In this article, we will show you how the Parabolic SAR indicator can help you predict the market trend and its oscillations.

The Parabolic SAR is another of the stock market technical indicators developed by the legendary Welles Wilder, who published it in his well-known book “New concepts in technical trading systems“, along with the RSI, the ATR, and the ADX.

Also known as PSAR, it is a technical indicator whose main objective is to indicate the possible change in a trend. SAR is the acronym for Stop And Reversal because it is very usual to use the points determined by this indicator as possible exit points, ie, its most common use is to determine zones where it is possible that the current trend ends.

The SAR is normally represented on a trading chart by a series of dots. It is the only indicator that is generally depicted in this manner. Therefore, it provides several advantages to the traders in their market analysis.

What type of indicator is the Parabolic SAR?

First of all, it is a trend indicator that is designed for the identification of trend changes, because it tries to give us the approximate points where it is likely that a trend is coming to an end. As such, it serves its purpose quite well because in many cases it gives us a fairly clear picture of when an important trend is ending or starting, but also, like all indicators, it generates quite a few “false” signals.

Therefore, as it is an indicator that follows the price and its trend changes, it can be useful for traders who use trend-following systems.

This indicator plots a curved pattern on a price chart. As we will explain later, the Parabolic SAR describes the potential levels to which the price will go and reverse its direction. To Wilder, the pattern design of this indicator reminded him of a satellite dish, hence the name of the indicator.

This indicator is present in different trading platforms, such as Metatrader 4, so it is not necessary to know how it is calculated, although it is useful to have this knowledge. In the next section, we will explain how this indicator is calculated. This can help you understand how it works, what the various parameters mean, and how to modify its use.

Remember that although it is useful to know, it is not strictly necessary, since the MetaTrader platform will do all the calculations for you.

How is the Parabolic SAR calculated?

The indicator plots the Parabolic SAR levels on the chart. The Parabolic SAR formula is as follows:

SARnew= SARcurrent + AF x (EPcurrent – SARcurrent)

AF = Acceleration Factor. It is a variable value, it increases in set increments for each period a new high is reached (for long positions). Or the opposite, for short positions. Wilder proposed a value of 0.02 for the initial value of AF. This value increases in steps of 0.02 until it reaches a maximum value of 0.20.

EP = Extreme Point. The maximum or minimum price reached during the current trend. The high for the uptrend, the low for a downtrend.

The curve of the indicator is intended to provide a guide to predict the change in a market trend. Wilder stated that a trending market will have a high chance of staying within the constraints of the curve on the chart. Therefore, if the price does not meet this dynamic and breaks the curve, the trend may have come to an end. That would be the time to close and reverse your position.

This is all we wanted to tell you about the theory of the Parabolic SAR indicator. Now let’s learn how the MetaTrader 4 platform can help you get the most out of this indicator.

So what are the best parameters for the Parabolic SAR?

The answer will depend on your risk appetite, the time frame you want to trade, and the goals of your strategy. With experience, you will find the parameters with which to get the most out of the indicator.

How to interpret this indicator?

- The smaller the acceleration factor, the further away from the price.

- The higher the acceleration factor, the closer it is to the price.

Consequently, the reversal is more likely the higher the acceleration factor. It’s important not to have too high an AF or it will reverse too often (too many false signals). Frequent reversals can decrease the accuracy of the indicator.

The price sensitivity (higher or lower), and consequently the number of reversals, will depend on your trading strategy.

For example, a scalping strategy requires a higher number of reversals than a long-term trading strategy. Consequently, a scalper is likely to find a high AF more appropriate.

Wilder found that the default value of 0.02 was the best for his trading strategy. But he stated that any value between 0.018 and 0.021 would also be suitable. He recommended not setting a value higher than 0.22.

Basic Strategy with Parabolic SAR

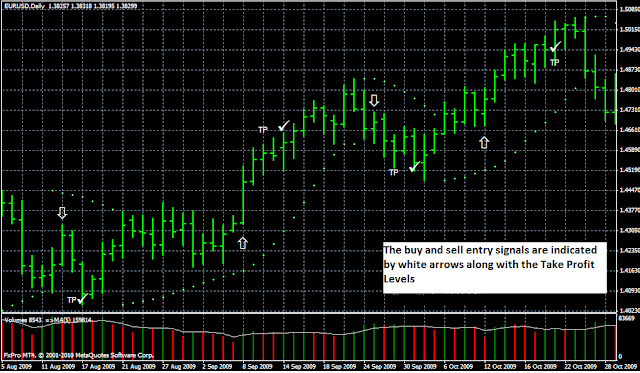

If we add the Parabolic SAR to a price chart in MetaTrader 4, the indicator will appear as shown in the image below:

The red dots mark where to place your stop loss. Observe how this indicator follows the market trend without moving away. As the trend continues, the increasing acceleration factor tells us that the stop is getting closer to the price. If the market movement does not continue in your favor, the indicator informs you that it is time to stop and change direction.

The rules of the Wilder Parabolic SAR strategy are as follows:

- Parabolic SAR points below the current market price point to an uptrend.

- Parabolic SAR points above the market price point to a downtrend.

- Buy if the price crosses above the Parabolic SAR points.

- Sell if the price crosses below the Parabolic SAR points.

- It’s time to stop and reverse your position when the price crosses the SAR again.

Anyway, you have to be aware that trading strategies are not infallible. Trading in the financial markets carries risks.

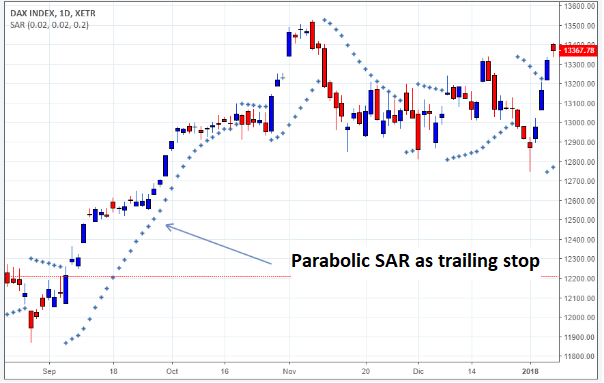

Parabolic SAR as trailing stop

There are many traders who use the Parabolic SAR to define a trailing stop, that is, a mobile stop loss that is moved up or down as the trend continues, and that will only be executed if the trend is ending and reach the stop order.

As such, it can be a useful tool, because if you look at the price charts, especially daily or weekly charts, many big trends run for a long time before the price reverses its direction and breaks the trend line. In a trend following the trade, this can give us great profits, especially if we manage to capture a long-term trend and the Parabolic SAR allows us to stay in it.

Parabolic SAR for day trading

Let’s see an example of how the Parabolic SAR can behave in a 15-minute price chart, very typical of intraday trading.

This price chart shows us three sessions of the DAX 30 index.

In this chart, we can see how out of five possible signals we had 4 very bad ones in which the price went in the opposite direction to what the SAR supposedly would have indicated.

This is a clear example of an “intraday sideways market”, which always gives us problems when the indicator is “lagging”, that is, it is behind the movement, something consubstantial to the “sideways markets”.

Combine other indicators with the Parabolic SAR

To build your strategy, we advise you to combine the Parabolic SAR indicator with other indicators. For example, the ADX indicator can help you in markets that are in a sideways range.

Knowing the general direction of the long-term trend is also helpful when opening a position. It may be advantageous if another trend indicator confirms the trend.

If we continue this line of thinking, we advise you to use an alternative indicator to confirm the market trend and close the position when the price crosses the SAR, not when it changes direction.

You may find the MetaTrader 4 platform useful as it will provide you with a substantial number of tools to build your trading strategy. It includes a trading simulator that allows you to check the effectiveness of your strategies.

How to add the Parabolic SAR in MetaTrader 4

The MetaTrader 4 platform includes 30 basic technical indicators. The SAR indicator is one of those indicators. This means that as soon as you install MT4, you will have access to the indicator. You do not need to download the indicator individually.

The Parabolic SAR indicator is located in the “Trend” subfolder in the “Indicators” list in the MT4 platform browser. Double-clicking on the indicator opens a dialog window as shown in the image below:

Conclusion

Parabolic SAR is one of the most useful indicators that we can find in the wide repertoire of technical trading indicators.

Sometimes it can give us spectacular signals of important trends, but it also presents us with many problems in ranging or lateral markets.

Before using this indicator it is important to incorporate it into a good trading system. We must incorporate other indicators that serve to confirm their signals and increase their reliability.

That is, we will need a trading plan that will serve as a base and with it we can already try to find a way to use the Parabolic SAR in some way that could be advantageous to us.

Due to its characteristics, the Parabolic SAR can be a good tool to define trailing stops.

In any case, I encourage you to study this indicator and try to put it into practice in demo accounts or simulations of any kind.