The Parabolic system price/time is another idea that introduced the famous Welles Wilder in his book “New Concepts in Technical Trading Systems“. This system was developed as a high and reversal strategy, which means that a trader using this approach will always have either a buy position or a short position in the market. Here we must remember that when the Parabolic SAR generates a buy signal, for example, a series of bullish points appears below the current price action. As the market moves higher, the indicator points also rise, first slowly and then faster.

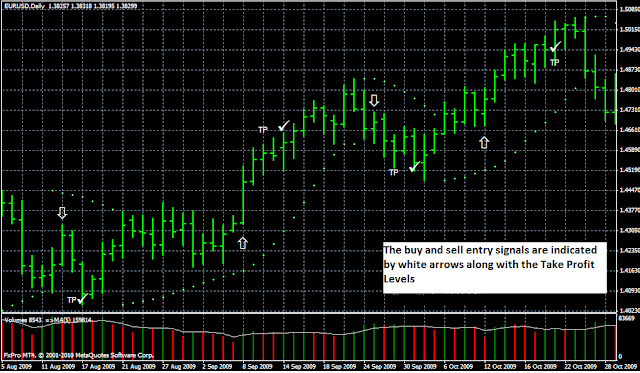

When the trend is stopped or begins to reverse, points and prices intersect, in which case a long position is closed and a new short position is open. For this system, we want to determine whether the addition of a volume requirement for Parabolic SAR entry signals can improve the performance of these signals. For example, the buy signal for this system is when a high in price reaches a point of Parabolic SAR above the market with a volume higher than the simple moving average of 5 periods (five bars) of volume. Both conditions must be met in the same bar.