- Ruchir Sharma believes that next year the inflation of the dollar will be noticed.

- For Sharma, the next few years will be better valued stocks that preserve their value.

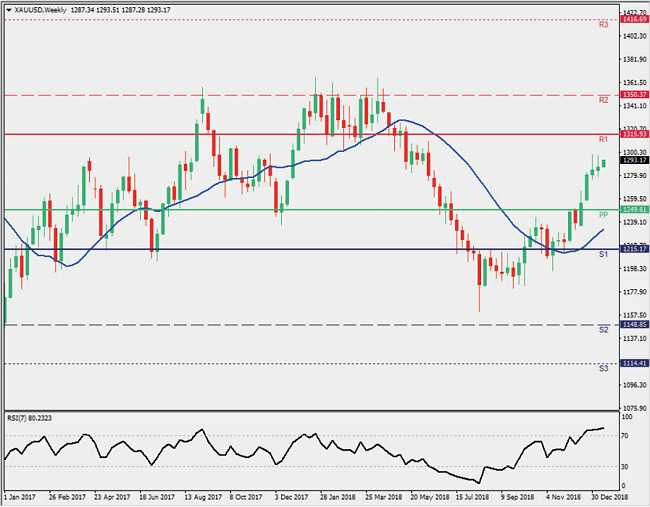

Morgan Stanley’s head of emerging markets and global strategy commented that commodities such as gold would do well for the next 3-5 years, and included bitcoin among them. Ruchir Sharma shared his point of view with Julia Chatterley, a CNN reporter. In his conversation, he showed his vision on how the economy and the global financial market will behave from 2021.

Ruchir Sharma, a writer and executive at Morgan Stanley, commented in an interview that current conditions have led to the vast majority of stocks being overvalued. Among the conditions, he mentions the enormous monetary liquidity and low interest rates that exist in most of the first world countries. Situation that would be an opening to an inflationary spiral that consumes the economy, product of the injection of money by central banks.

For this reason, he considers that it is a good time to invest in commodities, since their growth potential for the next 3 to 5 years is better than that of stocks, except for some video game companies.

When questioned by Julia Chatterley for his opinion regarding commodities such as gold and Bitcoin,

Sharma replied that both are speculative instruments. But beyond that, they are investments that demonstrate how little confidence people have in the implementation of financial policies that central banks currently need to carry out.

In addition, he added that he considers this a demographic issue: Older investors, the boomers, tend to invest in gold. Instead, millennials are increasingly turning to Bitcoin and other cryptocurrencies. He declared that having around 5% of the investment portfolio in gold “is not a bad idea” and thinks that the most adventurous explore cryptocurrencies.

Why will bitcoin and gold do well next year?

To properly understand Ruchir Sharma’s claims, it is necessary to review how central banks tend to deal with cash-rich environments, such as that found in many of the world’s economies today.

The CNN reporter asked Sharma about the factors that would lead to the scenario the analyst was drawing for next year. The executive stated two: the availability of a vaccine and the rapid inflation that will come once it exists.

Currently most of the countries of the world are in a situation in which consumption patterns have been upset. Despite the fact that there is a lot of money on the street, as a result of financial aid and other incentives, people are not consuming as much as they were used to.

The scenario that Sharma draws depends on the fact that, once the situation has normalized and “herd immunity” is achieved, people will resume their economic activities with greater confidence, and inflation will manifest itself quickly when artificially printed money begins to buy the same amount of products available in the market.

One of the preferred mechanisms for central banks to control inflationary environments is to increase interest rates. This in theory leads more people to think about saving instead of borrowing. For Sharma this will mean a change in the markets, from those who bet on explosive growth stocks, to one where they bet on assets that preserve their value, such as Bitcoin.

At least when it comes to their behavior in the financial markets, Bitcoin and gold have a lot in common. Previously, it has been reported that these two markets show a historical price correlation of 70%, and everything seems to indicate that it will continue to do so.

Despite all that has been said so far, the Morgan Stanley executive was cautious, referring to a New York Times article he wrote recently. The article concluded the following: adjusting for inflation for the last century, the shares of the North American stock market have had a return of 6.5%; instead, gold has had a return of 1.1%. In other words, betting on disruptive companies seems to continue to be more profitable.