The events and economic news bring strong movements in the financial markets at the time of publication. In this article we will explain all the keys to trade these scenarios successfully.

It is possible that more than once we have suffered the consequences of economic or political events with an open position. In such situations we observe how the market, suddenly, takes a strong impulse and sometimes advances in our favor and others against us.

There is no doubt, before and after the publication of an economic news the market reacts, and in many occasions in a very violent and unpredictable way. If you do not know how to handle these situations well, it is possible that you make the wrong decisions, those that inevitably lead to loss.

The objective of this article is precisely to learn how to improve your trading during these situations and try, with success, to trade with economic news. Being in a position to be able to make the appropriate decisions when important economic events are published, so that we can take advantage of the high volatility that occurs.

Fortunately or unfortunately there are economic news daily. This fact can not be ignored and every self-respecting trader must know the effects that these events produce in trading.

It is not necessary to have a higher education in economics to understand how economic news affects. Nor is it strictly necessary to try to decipher the news. What is essential is to know how we can trade in such situations.

What tools can we use? How do the economic news affect the market and our trading? What trading strategies can we carry out?

All this, accompanied by some tips to trade events and economic news is more than enough and that is what we will try to show you in this article. Let´s start:

Article Content

- What are the events and economic news?

- When do economic events and news take place?

- What is an economic calendar?

- Examples of economic news of greater importance

- How do events and economic news affect trading?

- Is the economic news good or bad?

- The market forecast and the real data

- What are the advantages and difficulties of trading with events and economic news?

- How to trade with events and economic news?

- Some tips to trade with events and economic news

What are the events and economic news?

The economy is not a static entity, it evolves as social conditions and policies evolve. That is, it is connected with reality; and reality is changing.

Although markets are actually driven by existing buys and sales, trading decisions are based on changes in the economic environment.

In other words, the markets are moved by the forecasts that their participants have regarding the changes in the economy, before they even occur (traders and investors try to anticipate the facts and other market participants and, therefore, the market can discount the changes before they happen).

Economic facts are also called “fundamentals“. Trading based on fundamentals is trading based on economic facts. Fundamental analysis is the discipline that studies economic facts and how markets can act accordingly.

Some short-term traders (who use strategies such as scalping) usually perform an analysis generally ignoring the fundamentals. This is because it is enough to know how supply and demand act in a market (among other reasons because there is no material time for a change in fundamentals). This trading style is carried out through the so-called technical analyisis and usually uses price charts to analyze these two forces that move the markets.

On the other hand, when we talk about economic facts, we can refer to either the macroeconomic or the microeconomic. However, the microeconomic realm is very narrow, affecting only one specific entity; and in no case to the market in general (for example, the benefits of a specific company is a microeconomic fact).

Therefore, it is the macroeconomic data (that affect an area, country or group of countries as a whole), or rather its changes and evolution, which really impact on currencies, indices, commodities and other instruments that are traded in the financial markets (the shares also, the difference is that a microeconomic news only affects the stock of the company object of the news). But what are the economic data?

The economy is measured by a series of indicators called “economic indicators” (GDP, inflation, unemployment, interest rates, …). In turn, these indicators are composed of other subindicators (Factory orders, Construction permits, Consumer confidence indexes, Sales of used homes, …).

In other words, we try to express the reality of what happens (the facts) in figures. A number can tell us a complete story. An economic indicator, in fact, tells us how the economy is behaving. Thus, a datum is a numerical expression that indicates an economic reality (a figure explains the economic facts).

The economic data are calculated and published with certain regularity; in order to observe the trend and evolution of the indicators; and ultimately the changes in economic reality.

The news and economic events and their impact are mainly based on the time of publication of the data. It is at this time when a large number of investors and traders are waiting for the data to come to light to trade accordingly.

The publication of a significant economic indicator usually causes the market to react violently in these situations, as we have explained at the beginning.

When do economic events and news take place?

The economic indicators and sub-indicators are calculated and published with certain regularity. There are quarterly indicators (such as the Gross Domestic Product, or GDP), monthly indicators, such as inflation and employment data; and even others that are weekly (such as the Inventories of crude oil).

There is a large number of economic data and a considerable number of countries subject to these data, which leads to the publication of economic news every day: Every day there is economic news, in any country.

Economic news are usually published in the mornings in most cases. Now, the mornings for a country do not have to coincide with the morning for the trader. Depending on the geographical region you are in, you must take into account the time difference.

In Germany, for example, the economic news of the eurozone countries or of the European Economic Community itself coincides with the mornings. However, economic news from the United States or any American country usually coincides with the afternoon schedule, which is when the US trading session is in progress. As for the news from Asian countries (Japan, China, Australia, etc.), they are usually published when it is early in Europe.

The fact is that economic events occur every day and at almost any time. Therefore it is necessary to have an essential tool for any trader: The economic calendar (also called the “economic agenda”).

What is an economic calendar?

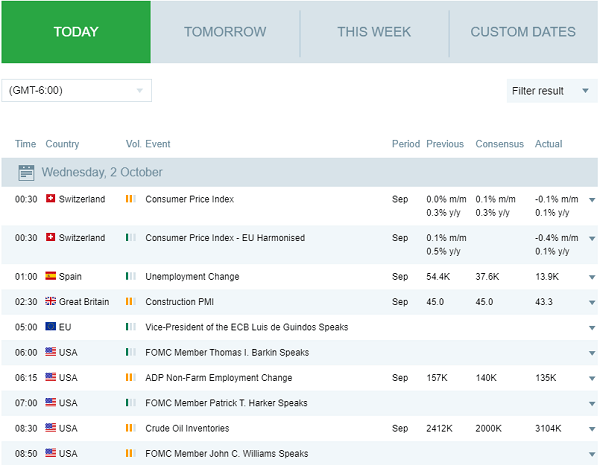

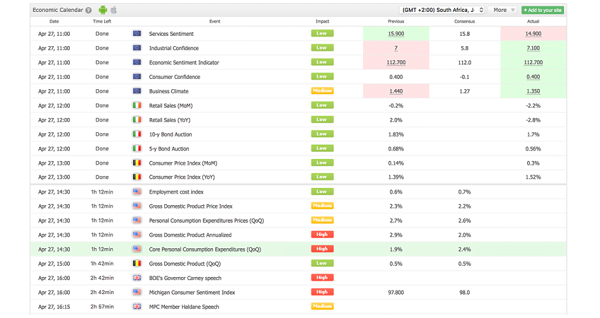

As its name indicates, the economic calendar is an agenda in which we can see the next economic news and the date and time of publications. In some, we can also see past results of publications.

But the economic calendar does not simply inform us about the date and time of an economic event, the economic calendar offers a series of interesting data that we must keep in mind to operate with news and economic events. Let’s see them in detail, but first let’s see what an economic calendar looks like on our website:

Each of the lines represents a different economic event on a specific day. The news is read as follows:

- The date usually appears at the beginning of all the lines. As you can see the economic news is arranged chronologically (in date and time). When a day ends, a line will appear indicating the date to separate both days. In the following image we show you this:

- The first column corresponds to the local time (in this case the Spanish peninsular time) of the publication of the news.

- The flag indicates the country to which the economic news corresponds. It will especially affect its currency (or currency pairs that cross with it in the Forex market).

- Then we are informed of the concept, the data itself that will be the subject of the news.

- The exclamation signs indicate the importance of the news for the traders. The more important a news is, the greater impact it will have on the intervening parties and the volatility it will generate in the markets. As is to be expected, the three exclamation marks indicate that the news is of the utmost importance, two of medium importance, and a single sign represents news of lesser importance.

- The next column corresponds to numerical data. This is the column in which the data should appear once published. If no data appears in this column, it is because the data has not been published yet. We will recognize this column because it is usually called “Current” (current data).

- Next, we have the column called “Consensus“. Here appears the expected data before its publication. This is the “consensus of analysts” since a series of experts are responsible for projecting this data. It can be interpreted as “what is expected to be published“.

- The last of the numerical data corresponds to the “Previous” column. It is the publication immediately before the “Actual” (the data to be published). It is important to know if the “Previous” value is greater or less than what is foreseen in the “Consensus” before the publication, because this represents if news is expected to be good or bad, affecting the market in a positive way (increases in the quotes) or in a negative way (decreases in the quotes) for the financial instrument that we intend to trade.

Examples of economic news of greater importance

We are going to review some of the most important economic news and indicators that are published so that you can get a first idea of how the news influences the markets:

Employment data

In the United States, one of the most important economic events is the employment report. This report is composed of several indicators (unemployment rate, job creation, hours worked per week, etc.) and within them, the creation of non-agricultural jobs (non-farm payrolls) is of particular importance.

It has a monthly periodicity and measures the change that has occurred in the number of people employed during that month (excluding agricultural jobs). It is published on the first Friday of each month at 2:30 p.m.

Figures higher than expected, or the “Previous” data will generally mean a rise in the dollar (USD). Besides being good data for the North American stock markets (stocks and indices).

It is important to keep this event in mind because the main currency pairs include the US dollar. In the same way (because they are traded against the dollar), it will affect commodities markets.

The employment indicators of the other countries are also important for their corresponding currencies and markets. But as you can see, the economic events that affect the dollar are of capital importance for the reasons described and the non-farm payroll data is important. No trader should ignore it.

Decisions on interest rates

Central banks have the power to set the interest rate they apply to commercial banks in their area. This prerogative is executed to cool or heat the economy as circumstances require.

Higher interest rates mean an increase in the exchange rate for your currency. A decrease in rates will have the opposite effect.

However, an increase in interest rates may lead to a decline in the stock markets if the rates are considered very high (companies have greater difficulty in obtaining financing and the higher costs reduce their profits).

In general, a moderate rise does not have to be a reason for the stock market to fall by itself. It can be interpreted as a state of good health in the economy.

The same can be applied in the opposite direction. It may be that a decline in interest rates can be interpreted as the economy not doing well and must be reactivated with this measure (causing the indexes and stocks to fall). But a drop in interest rates from high levels will be well considered by the stock markets.

The Federal Reserve of the United States (FED) through the Federal Open Market Committee (FOMC) usually meets an average of 8 times per year to address these issues. The date and time of publication of the interest rate decisions will appear in the economic calendar. Its policies will affect the dollar and we have already discussed the importance of the dollar for the economy and the world markets (especially for the Forex currency market).

In the case of the euro, it will be necessary to pay attention to the meetings and decisions of the European Central Bank (ECB). Like the Bank of England (BoE) for the pound sterling, the Bank of Japan (BoJ) for the Japanese yen, and the rest of countries for their respective currencies.

Inflation data

The Consumer Price Index (CPI) is the main indicator of inflation. As in the previous case, it is particularly important to bear in mind the inflation of the United States. Although the inflation of the countries of the eurozone (including the harmonized CPI of the European Economic Area) and other regions are also important if you have positions in their currency or other interests in them.

As a general rule, an increase in inflation tends to have negative effects on the economy and, therefore, markets and the currency will tend to fall.

However, high inflation may mean that central banks will raise interest rates as a countermeasure. If inflation exceeds 2%, we must be alert because the currency may rise as a result of an imminent rise in interest rates.

On the other hand, if inflation is very low, it may be the case that the market expects a drop in interest rates and the currency in question depreciates.

In addition to the CPI, we can also track inflation with the Production Price Index (PPI). Inflation data for each country are usually published monthly.

Gross Domestic Product (GDP)

This data has a quarterly periodicity and measures the growth of the economy of a certain area. Higher growth is a sign that the economy is working as it should (there is demand for goods and services), therefore, will cause a rise in the currency and the stock markets.

However, very sharp growth for a few consecutive quarters may cause an increase in inflation. The ideal is for the economy to grow at a steady and sustained rate.

The data for Durable Goods Orders and Non Durable Goods Orders are sub indicators of GDP. Like data on consumer confidence, they can give us information about the growth (or decrease) of the economy.

Balance of trade

This report includes both Exports and Imports, in fact, the trade balance is the result of subtracting both concepts.

The exports suppose a greater demand, greater sales, and greater growth, being positive for the companies which causes the exchange rate of the currency increases. On the contrary, imports contribute to lowering the GDP and the exchange rate of the currency.

Thus, a positive trade balance will cause an increase in the price of the currency. The data in this report are published monthly.

How do events and economic news affect trading?

We have seen that when important economic news is published there is a violent reaction in the market, a massive wave of buys or sales that produce a sudden movement in prices. The offer or demand increases greatly, and undoubtedly, if we have an open trading position during an economic event, the impact on the trade can be substantial.

To control this, we must re-emphasize that the economic calendar is one of the tools that a trader can not forget, even if our trading is not based on economic news.

One of the trader’s routines should be to prepare for the work session and for that, he must know what economic events will occur. The trader must also decide whether he will be in or out of the market when the news comes.

Now, there are trading strategies to trade when events and economic news occur, a trading type that we could call “based on news”. To carry out these strategies we must be aware of how these publications can affect us.

Economic news does not always make the market behave as it should, since everything depends on how the market takes the published data.

Is the economic news good or bad?

The first thing that the trader must keep in mind is whether the news is positive or negative for the financial instrument in which he is trading (currencies, stocks, stock indices, …), as this can generate an upward or downward movement respectively.

As a general rule, it will be understood that the data is positive if it is greater than the previous one for the indicators of economic growth (not so for inflation and interest rates, in some cases).

To help us interpret the news, the economic calendar will show the “Current” data in green for the cases in which the data is positive, and for the negative data, the data is shown in red.

At this point we must be cautious in the Forex market, because transactions are made on currency pairs, buying one and selling the other. We must ensure that the data causes the currency pair to move in the proper direction.

When we open a long position with a currency pair, what interests us is that the first of the currencies that make up the pair (base currency) raises its value against the other currency. If we open a short position, we will look for the opposite: negative news for the base currency.

In this case, we will be interested that the remaining currency (quoted currency) moves in the opposite direction. Therefore, the news for this currency must be negative when our position is long and positive when our position is short.

The market forecast and the real data

This point is important, it is the true essence when it comes to trade with events and economic news.

At the beginning of this article, we have commented that investors are based on forecasts and expectations when making trading decisions, in many cases anticipating the news release and causing the market to discount it in advance.

If this is the case when a piece of economic news is published, there is great volatility and volume in the market, when all (or the vast majority) of traders have already opened a position?

Actually, what makes a piece of news interpreted as good or bad, is the existing deviation between what was anticipated (in the “Consensus“) and the “Actual” data. This is what causes the market to react.

Traders adjust positions and enter and/or exit the market depending on whether the published data has been a disappointment with respect to the forecasts or, on the contrary, it is more optimistic than expected. The greater the deviation produced between the published event and the forecast made by the consensus of analysts, the greater the impact of the news in our trading.

It is for this reason that good news, sometimes, can generate a decrease in the prices of a currency pair or any other asset. The same can happen with the bad news that being less bad than expected, generates a rise in the prices.

From these statements we can obtain a valuable lesson, fundamental when it comes to trading economic news: Do not try to interpret the news on all occasions, the markets are moved by the reaction they provoke in the investors, not by its real impact on the economy.

The importance of the economic news

The greater the importance of the news (we can help ourselves to know this with the exclamation signs in the economic calendar), the greater impact and repercussion it will have on the market.

If we add to news of greater importance a deviation that causes a big surprise for the investors, the movement in the periods after the publication can be of great importance.

It is at these times that there will be greater volatility and uncertainty in the market. We must be cautious and, at the same time, establish a good strategy to trade in these situations.

What are the advantages and difficulties of trading with events and economic news?

Trading with economic news has its risks. The first and foremost of them is the one produced by high volatility.

A movement in the price so strong can make us earn a lot of money, but it can also make us lose more than expected. The trader must be especially prudent, disciplined, and calm at this time.

When there is economic news, markets do not move on a regular basis, there are many transactions, both long and short, and this can have as a consequence that the price is turned (in addition several times) before taking a definitive direction.

The turns against can be also volatile, which can even lead the trader to think that this direction is what the market will take. The volatility of these price reversals, together with the false signals, constitute a dangerous scenario.

In other words, markets can become untamable during the first few minutes of economic news. Much noise and confusion is generated when such an amount of transactions is produced in such a short space of time.

Finally, we must add that in these moments in which everyone wants to trade, liquidity is considerably reduced and the online broker can expand the commission for trading (in the form of high spreads) and can even affect the orders execution, causing the order to be executed at a different price than the one requested (what is known as “slippage” or sliding orders).

You have to think that the price moves so fast that even the broker, at times, can not execute the order at the price at which we want.

In short, to trade news properly it is necessary to have a certain experience, cold blood, trade with a reliable broker to execute orders quickly, and, most importantly, a proven strategy.

As the main advantage, we can affirm that, at the moment in which these factors are controlled, economic events can generate great opportunities to obtain benefits (and they occur practically every day).

How to trade with events and economic news?

There are several types of trading strategies that allow us to trade economic events:

Analysis of the trading day strategy

A good trading strategy is to perform an analysis of the economic news for a certain area or a certain currency, which will happen during the day. Above all, we must analyze the forecasts that exist for them.

Are the forecasts positive or negative in most cases? If the forecasts are coherent and point in the same direction (the majority), there is a good chance that this currency or financial instrument will move in the direction indicated.

Now, the Forex market is made up of currency pairs. If we have been observing one of the currencies, what is the other currency that will form the pair in which we are trading? In this case, it will be necessary to search the calendar for news or events that affect the other currency in the opposite direction.

For example, if we have been observing that the forecasts of the news are positive for the euro, we should look for news with negative forecasts for another currency. This will allow us to take long positions, as long as the base currency is the euro (EUR/USD, EUR/GBP, EUR/CHF, etc.).

The same can be applied to any currency pair and for short trades (in this case, we will look for negative forecasts for the base currency and positive forecasts for the counter currency). It’s just a matter of investigating, to see if we find forecasts in the news according to our interests at the beginning of the trading day.

This strategy is designed above all for intraday trading (day trading), taking positions that can last from a few hours to the entire trading day. However, it can be executed in higher time frames analyzing several days.

Double programmed order strategy

This strategy is based on the expected volatility and not so much in the direction in which the asset can move.

For this, two pending orders will be placed. That is, programmed to be executed when the price reaches the pre-established level. The orders are placed on both sides of the quote: A long position above the price and a short position below. A few minutes before the publication of the news.

For this strategy to work well it is necessary that the news is of greater importance, since what we need is that it has the greatest possible impact.

When the news is published and the price moves explosively, some of the programmed orders will be activated. At this time, we can try to hold the position a few points in our favor and close the trade.

It is also possible to establish a Take Profit order a few points away from the opening of the order. When the price reaches the Take Profit order, the transaction will automatically close with benefits.

We have the possibility (and sometimes the temptation) to hold the position longer, and not close it (manually or automatically) in such a short space of time. However, given the unpredictability of the market and the high volatility, it is inadvisable to hold the order open too long. It is a strategy focused on very fast trades (Scalping type).

Trade in the direction indicated by the news

It’s simply a matter of waiting for the publication to be published. We wait a few minutes to eliminate the false signals during the later instants and we observe if the news has been good, or bad, the deviation, and how it seems that the market is taking it.

After that, it would only be a matter of trading in accordance with the conclusions obtained and confirmation that the market is moving in the direction expected. We will get a stretch of the impulse taking advantage of the inertia and avoiding the first minutes of confusion and danger.

The greater the impact of the news, the greater the momentum and, therefore, our possible gains.

There is a variant to this strategy that provides greater security. It is called: “The 50k strategy“. This strategy is only based on trading that news that have suffered a deviation with respect to the expected data in more than 50k (50,000).

This deviation figure is considered acceptable, but each trader can establish which minimum figure of deviation between the forecast and the published data may be suitable for him, depending on his experience and the tests he has done.

Small deviations from forecasts do not usually cause a strong movement. It is necessary that there is a strong and surprising deviation for the operators and thus capture a strong impulse.

While we take a few minutes to analyze the deviation and its implications, the market can calm down to establish its definitive direction. It is necessary that there is a strong and surprising deviation so that the traders can pick up a strong impulse.

While we take a few minutes to analyze the deviation and its implications, the market can calm down to establish its definitive direction. It will be enough to confirm that the direction in which the market moves agrees with our conclusions when analyzing the deviation of the news.

Although this strategy does not pose as much risk as the previous one, we must take all the appropriate protection measures.

NOTE: The release of any news can be a good catalyst for the breakout of a significant short-term resistance or support (including trendlines). It will be necessary to pay attention to these zones and determine if the publication of the news has been able or not to penetrate them. This technique can be the basis of a trading strategy in itself.

Some tips to trade with events and economic news

Always put a Stop Loss

It is always important to place a stop-loss order, especially when we are faced with such a volatile scenario with the described risk characteristics.

A Stop Loss order is a pre-established, programmed order (similar to the Take Profit order). This order is to close the position, not to open a new one. It is about closing the position if the price changes its direction against us. The idea is to abandon the market and cut the losses, assuming that the transaction has not moved in the direction we expected. It is a measure of protection, an insurance against more severe losses.

Keep in mind that in times of high volatility there may be sudden movements in the price which can produce price gaps so a conventional stop loss may not be executed properly as the price may not pass through that exact level you have marked. This requires supervision on your part and some brokers also offer a guaranteed stop-loss alternative (Example: EasyMarkets Stop Loss Guaranteed), usually in exchange for an additional commission.

Study the economic calendar

It is important to study the economic calendar well. More than important, it is one of the basic tasks in the work of the trader.

Analyzing the news every day will help us make decisions about what news is tradable and what is not. It also helps us decide when we can open and close our trades, as we decide to be inside or outside the market in any news situation.

The ideal is to analyze the economic calendar of several subsequent trading days, to have anticipation and start designing plans. There are traders who analyze the calendar as a weekly or monthly block. Based on their conclusions, they establish campaigns and fine-tune their trading strategies. But, at least, a trader must analyze the economic calendar of each day, when preparing his trading day.

Analyze the previous behavior of the market with respect to an economic news

We can take historical data and analyze the past behaviors of the same economic news. It is always a good option. Historical data is a great source of information that will help us gain knowledge about how the market reacts to large and small deviations, different types of events and economic news, volatilities, strange movements, …

Keep calm and discipline when trading

It is extremely important to execute our strategy in an absolutely disciplined way. A trader can not improvise; and not in such critical moments.

If we get the confusion and nervousness existing in the market during the release moments of economic news we can lose perspective and make bad decisions.

Everything must be well calculated, including the maximum loss (placement of Stop Loss). In case something does not happen as expected, continue with your plan with the cold blood that the situation requires as this can save you from a great loss.

On the contrary, only by trading in a calm and disciplined way under tense situations can we obtain benefits.

Do not abuse of leverage

If in addition to volatility and unpredictability we add a position of a volume greater than the correct one (according to the volume of our trading capital), disaster is served.

In scenarios of these characteristics, we must be especially careful with the use of leverage and the size of our positions. Let’s not get carried away by greed and look for the balance between risk and benefit.

Devote the necessary time to test

Practice makes perfect and especially in this case, trading economic news requires a certain skill. It is necessary to know firsthand how the market can react to one or another economic news.

The only method that makes this approach possible is experience, and the experience is only achieved by practicing. For these questions, one of the most useful tools is demo accounts. Trading accounts with virtual capital to practice, in an environment almost identical to a real account but without risking our money.

Now, we must use these trading simulators as if they were real trades. It is not possible to learn the unique lessons of experience if we do not take these test operations seriously.

In summary, trading with events and economic news can be learned and properly managed to obtain benefits. In this article we have exposed the keys and what you need to know to begin with. Now it’s your turn, what are you waiting for to start practicing?