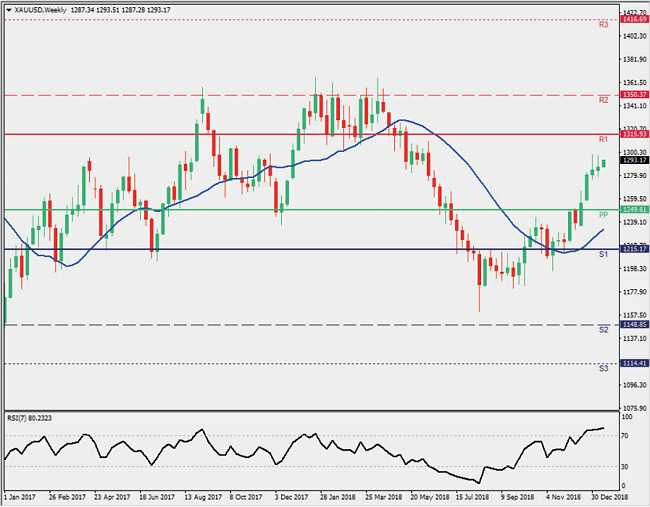

2018 was full of disappointment for commodities, contrary to expectations. Markets started the year with very high hopes, after upwardly revised growth projections in late 2017. As January and February are traditionally strong months for Gold, the strong demand noticed in the first quarter of 2017 helped the asset start 2018 in bullish mode.

In contrast to the forecasts, however, Gold markets bottomed out by the end of August at $1160 as it faced Dollar strength, mainly due to the Fed interest rate hikes. By the close of 2018 things changed as commodities perked higher, with Gold reversing more than 61.8% of the year’s losses.

Projections for 2019 point towards a bullish outlook for Gold on the perspective of a weaker year for the US Dollar. The slowdown in the global economy and the fact that policymakers are trying to focus on maintaining robust domestic growth momentum, as well as trade tensions and political jitters, leave the balance of risks to the downside.

US monetary policy ceased to support Gold markets until September, and US Fed funds futures priced out Fed tightening expectations for 2019, factoring in 2 tightenings in 2019. Hence, monetary policy, along with US growth, robust employment, and trade uncertainty, is expected to remain in play for 2019.

During 2018, we saw the yield curve flattening, as long-term rates have not moved in line with short-term ones. Historically, a flat yield curve indicates that the Fed is likely to reduce or stop tightening policy, in the face of an upcoming recession. Furthermore, global demand for precious metals changed in 2018, with Russia replacing the Dollar with Gold as its principal reserve currency.

If the Fed continues raising rates into 2019, the policy could become restrictive, resulting in an inverted yield curve. Under these conditions and based on the inverse correlation between Gold and interest rates, Gold is expected to gain. In 2019, there is also a possibility for Yuan-Gold futures, in an attempt to eliminate China’s exposure to the US Dollar.

Overall, based on the above, expectations are for resistance to further advance on the US Dollar, and consequently forecast Gold markets to rise in 2019.

Outlook for Gold markets

– Technically Bullish – end of Q1 important for rest of year

– Pivot Point – 1250

– Support – 1215.00, 1150 and 1115.00

– Resistance – 1315.00, 1350.00, and 1415.00

Gold Review

A weakening US Dollar, an inverted yield curve, and increasing geopolitical tension would aid commodity prices and this precious metal in particular, as it is treated as a safe haven asset.

Source: