Equity markets continued to rise the previous week, while the dollar and global bond yields contracted, after the Federal Reserve signaled possible cuts in interest rates for this year. The yield on 10-year US Treasury bonds fell to 1.974%, its lowest level since November 2016.

Signs that China and the United States will resume trade negotiations after a six-week hiatus also reinforced investor sentiment.

The Federal Reserve chairman, Jerome Powell, said after the monetary policy meeting that the “justification for a more accommodative monetary policy has been strengthened” but the Fed wants to “see more data” before making decisions.

The Federal Reserve announced that interest rate cuts will likely begin in July, signaling that it is prepared to fight against rising global economic risks, trade tensions and concerns about weak inflation. Although expectations of rate cuts could be reversed if Washington and Beijing made some progress in their talks.

US Trade Representative Robert Lighthizer said he will hold talks with his Chinese counterpart Liu He ahead of next week’s meeting between President Donald Trump and Chinese President Xi Jinping at the G20 summit in Osaka.

Several Chinese state media have pointed out today that there is little likelihood that the main disagreements between the two parties will be resolved in the next talks, but that the most important thing is to begin a new phase of negotiations.

The Bank of Japan (BoJ) maintained stable interest rates and monetary policy at its meeting on Thursday, but it is speculated that it could further increase its accommodative position towards the end of the year.

At 13 o’clock in Spain, we will know the decision of interest rates and monetary policy of the Bank of England. It is expected that the British central bank will not make changes in its meeting today, waiting to know the outcome of the elections to relieve Theresa May.

In the stock markets, the MSCI index of shares of Asia-Pacific rose 1.06%, the Nikkei 225 of Tokyo advanced 0.60%, while the composite index of Shanghai soared 2.38%.

Wall Street closed the session on Wednesday with moderate increases after the Federal Reserve announced that it kept interest rates unchanged between 2.25% and 2.5%, as expected by the markets.

The Dow Jones rose 0.15% to 26,504 integers, the S & P 500 advanced 0.30% to 2,926 units, and the Nasdaq composite index ended up closing with a revaluation of 0.42% at 7,987 points.

The European indices quoted with general increases reaching 0.92% in the German DAX 30, 0.41% in the British FTSE 100, 0.68% in the French CAC 40 and 0.72% in the Euro. Stoxx 50. The Ibex 35 gains 0.47% and approaches the resistance of the 9,300.

On the daily chart of Frankfurt’s DAX 30, the most representative index in Europe, we observe that at this moment it is attacking the annual highs of April, set at around 12,400 points. Overcoming this technical barrier would confirm and strengthen the upward trend in force since the beginning of the year.

EUR/USD continues to rise

In the Forex market, the weakness of the dollar against the main currencies continues. Against the yen marks a new falling minimum to stand at 107.50 yen per dollar, the euro rises for the second week in a row and is close to 1.14 dollars, while the pound sterling is going to experience its second week of increases and is trading at the moment above the resistance located at $1.27.

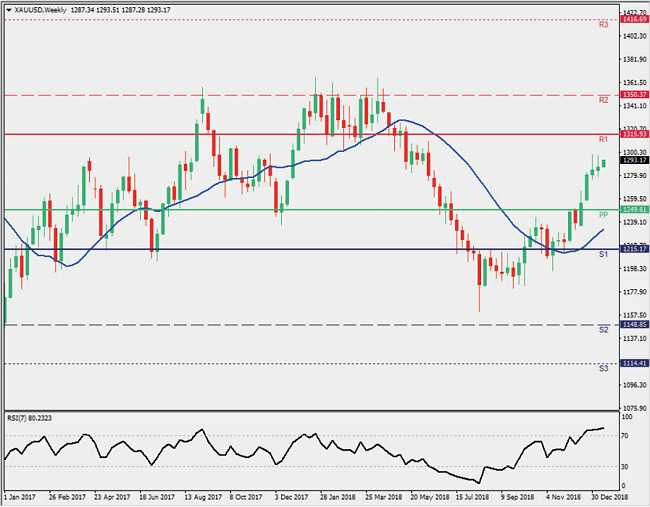

In the commodities markets, gold has surpassed long-term resistance at $1400 and is quoted at $1406, at its highest level since September 2013. The price of West Texas oil rises at the European opening to $57.39 per barrel and touches four-week highs.

In the economic field, today we will know the retail sales of the United Kingdom, the economic bulletin of the European Central Bank and the weekly requests for unemployment benefits from the United States.