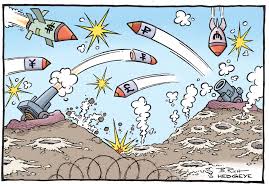

The fundamental indicators shown below are of high importance for the euro, however, since the EMU (Economic and Monetary Union, the countries within the European Union which share a common market and a single currency, the euro) is composed of 17 countries, it is essential to be aware of major political and economic events of the member countries, such as changes in GDP, unemployment, and inflation. The major economies of the EMU are Germany, France, and Italy, for which, in addition to general economic data from the EMU, economic information from these three countries have the most relevance for the euro.