procedure before we use a signal provider whose trading signals will be executed in our account.

- Play with the slippage and check if the strategy is viable in real life (unless the provider sends signals directly from a live trading account, in which case all the results are quite realistic).

As we can see, Zulutrade provides the tools necessary to select the best trading signal providers. The main problem is that in many cases, investors do not take the time to study these tools and their mode of application, so they do not select signal providers whose strategies are most suitable for their accounts. In these cases, they choose traders who are having the best results so far without analyzing how far their strategy is viable or not in the long term. There are even investors who do not use stop-loss, which is essential in a market as volatile as the Forex, and that can be applied easily in Zulutrade.

More information about Zulutrade and its services is on its website: