JustMarkets

| –ECN/STP broker from Europe specialized in Forex and CFD -More that 200 trading instruments -Tight spreads, fast executions and low commissions |

JustMarkets was founded in 2012, establishing its headquarters in Cyprus and quickly expanding to become one of the most recognized brokers in the Forex and CFD markets. Its growth is backed by a solid track record, adapting to the needs of both beginner and advanced traders. The broker operates under several global regulatory entities, which has helped solidify its reputation in the financial sector.

Main Features of JustMarkets:

- Demo Accounts: Ideal for those who want to practice strategies without risking real capital. These accounts allow users to simulate trades under real market conditions, making progressive learning easier.

- Cent Accounts: Designed for novice traders or those with limited capital. They allow trading with microlots and managing risk from low deposit amounts.

- Copy Trading: The option to automatically copy trades from experienced traders is integrated for those looking to learn or diversify without prior experience.

- 24/7 Support: Continuous support that backs global operations, adding confidence among users.

- Education and Resources: Accessible educational materials to support the trader’s ongoing learning process.

Pros:

- Low spreads and fast execution

- Accessible minimum deposit

- Variety of instruments and platforms (including MT4/5)

- Copy trading with no additional commissions

Cons:

- Issues with support

- Limited education and analysis

Services Offered by JustMarkets

The range of products includes over 260 tradable instruments: currency pairs, commodities, stock indices, shares, and cryptocurrencies. This catalog covers both the most popular markets and less traditional segments. Reviews of JustMarkets often highlight the flexibility and breadth of these services, positioning it as an attractive option within today’s online trading ecosystem.

Financial Instruments Offered by JustMarkets

The wide range of financial instruments offered by JustMarkets allows traders to access multiple markets from a single platform. With more than 260 tradable assets, the broker caters to the needs of both beginner and advanced traders.

Main categories available on JustMarkets:

- Currency Pairs: 61 Forex pairs—exceeding the industry average—facilitating diversified trading strategies.

- Commodities: 12 options including metals and energy assets, ideal for those seeking hedging or exposure to raw materials.

- Stock Indices: 13 major global indices enable traders to speculate on movements in key markets.

- Cryptocurrencies: 17 crypto pairs for those looking to benefit from digital market volatility.

- Stocks (CFDs): 164 CFDs on international stocks, granting access to leading companies without owning the underlying asset.

This selection includes the most popular and in-demand instruments in today’s trading landscape. The integration of various asset types within the same platform simplifies portfolio management and offers opportunities to diversify risk based on the trader’s profile.

Diversity in Currency Pairs and Stock Indices Offered

JustMarkets stands out for its broad selection of currency pairs and stock indices, providing traders with numerous opportunities to diversify their investments.

Currency Pairs

The broker offers 61 currency pairs, exceeding the industry average of 55. This includes:

- Major pairs such as EUR/USD, GBP/USD, and USD/JPY.

- Minor pairs like EUR/CAD and GBP/AUD.

- Exotic pairs including USD/TRY and EUR/PLN.

Stock Indices

As for stock indices, JustMarkets provides:

- 13 indices covering major global markets.

- Examples include Germany 40, Dow Jones 30, and FTSE 100.

This variety enables traders to take advantage of opportunities across different markets and to adapt to changing financial conditions. The offering exceeds expectations when compared to many other brokers, making JustMarkets an attractive option in broker reviews.

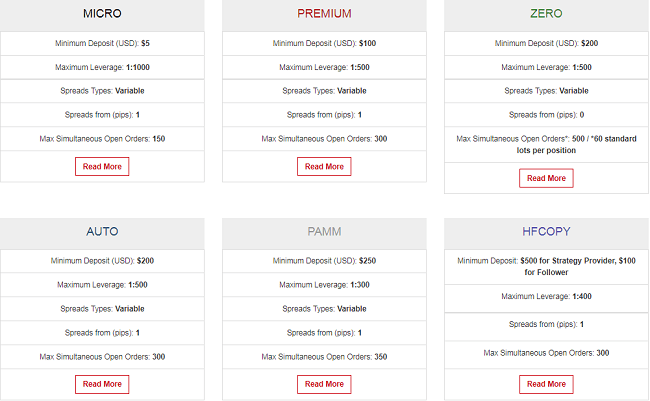

Available Account Types in JustMarkets

JustMarkets offers a variety of account types tailored to both beginner and advanced traders:

- Cent Accounts: Ideal for beginners, allowing trading with microlots and learning without risking large amounts of capital.

- Demo Accounts: Perfect for practicing strategies risk-free, providing a simulated environment before investing real money.

- Standard and Pro Accounts: Designed for advanced traders, these accounts offer access to tight spreads starting from 0.0 pips and fast execution.

- Copy Trading: Enables users to follow and copy the strategies of successful traders, making learning and diversification easier.

These options ensure that traders can find an account suited to their experience level and financial goals.

Available Trading Platforms: MT4, MT5, and JustMarkets Mobile App

JustMarkets is committed to technological flexibility, allowing users to trade on the well-known MT4 and MT5 platforms, as well as through its own mobile app. These solutions cater to both beginner traders seeking ease of use and advanced users who require powerful tools.

MetaTrader 4 (MT4): MetaTrader 4 (MT4) stands out for its intuitive interface and four main panels: Market Watch, Navigator, Charts, and Terminal. It enables real-time price tracking, access to over 60 technical indicators, drawing tools, and one-click trading. Customization is key—you can organize multiple charts and manage accounts or expert advisors from the Navigator panel. Live P&L tracking and the ability to set price alerts provide full control over trading activity.

MetaTrader 5 (MT5): MetaTrader 5 (MT5) expands on MT4’s capabilities with more indicators, advanced order types, and access to a wider range of markets and instruments. For those seeking a professional experience in algorithmic trading or multi-asset analysis, MT5 becomes the preferred choice.

JustMarkets Mobile App: The JustMarkets mobile app (available for iOS and Android) impresses with TradingView-powered charts, over 100 technical indicators, and 50 drawing tools. It features a constantly updated market news section, allowing users to make informed decisions from anywhere. Order management is simple and intuitive—you can open trades, set stop loss/take profit levels, and adjust lot sizes directly from your phone.

Those who value trading without time constraints will find in these platforms a strong combination for maintaining full control over their investments at any time.

Fee and Commission Analysis: JustMarkets Fee Structure and Comparison with Other Brokers

JustMarkets’ fee structure stands out for its competitive approach, especially for traders seeking low operating costs in daily trading. The commission-free Pro CFD accounts offer tight spreads, which in real-world tests showed:

- EUR/USD: An average of 1.0 pips during the London session and 0.9 pips in New York—below the industry average of 1.08 pips.

- GBP/JPY: 2.1 pips in London and 2.9 pips in New York—slightly above the sector standard of 2.44 pips.

- Stock indices like Germany 40 show lower-than-average spreads during certain sessions, while others such as the Dow Jones 30 exceed the average.

- Popular stocks such as Apple CFD offer highly favorable spreads (0.17 points versus the average of 0.33 points).

JustMarkets does not charge an inactivity fee, which benefits less active traders. Compared to other brokers, its spreads are typically lower or similar on Forex and stocks, although U.S. indices can be less competitive.

Swap-Free Accounts

These accounts add flexibility for clients who require interest-free overnight trading, aligning JustMarkets’ offerings with various financial profiles and needs.

Swap Fees and Their Impact on Short- and Long-Term Traders

Swap fees at JustMarkets are medium to high, which is particularly relevant for traders who hold positions open for several days. These fees can significantly affect long-term traders, as cumulative charges may reduce profitability if not properly managed. Conversely, short-term traders and scalpers are barely affected, as they usually close trades before the daily rollover.

To accommodate traders looking to avoid swap fees, JustMarkets offers swap-free accounts, intended for Islamic traders or those with specific needs.

There is no inactivity fee, making the platform more appealing to occasional users.

Carefully analyzing your trading style is essential to determine how these costs affect you and to choose the most suitable account type.

Reliability and Security: JustMarkets Regulations

A broker’s reliability largely depends on its regulatory framework and the measures in place to protect client funds.

JustMarkets operates under four regulatory licenses, including two top-tier ones: CySEC (Cyprus) and FSCA (South Africa), along with FSA (Seychelles) and FSC (Mauritius). This offers a strong foundation, as highlighted in broker reviews when evaluating JustMarkets’ regulatory standing.

Client funds are held in segregated accounts, meaning the money is kept separate from the company’s operational capital. All entities offer negative balance protection, ensuring accounts don’t fall below zero. Only the CySEC-regulated entity provides access to a financial compensation scheme in case of broker insolvency.

Broker Experience Since Its Founding in 2012

JustMarkets has a solid track record in the financial markets, having been founded in 2012. The broker’s experience is reflected in its ability to adapt and evolve, showing resilience and trustworthiness over the years.

Operating under four regulatory licenses, including top-tier regulators like CySEC and FSCA, JustMarkets maintains high standards of operation and investor protection—helping solidify its reputation among both beginner and advanced traders.

JustMarkets Minimum Deposit and Payment Methods

The minimum deposit required for all JustMarkets accounts is $1. An interesting aspect of this broker is that it accepts multiple payment methods for both deposits and withdrawals.

The payment methods accepted by this broker are:

- Debit and credit cards (VISA and Mastercard)

- Skrill

- Neteller

- Perfect Money

- Sticpay

- FasaPay

- Wire Transfer

- Alipay

- Bitcoin

- Airtm

- Ethereum

- Boleto

- Bitwallet

Security and Protection

All data is transmitted via a secure SSL connection, and the company’s internal procedures comply with the PCI DSS security standard. Additionally, JustMarkets uses a multi-level server system with data backups.

The MetaTrader brand also adheres to high standards of data privacy and client protection. All accounts can be secured with two-factor authentication (2FA) and one-time passwords (OTPs) for added peace of mind.

Current promotions of JustMarkets

The main promotions of this broker are the following:

- 50% deposit bonus: JustMarkets offers a deposit bonus up to $5000 which applies top every deposit made by the trader.

- 0% commission on deposits and withdrawals: JustMarkets covers all fees that may occur when you deposit or withdraw funds.

- Invite friends: Earn up to $25 for every lot traded by your referrals.

Other categories of this broker

- Gold Broker.

- Silver Broker.

- CFD Broker.

- ECN Broker.

- MT4 Broker.

- MT5 Broker.

| Company | JustMarkets Limited |

| Operating since | 2012 |

| Minimum account size | $10 |

| Minimum lot size | The minimum transaction size is 0.01 lots |

| Maximum Leverage | 1:500 |

| Spreads | JustMarkets offers variable spreads depending on market conditions from 0.0 pips for EUR/USD. |

| Demo account | Yes, with no limit of time. |

| Link to the website |