There are certain facts that have remained strong in recent years in connection with trading. Experienced and successful traders point out that, despite being able to develop trading strategies with high probability of success that allow them to enter the market at the right time through their systems signals they almost never close a position in the optimal moment.

Close the trades at the right time is one of the most challenging aspects of trading in general and for many beginning traders it is difficult to understand that the market exits are difficult to visualize and we just have to execute them as part of our trading plan. In this case, the trades must be closed according to our trading plan with no doubt and fear even if it appears that there are some pips or points that were closed for closing a position “too soon”. We may be able to achieve excellence, but perfection (as far as trading is concerned) is an impossible ambition.

Therefore, to maximize our profits and minimize losses can only be achieved within the parameters of our trading plan. We will never be able to predict accurately with any kind of certainty, the absolute maximum or minimum of any market movement, but what we can do is to design a strategy that allows us to take a considerable share of the market movement in terms of pips or points. Instead of learning to maximize our profits and minimize our losses we must learn to accept our limitations and work within them. So how do we set our parameters?

Plan your trades and trade according to plan

Fortunately, if we have the self-discipline to stick to a trading strategy and trading plan in which we have faith, then our ability to take our profits and limit our losses must be determined by the stop loss and take profit limit orders that we set to enter the market, although these two parameters can be adjusted if the trade progresses in our favor. By setting the parameters of a stop-loss and a take profit limit, anxiety and responsibility to choose the maximum or minimum of any market movement will be eliminated, as we refer only to the strategy.

Use of trailing stops to minimize our losses

A method to minimize our potential losses is to use a trailing stop to “follow” the market price, or move the stop loss by following the readings of an indicator as the Parabolic SAR. Thus, assure a percentage of our profits as the market moves in our favor, and reduce the potential for a sudden reversal that can wipe out the gains for a position impact.

Trailing stop loss orders are available on most trading platforms and are one of the most underrated and least used tools available for applications of this type. These orders allows traders to minimize their losses and protect profits. The trailing stops are also relatively easy to “code” in Expert Advisors (EA) as used, for example, in the MetaTrader 4 platform.

Control your risk and will have an advantage

There are to many traders, particularly novice traders, who imagine that their best chance of success come from the use of strategies to open profitable positions most of the time. The reality is that the most important aspect of an overall strategy is derived from the risk control and money management techniques that we use, not the methodology of market entry. When we trade, it is always important to think about the worst case scenario before opening a position and plan according to this possibility.

Maximizing our benefits as part of our trading strategy

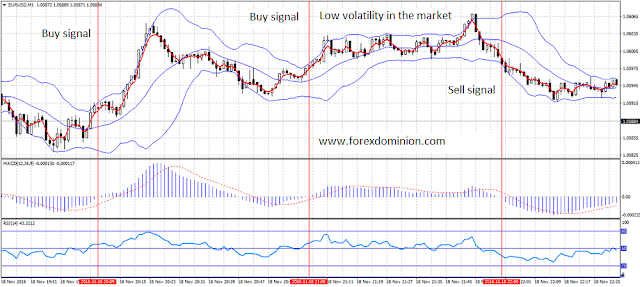

As noted above there is no method that allows us, with any degree of certainty or regularity, find the maximum and minimum of a market move perfectly, whether we focus on day trading, swing trading or position trading, because it is simply impossible. Therefore, when we devised our trading system and include it as part of our trading plan, we have to use any of the indicators that tell us what is the best time to close a position, or we can use some form of recognition of candlestick patterns (commonly known as price action). However, whatever the method we choose, ie closures positions based on price action or indicators, none have a 100% reliability.

A tool to close positions we can use is the Parabolic SAR, which indicates a possible changes in the market trend. Alternatively we could use an indicator like stochastics or RSI when they enter overbought or oversold conditions. Another option is an indicator such as MACD and DMI, whose lower highs or higher lows in the visual histogram maximum, point to a possible reversal in the market sentiment.

On the subject of higher highs or lower lows, this leads directly to the price action. In order to maximize our profits, we should try to exit the market at the right time, so it is necessary to look for clues about a possible change in the sentiment. For swing traders, using price action could be represented by the inability of price to make new highs, the formation of double tops and double bottoms on daily charts, or the classic appearance of a doji candle, which can indicate that the market sentiment may have changed. Although these methods are not foolproof, have been used successfully over time to determine a possible market reversal or loss of the current price momentum and can be used very effectively to indicate the best time to close out trades and to obtain the maximum benefit.

Naturally, there are cases where we will exit the market in the belief that we have taken the greatest possible amount of pips or points of a price movement, to then watch helplessly as the price temporarily make a retracement and then continues its previous movement. However, it is one of the dangers to which we will always be exposed as traders because the market always brings surprises, and no trader, even the most experienced, can guess what will happen in the future.

You can access a complete list of Forex strategies in the following section: Forex Trading Strategies