Strong concerns raised around Credit Suisse in early October are resurfacing as the bank loses its wealthiest clients.

- The division that serves the richest clients has lost 10% of the assets it manages.

- The Swiss financial institution has strong ties to banks in the United States and Europe.

Cryptocurrency exchange FTX filed for bankruptcy along with its 130 affiliated companies, a fact that is impacting the entire cryptocurrency industry, but looking a little further, in the world of traditional finance Credit Suisse is facing a deep crisis.

The Swiss-based bank, considered by the Financial Stability Board to be of great global systemic importance, warned today that it expects a loss of up to 1.5 billion Swiss francs (USD 1.6 billion) by the end of the fourth quarter of the year.

Credit Suisse’s financial problems have been exacerbated by customers withdrawing their savings and investments.

So its “wealth management” division, which caters to the bank’s wealthiest clients, has suffered a net outflow of 10% of the assets it manages, enough to weigh on the bank’s balance sheet, according to a Financial Times publication.

The Swiss bank, which is the main dealer and foreign exchange market counterparty of the US Federal Reserve (FED), said it is facing a “challenging” economic and market environment.

As a result, Credit Suisse was forced to resort to liquidity buffers, slipping below certain minimum regulatory requirements. And, at its extraordinary general meeting held today, it obtained approval for a capital increase with the idea of financing the recovery from what appears to be the biggest crisis in its 166-year history.

A true systemic risk?

After the collapse of FTX, some players point to the cryptocurrency sector, pointing out that this ecosystem represents a risk for the traditional financial system. In fact, that’s what Federal Reserve Vice President for Supervision Michael Barr recently told the Senate Banking Council.

We are concerned about risks that we are not aware of in the non-banking sector. That obviously includes the cryptocurrency industry, but more broadly the risks in parts of the financial system where we don’t have good visibility, we don’t have good transparency, we don’t have good data. That can create risks that feed back into the financial system that we regulate.

Michael Barr, vice president of supervision at the Federal Reserve.

However, it is curious that not many are talking about systemic risk in the midst of the Credit Suisse crisis. Only on Twitter has a warning been issued about a possible impact on the global financial system, given the deep connections that the Swiss lender has with banks in the United States and Europe.

Regarding the FTX case, several financial analysts have ruled out that a systemic risk could occur, given that the cryptocurrency ecosystem only represents 2% of all the assets that currently exist in the world.

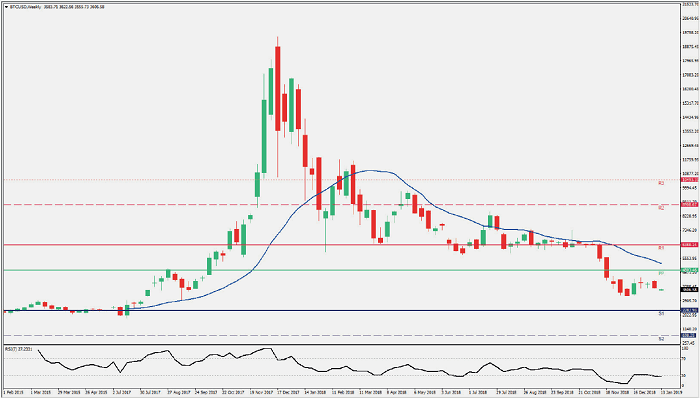

As reported by ForexDominion, since October there has been talk of the Credit Suisse crisis, given that in the third quarter of the year it lost USD 4,000 million.

So far this year, the entity’s shares have depreciated by more than 50%, while its closest competitor, UBS, has lost around 12% of its value. This discrepancy is due to fundamental factors rather than cyclical developments.

Due to a lack of risk management, the bank found itself embroiled in a series of scandals, including a case of money laundering with drug traffickers. Most recently, the company agreed to pay $495 million to settle a case involving mortgage investments in the United States.

According to the New Jersey attorney general, Credit Suisse “misled investors and committed fraud or deception in connection with the offer and sale of mortgage-backed securities.” The good news is that the bank was “fully provisioned” for the payment of the fine.

As for asset management, the Swiss bank’s clients lost $10 billion in operations with the start-up Greensill, which went bankrupt in 2021. The collapse of Bill Hwang’s Archegos fund, which invested leveraged in high-risk stocks, cost them $4.7 billion.

What if the bank ends up failing? A Credit Suisse default would trigger a wave of panic. It is unlikely that we will see a version 2.0 of the 2008 crisis, when the bankruptcy of Lehman Brothers triggered a global recession. However, a chain reaction could cause many a severe headache. Deutsche Bank, which is already breathing heavily, could also be in the crosshairs.

Despite losses of 4.03 billion francs and a net asset outflow of 12.9 billion francs in the third quarter, all is not lost for Credit Suisse. Last week the bank presented investors with a new strategic plan that, among other things, includes cutting thousands of jobs.

Judging by the market reaction, investors have not given much importance to the news. The tables could turn if traders on the Wallstreetbets forum decide to bet against the market. Alternatively, talk of a takeover by a larger bank could restore investor optimism.