Research the market

- How strong is the economy of country A relative to country B at this time? This question can be answered by looking at the current gross domestic product, unemployment, and production indicators, among others.

- Is one of these currencies seen as a safe haven? Historically, the dollar was always considered a safe currency but this may change for various reasons as the debt ceiling crisis in the United States. Other safe havens are the Japanese yen and the Swiss franc.

- How have reacted the currency against various news in the past? Investigating the behavior of the currency allows traders to make a prospective analysis of how the currency would react.

If a trader does not investigate the market in which he is trading, an unpleasant surprise can easily ruin his day.

Keep informed and study

Once you have identified what moves a particular currency, is essential to follow the news. There are multiple resources, from finance websites to specialized newspapers, which may vary by country. If you choose to trade in a given pair, it is always advisable to stay updated on the economic situation of both countries.

There are some economic announcements that are fundamental to note because they can impact the market, such as the unemployment rate in the United States or the European Central Bank announcements regarding monetary policy, for example. In all cases, you should always be careful in how it impacts the pair you trade.

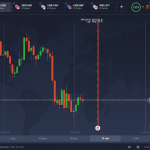

Fundamental analysis is always key for Forex, but so is the technical analysis. Price charts allow us to understand how different news has impacted the currency cross historically, viewpoints of return, identify support and resistance levels, and spot trends. Once you have done this analysis, it will be easier to learn to interpret market behavior and its position in the future.

Most beginning traders believe that trading is simple and requires little time. That is a big mistake. When you start trading Forex you must study and learn about the different methods of market analysis and forecasting. This will allow you to select the trading systems that best suit your style. If you do not stay informed, the trader will not know exactly what is happening in the market and how to react to their changing conditions. Nor will he know how to apply a system no matter how good it is.

Focus on one currency pair at the beginning

Trading can be exhausting at times, so traders should be selective. Every trader should choose a specific currency to start trading Forex and learn what to do and what not to do. Each pair is correlated to some extent with the financial markets. For example, the USD/JPY may have some correlation with the Nikkei. To identify correlations, it is best to see the price charts as the visualization process can always help eliminate doubts.

When the market moves quickly, more experienced traders know they must rely on their strategies. However, what a trader should never do is get carried away by emotions and change the strategy once it has been developed and implemented (the typical mistake of inexperienced traders).

Use a small number of indicators when you start trading Forex

It is best to use a limited number of indicators since many can cause much distraction. There are many traders trading in Forex using only one indicator, such as support and resistance. It is important to analyze which indicators are more suited to our needs for trading.

Finally, developing a balanced strategy incorporating fundamental and technical analysis, with a limited number of currency pairs can lead to successful Forex trading.