Equity markets start the week lower after expectations of an aggressive interest rate cut by the US Federal Reserve and rising tensions in the Middle East fade.

At the end of last week comments from New York Fed President John Williams, noting that FOMC members could not wait for the economic slowdown to hit them to introduce monetary stimulus, raised expectations that the central bank would lower the interest rates to 50 basis points at the meeting from July 30 to July 31.

But Wall Street stock markets closed lower last Friday, after the Fed contradicted Williams’ comments saying he was referring to a possible 25 basis point cut, not 50 points. The main US indices closed with falls of 0.25% in the Dow Jones, 0.62% in the S&P 500 and 0.74% in the Nasdaq.

Expectations of a larger cut were also reduced after the Wall Street Journal reported that the Fed would likely reduce rates by 25 basis points this month, and could make further cuts in the future based on global economic growth and development of the world economy and trade negotiations with China.

In geopolitical terms, note that the Iranian Revolutionary Guards captured a British-flagged oil tanker in the Strait of Hormuz on Friday, after Britain took an Iranian ship earlier this month, causing further tensions on a key route of international oil transportation.

In addition, last Thursday the United States reported that it had shot down an Iranian drone for carrying out a “hostile” maneuver by flying over this strait. The Iranian authorities denied the loss of the drone, but Trump reiterated the destruction of the aircraft and warned that, if Tehran did something imprudent, it would pay a price that nobody has ever paid.

In Asian markets, the composite index of Shanghai fell 1.26% on Monday and stood below 2,900 points, while the Tokyo Nikkei closed with a decline of 0.23% at 21,415 points.

Europe has started the week with a mixed sign, in the first trading hour of the session the German DAX 30 trades with a rise of 0.06%, the British FTSE 100 gains 0.15%, the CAC 40 decreases by 0.08% and the Euro Stoxx 50 loses 0.07%. The Ibex 35 loses 0.30% to 9,140 points.

In the price chart of the Frankfurt DAX 30 we see that the market has been testing for three sessions the support at 12,160 points, after crossing the short-term bullish trend line and the support at 12450. If the DAX 30 ended up falling below 12,160, the technical perspectives would be much more bearish.

The dollar strengthens

In the currency markets, the dollar strengthened against its main crosses due to the lower-than-expected rate cut of the Fed. The dollar index rose 0.38% to 96.80 points, against the yen it advanced 0.31% to 107.73 yen. The euro lost 0.36% to $1,1221 against the USD and sterling closed down 0.31% and it is trading at $1.25.

In the commodity markets, the prices of Texas crude closed Friday’s session with a rise of 0.60% at $55.63 per barrel, in the Asian session today oil continued to rise due to growing tensions in the Middle East. Although it should be noted that the WTI closed the week with a decline of 7.6% due to expectations of lower demand for crude oil.

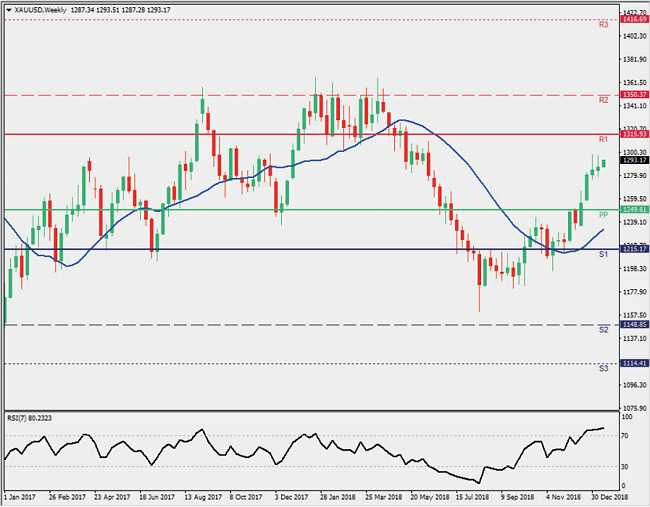

Gold fell from a six-year high by registering a fall of 1.21% to $1,425, pressured by dollar rallies and expectations of a smaller-than-expected cut in US interest rates.

In the macroeconomic front, attention will be focused on the publication of the monthly report of the Bundesbank and in the speech of Haruhiko Kuroda, the governor of the Bank of Japan will offer a press conference on monetary policy in Tokyo at 17:00 hours in Spain.