Ichimoku indicator is one of the most versatile technical indicators, with many facets designed to identify support and resistance levels, trend direction, entry points, and exit points. It was developed by Goichi Hosada, a Japanese journalist who called it Ichimoku Sanjin (“view of the Mountain Man”). It is widely used since the 60’s in Japan and since the late 90’s of the XX century has been gaining popularity in the West. Ichimoku Kinko Hyo could be translated as “balanced graphical first sight”, which gives an idea of the functionality of this indicator in technical analysis.

It is one of the most popular indicators in recent decades. The Ichimoku Kinko Hyo indicator is a technical analysis tool that, through five complementary lines that are added to the traditional candlestick chart, tries to define the general trend, give a buy-sell signal or see the strength of the signal that the chart is giving.

The Ichimoku indicator was developed in the 1930s by Goichi Hosoda, a Japanese journalist. Goichi Hosoda spent 30 years perfecting his technique before making it public in the 1960s. But why is this strategy so famous?

What is the Ichimoku Indicator

The Ichimoku Cloud, also known as Ichimoku Kinko Hyo, is a versatile manual trading indicator that defines support and resistance levels, identifies trend direction, measures momentum, and provides profitable trading signals.

Ichimoku is a trading system that works on all timeframes with any instrument. This indicator provides traders with a good understanding of the different markets and helps them to discover multitude trading opportunities with a high probability so that in a few seconds we are able to determine if a trade, with the current trend, will have positive results. , or whether to wait for a better market set up in a given market.

The Ichimoku cloud can be used both in upwards and downwards markets. This indicator should not be used when there is no clear trend.

Above all, it is important to specify that the Ichimoku Kinko Hyo Indicator is not based on moving averages. It is a trend indicator based on the Donchian indicator.

The Ichimoku Kinko Hyo approach consists of 5 elements. To use it, it is important to understand its components well.

What are the components of Ichimoku indicator?

The Ichimoku consists of 5 lines and a cloud made up of the space between two lines. These 5 lines are Senkou Span (A and B, the space between them forms the Kumo or cloud), Chikou Span, Tenkan, and Kijun (also called Tenkan-Sen and Kijun-Sen). All these lines are a calculation based on the midpoints between the maximum and minimum of a given period.

Each line is calculated with certain mathematical models, although the calculation itself is not important. The important thing is the information that each line offers.

- Chikou Span: The delayed line represents the current price drawn back 26 periods.

- Tenkan: It is known as the conversion line. It is calculated by the following formula: (Highest High + lower minimum) / 2 calculated for the last 9 periods.

- Kijun: It’s the baseline, its formula is (Highest High + Low minimum) / 2 calculated for the last 26 periods.

- Senkou Span A and B, Kumo or Ichimoku Cloud: The most important feature of these lines is that are drawn several periods ahead in time. The calculation of these lines is:

- Senkou Span A: It is estimated by (Tenkan – Kijun) / 2 and is plotted 26 periods ahead.

- Senkou Span B: Its value comes from the formula (Highest High + Low minimum) / 2, calculated for 52 periods and drawn 26 periods forward.

- Kumo, Ichimoku Cloud: The space between Senkou Span A and Senkou Span B is called Kumo, or cloud, and represents an area of support/resistance. Therefore it is a representation of different levels of support and resistance. The cloud was one of the most important points in the development of this indicator. In this case, Hosada did not represent the levels of support and resistance as single lines as the traders opened their positions at different distances from the points of support or resistance, creating a cloud of support and resistance levels corresponding to different bid / ask or prices of supply and demand.

Calculation of Ichimoku components

Now that we know the name of all the lines that make up the Ichimoku Kinko Hyo, let’s see how they are calculated in the following table:

| Name | Formula |

| Senkou Span A | (Tenkan Sen + Kijun Sen)/2 projecting to 26 periods |

| Senkou Span B | (Highest High + Lowest Low)/2 of the last 52 periods, projecting to 26 periods |

| Tenkan Sen | (Highest High + Lowest Low)/2 of the last 9 periods |

| Kijun Sen | (Highest High + Lowest Low)/2 of the last 26 periods |

| ChiKk Span | Current closing price carried back 26 periods |

Technical Analysis with Ichimoku Kinko Hyo indicator

- General trend: In general, when the price is on the Ichimoku cloud, we can say that there is an uptrend. On the contrary, if the price is below the cloud we have a downtrend.

- Buy/sell signal: The buy or sell signal is given by the crossing of the Tenkan and the Kijun. As we have seen before, both lines are calculated in the same way but for different periods, therefore the buy signal is when the line of the least period (Tenkan) crosses from the bottom up to the line of the longer period (Kijun). The sell signal is given by the crossing of the Tengan from top to bottom over the Kijun.

- Signal Strength: The Chikou Span gives us information about the strength of the signal. Just think, What information can offer the current price drawn back 26 periods? For example, if we see that the current price is above the Ichimoku cloud, Tenkan has crossed from the bottom up to the Kijun, and Chikou Span is above the cloud, we can say that the buy signal is stronger than if the Chikou span is below. This is because if the current price is above the cloud, and if we draw it some periods backward it is also above the cloud, which indicates that the trend is confirmed. It also increases the signal strength if Chikou Span is above the baseline (Kijun). Another point to bear in mind when evaluating the signal is that the signal (Tenkan-Kijun crossing) occurs above the cloud.

Basically, the Ichimoku Kinko Hyo can be used to inform us about the general trend of the market, to give us an entry signal, and to show us the strength of the trading signal. These applications demonstrate the versatility of this technical indicator.

Signals of the Ichimoku Strategy with the Cloud

- A bullish cross over the Ichimoku cloud is a strong signal

- A bullish cross under the cloud is a weak signal

- A bullish cross in the Ichimoku cloud is a neutral signal

- A bearish cross under the cloud is a strong signal

- A bearish cross over the Ichimoku cloud is a weak signal

- A bearish cloud cross is a neutral signal

Stronger Ichimoku Cloud Signals

- The bullish cross over the Ichimoku cloud.

- The bearish cross under the Ichimoku cloud

Weaker Ichimoku signals

The cross signal of the Tenkan line with the Kijun median.

Buy signals with Ichimoku

- A bullish crossover and a bullish close, between the first 5 candlesticks above the Kumo cloud, illustrate a buy signal

- A bearish crossover and a bearish close, between the first 5 candles under the Kumo cloud, illustrate a sell signal

How to close a position with Ichimoku?

There are several signals to make the decision to close a trade based on the Ichimoku system

- The reverse crossover with the trend of the Tenkan and the Kijun.

- A trailing stop based on the Ichimoku Cloud SSB

Ichimoku analysis and Chikou filter

When conducting an Ichimoku analysis, it is important to ask yourself the following:

Where is the Chikou line compared to the current price?

- If the Chikou is above the price, it is possible to look for an Ichimoku buy signal

- If the Chikou is below the price, it is possible to look for an Ichimoku sell signal

It is actually an additional filter! Chikou can also be used to identify support and resistance automatically by following the peaks represented on the chart by the Chikou line!

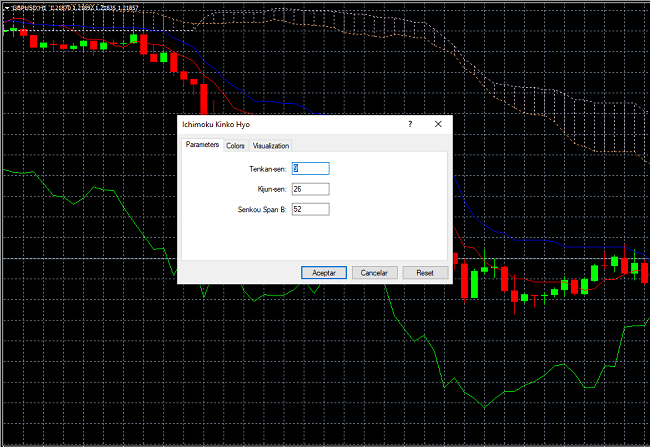

Configuration of the Ichimoku Indicator

This indicator has three parameters:

- The first parameter influences Tenkan Sen and Senkou Span A

- The second parameter influences all time steps except Tenkan Sen

- The third parameter only influences Senkou Span B

What are the parameters of Ichimoku?

By default, the Ichimoku parameters in MetaTrader are 9, 26 and 52.

These parameters can be modified to suit your needs, but keep in mind that the higher the adjustment you make to these parameters, the greater the noise.

The main disadvantage of changing these parameters is that if there is a clear opportunity to make a trade, this signal will jump later than if you leave the default parameter settings.

What is the best Ichimoku setup?

Goichi Hosoda carried out various tests with different combinations of these parameters and concluded that 9, 26, and 52 is the best possible combination for this indicator. These parameters adjust to any time frame.

Other settings of the Ichimoku indicator are:

- Ichimoku 7 22 44

- Ichimoku 45 130 260

Questions before using the Ichimoku indicator in Forex

What to look for and how to correctly analyze the Ichimoku indicator?

Here are the 8 questions to ask yourself when you are in front of a chart with the Ichimoku Kinko Hyu indicator.

- Is the current price higher than that of the Ichimoku Kumo cloud or the neutral zone?

- If the market is trending, ask yourself where the price is compared to the Ichimoku cloud. This helps to know if the trend is up or down. If the price is in the Kumo cloud, it is a neutral zone. In this case, you have to wait for a breakout.

- Is there a Tenkan/Kijun junction? If so, is it a strong or weak signal?

- Is the cloud or Kumo bullish or bearish?

- Is the price higher or lower than Chikou?

- Where are Chikou support and resistance?

- What is the volatility range?

- Where is the price compared to the Tenkan and Kijun lines?

This combination of factors, complemented by multi-time unit analysis, provides excellent results for finding an overall trend and major support and resistance levels.

The Ichimoku indicator provides us with a lot of entry and exit signals. First, we will show them in a general way, to determine when they are strong and when they are weak, and then we will analyze each of the components of this indicator one by one.

Conclusion

The Ichimoku technical indicator is an interesting analysis tool due to its many components. It is designed to identify support and resistance, the market trend, and momentum and provides us with buy and sell signals.

Next, and to finish, we will detail some tips to be able to get the most out of this interesting indicator.

Support and resistance levels are represented by the cloud or Kumo. The thicker the cloud, the stronger the support and resistance, so if we run into a thick cloud these levels will be harder to break, if the cloud is very thin these levels could easily be broken by price action.

- If the fast line deviates from the slow lines, the probability of having price consolidations again will be greater.

- If the price moves away from the slow line or the fast line, it is advisable to wait for the price to return and then study the market again before making the appropriate decision.

If you are not able to see these opportunities in a few seconds, try a longer time frame and if you still do not see the trade clearly, we advise you not to enter the market and wait for another trading opportunity.

Always test all your strategies in a risk-free environment.