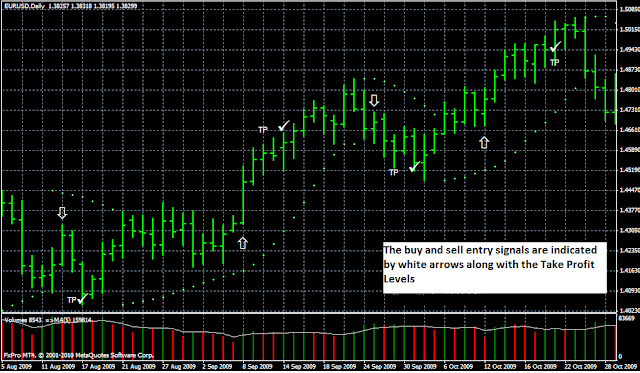

The trading system that we are going to present below is a market reversal strategy that uses several modified technical indicators developed for the Metatrader 4 platform. Due to this, this system can only be used on this trading platform. This methodology can be used to trade in most markets, including Forex.

This strategy aims to identify the areas in which the price is likely to change its trend. The modified indicators are based on the well-known Parabolic SAR and Zigzag and a modified moving average is known as the VAR Moving Average, which is used to indicate whether the trend of an asset is reversing. As a filter, we use the RSI indicator.

Because it is a trading system based solely on technical indicators, it has mechanical entry and exit rules and it is quite simple to apply. Therefore, it does not require much interpretation.

As always, it is recommended to test this reversal trading system with a demo account before using it to trade with real money.