What a limit order?

A limit order can be defined as a trading order given to the broker or dealer to buy or sell an asset at the specified price or better.

As a limit order is executed only at the specified price or better, a limit buy order will be executed only at the specified price or at a lower price, while a limit sell order will be executed only at the specified price or at a higher price. In both cases, a limit order is only executed if the market price reaches the limit price (price specified in the limit order) or passes it, which means that a limit buy order is accepted only if the limit price is less than the current market price and will be executed if the price falls to the limit price or to a lower price. A limit sell order will be accepted only if the specified limit price is higher than the current market price and will be executed only if the market price goes up to that limit price or up to a higher price.

The limit orders do not have a guaranteed execution because it can happen that the price does not reach or exceed the limit price, however, they fulfill the role of assuring the investor the order execution price or a better one. This is why they are especially useful in low-volume assets, such as exotic currency pairs, in which a market order can slippage frequently.

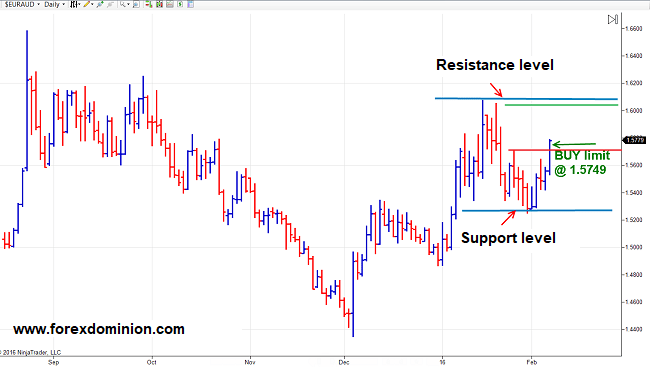

A limit order is one of the most useful trading orders. They can be used to open positions in the market without the need to monitor price action for hours. The trader just has to place the limit order and wait for the price to reach and activate it.

Examples of limit orders

- Buy limit order: Suppose we want to open a buy position in the EUR/USD (Euro/US Dollar) at the price of 1.2000, but we do not want to pay more than that price. The current market price is 1.1960, and we decided to place a limit buy order at the price of 1.2000 through our Forex broker. This will ensure that the execution price of the order will be 1.2000 or a lower price (better for the buy trade) although it does not assure us that the order will be executed because the market price may not fall to 1.2000.

- Sell limit order: Assume that the price of the EUR/USD is at 1.1960 and we think that it will go up to 1.2000 and that from here it will start to go down, so we are interested in opening a short position at 1.2000. To ensure that our order is executed at that price we can place a sell limit order at 1.2000, so the order will be executed if the market reaches up to 1.2000 or to a higher price (better for the sell trade).

Two types of limit orders are the stop loss order and the take profit order.