- The EUR/USD is recovering after testing the 1.1200 level, but the bullish outlook is still unclear.

- The disappointing data from the United States caused the dollar bulls to be in suspense for the time being.

The EUR/USD has been moving around 1.1200 since the beginning of the day, bouncing from the area in a modest way, since the psychological barrier is a level difficult to break. However, the US currency maintains its strength, since the latest macroeconomic publications in the United States make investors doubt a turn in the monetary policy of the Federal Reserve, given that consumption continues to be resilient. The central bank of the United States is scheduled to meet this week, and its decision will be key to the dollar. Meanwhile, Benoit Coeure of the ECB warned of “gloomy” indicators on the health of the global economy, and that the risks could materialize in the next meetings.

The news from the EU showed that the Labor Cost increased less than anticipated in the first quarter, 2.4% compared to the 2.6% expected. As for the United States, the country has just published the Empire State Manufacturing Index for New York in June, which was much worse than expected, showing a result of -8.6 compared to the previous 17.8 and the expected 10.0. Pending publication is the NAHB Housing Market Index for June, with a forecast of 67 versus the previous 66.

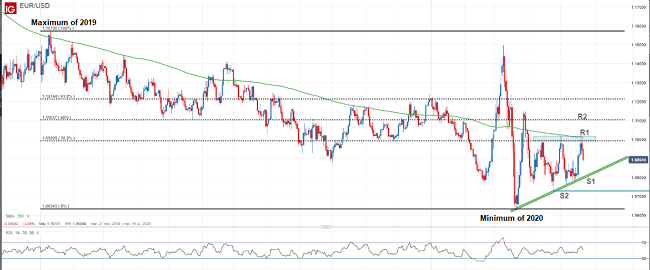

The dollar fell slightly in the middle of the European session, due to further bearish pressure after the publication of discouraging US data, which resulted in the EUR/USD trading in the 1.1240 region before the opening of Wall Street. US stocks have had a good morning, while European stocks are losing strength early in the session, now struggling to stay afloat. The 4-hour chart shows that the EUR/USD rebounded approximately from the 61.8% Fibonacci retracement of its last daily advance, and now is traded a few pips above the 50% retracement of the same rally and also above the SMA 100, which converges with the aforementioned Fibonacci level around 1.1230.

The technical indicators in the previous price chart have been recovered from oversold readings, but remain well below their mid-lines, maintaining the advance as a corrective move. The rise could continue if the pair manages to extend beyond the 1.1260 / 70 price zone, which is now the immediate resistance.

Support levels: 1.1230, 1.1185, 1.1140

Resistance levels: 1.1265, 1.1310, 1.1350

Oil continues to fall – will demand expectations rebound?

- While the commercial war extends its duration, the expectations of global growth continue to fall.

- The drop in growth expectations directly impact the prices of raw materials and oil can not get rid of this adverse scenario.

- The FED will meet this Wednesday and will surely try to relieve markets by announcing expansionary measures, however, until that moment the trend will surely continue to look down.

The Petroleum inventories of the API and US Petroleum inventories will be published Tuesday (17.30) and Wednesday (10.30) respectively. Changes in inventories can produce strong fluctuations in short term periods.

Results of the Monetary Policy Meeting of the FOMC (Wednesday, June 19) – 14.00 in New York. Expectations point to a maintenance of interest rates, however, the market expects updates of what could happen in the next meetings.

Central banks will determine the evolution of the markets

Investors are cautious in the first trading session of the week, awaiting the outcome of the monetary policy meetings of the Federal Reserve of the United States, the Bank of Japan and the Bank of England. While political tensions in the Middle East and Hong Kong also kept investors’ spirits under pressure.

Strong US retail sales data released on Friday pushed back the expectations of a Fed rate cut. The probabilities of the US central bank lowering rates this week were reduced from 31% to 17% after the publication of the data, but the expectations for the July meeting remain high since they remain at 84%.

Geopolitical tensions in the Middle East added further uncertainty after the United States blamed Iran for the attacks on two oil tankers in the Gulf of Oman.

US Secretary of State Mike Pompeo said on Sunday that President Donald Trump would raise Hong Kong’s human rights issue with Chinese President Xi Jinping at a possible meeting of the two leaders at the G20 summit in Japan to be held later this month.

Global equity markets reacted with falls to data released on Friday on industrial production in China, because they showed their slowest pace of growth in 17 years.

Wall Street closed Friday’s session with slight declines in a day marked by weak corporate results and the profit warning of the Broadcom group, the chip maker reduced its business forecasts for 2019 because the trade war and restrictions on the firm China Huawei reduced the demand for its products.

The Dow Jones fell 0.07% to 26,089 points, the S & P 500 index fell 0.16% to 2,886, and the Nasdaq composite index led the declines with a 0.52% drop to 7,796 units.

Europe has started the week trading without defined course between small losses and gains. The German DAX 30 loses 0.02% at this moment, the FTSE 100 of London quotes flat at the same closing levels on Friday, the Euro Stoxx 50 advances 0.09% and the Ibex 35 is left 0.5 % that has placed you below the 9,200 points.

The euro fell 0.63% to $1.12, while the pound sterling fell 0.67% to $ 1.2555. On the daily chart, we observe that the British currency set a new decreasing minimum that opens the possibility of continuing to fall to the December lows, set at $1.24.