The purpose of this article is to provide traders with a detailed explanation of the use of Bears Power and Bulls Power indicators, their calculation and their signals with a step-by-step tutorial. We will also explain how to use these indicators for trading in the financial markets.

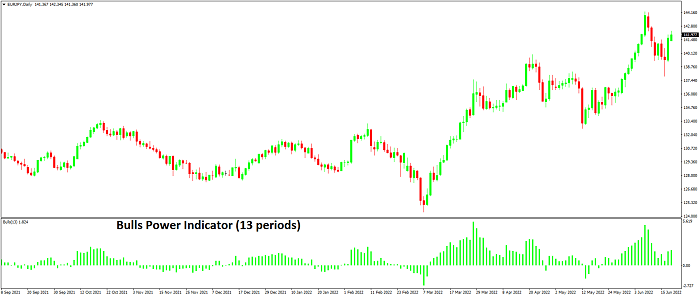

Bulls Power – Indicator that measures the strength of buyers

The financial markets like Forex are a constant battle between buyers (Bulls), struggling to raise prices, and sellers (Bears) struggling to lower prices. For that reason, it is fundamental to be able to estimate the Bulls Power balance as an important change in this balance could be a signal of a possible trend reversal in the market. A tool that accomplish this task is the Bulls Power oscillator developed by Alexander Elder, a famous stock trader who described this indicator in his book Trading for a Living. The basic principles on which Elder based this oscillator are the following:

- The highest price in a specific period of time shows the maximum power of buyers for that period.

- The moving average can be interpreted as a price agreement between buyers and sellers for a certain period of time.

Basically, the Bulls Power allows to identify if buyers are weaker than sellers, and if that is the case the trader should look for short positions. The Bulls Power technical indicator is used to define in which way the rate will change in a determined market instrument. This sort of indicator is closely related to the Bears Power indicator which we describe later. Since it is an estimate of the Bulls power balance, is a tool that can be used to forecast the possible change of a trend from bullish to bearish. In general terms, it is an oscillator that helps to determine the time entry of a short position and is plotted in the chart as a histogram with the following formula:

Bull Power = High − EMA

Where:

-High: Is the highest (maximum) price in a certain period of time.

-EMA: The exponential moving average. Initially Elder choose the EMA of 13 periods which is the most commonly recommended value.

Note that when the market is in an uptrend, the maximum is above the EMA, so the Bulls Power is above 0 and its corresponding histogram is above the zero line in the chart. In case the maximum falls under the EMA when prices are falling, the Bulls Power becomes below zero and its corresponding histogram is below the zero line in the chart.

Basically, the EMA measures the market’s consensus on value and the High represents the maximum bullish power in the bar/candle. The height of the Bull Power histogram shows the spread between the high in price and the EMA. The taller the histogram rises the greater the maximum bullish power. If the entire price bar falls below the EMA then the histogram will fall below zero.

- The Bulls Power displayed in a chart offers complete information about the buyer’s strength during the analyzed time period. The technique of the Bulls Power developed by Elder is fully based on the variation between the 13-period exponential moving average and the maximal rate of a current trend.

- Also, the Bulls Power is commonly used in the amalgamation with moving average. It is the right option for you to read the book of Elder. In this way, you can get a better understanding of this tool used to trade in many markets.

Trading signals

The Bulls Power should be used in conjunction with a trend indicator such as the Moving Averages. In this way we can define the following rules to trade with this oscillator:

- If the moving average is directed downward and the Bulls Power index is above zero, but at the same time falling, that is a clear Sell signal.

- It is also desirable but not essential that, in this case, the divergence of bases was being formed in the indicator chart.

The Bulls Power is used extensively in conjunction with the Bear Power, also developed by Elder. This set can be used as a single indicator to produce buy and sell signals.

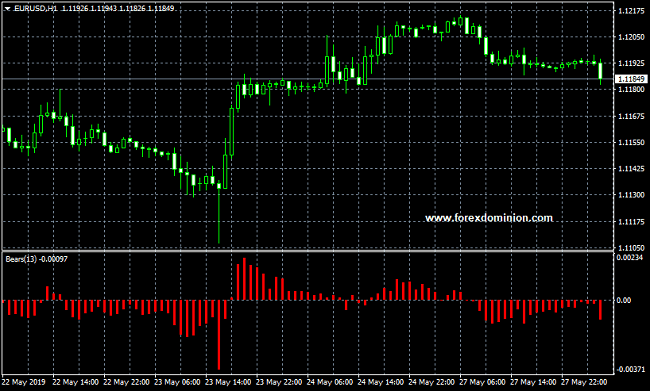

Bears Power – Indicator that measures the strength of sellers

imagen de bears power

The trading participants in the market are the buyers, struggling to raise prices, and the sellers, struggling to lower prices. In this case, depending on which side scores off, at the end of the market session, the price will end higher or lower than the price of the previous session. Intermediate results related to the highest and lowest prices at any moment in the day allow establishing how the battle between buyers and sellers is developing.

For this reason is important to be able to estimate the Bears (sellers) balance, as a change in this balance could mean a possible change in the market trend, which offer important opportunities to trade. This task can be solved using a technical analysis indicator known as Bears Power. This tool allows to identify if the sellers in the market are weaker than buyers, and if so, then look for long positions to catch a trend change. The creator of this indicator was the Dr. Alexander Elder, a famous stock trader who is living in New York. Basically, the Bears Power is the difference between the close price and the exponential moving average. The basic formula for calculating the Bears Power is the following:

Bears Power = Low – EMA.

Where:

-Low: The minimum price of the current bar.

-EMA: The exponential moving average, (generally we use an EMA of 13 periods.

Elder developed this oscillator based on the following premises:

- The minimum price in any period indicates the maximum power of the sellers (Bears) for that period.

- The moving average can be seen as a price agreement between buyers and sellers for a certain period of time.

Note that when the market is in a downtrend, the minimum is under the EMA, so the Bears Power is below 0 and its corresponding histogram is below the zero line in the chart. In case the minimum rises above the EMA when prices are rising, the Bears Power becomes above zero and its corresponding histogram is above the zero line in the chart.

The Bears Power indicator assesses the balance of the seller’s power as well as indicates the possible trend change. Elder developed this indicator totally based on the difference between the minimal price (the lowest price) and the 13-period EMA. The Bears Power is generally used with the trend indicators such as moving averages. Buy the signal appears when trend indicator now is going up & bears power under zero are growing.

Trading signals with the Bear Power

The following are the basic rules to open a bull position in the market using the Bears Power (Let us assume that we use moving averages as trend indicators):

- If the moving average is rising and the Bears Power index is below zero, but at the same time growing, that it is a clear Buy signal.

- It is also desirable but not essential that, in this case, the divergence of bases was being formed in the indicator chart.

The Bear Power is used extensively in conjunction with the Bull Power, also developed by Elder. This set can be used as a single indicator to produce buy and sell signals.