Large macroeconomic imbalances in many economies make recovery difficult. Countries such as Spain or Italy foresee an exorbitant increase in their levels of public debt, with IMF forecasts that put the debt at 120% and 150%, respectively.

In recent weeks, the harsh global pandemic the economy is going through has put the world in check. A check that could be considered as conjunctural, but that could have devastating effects for certain economies. And the problem is that we are not talking about another crisis, but a crisis that, as indicated by the International Monetary Fund and as we indicated in an article a few days ago, is the largest economic contraction since the collapse of 1929; in short, one of the biggest contractions in our history.

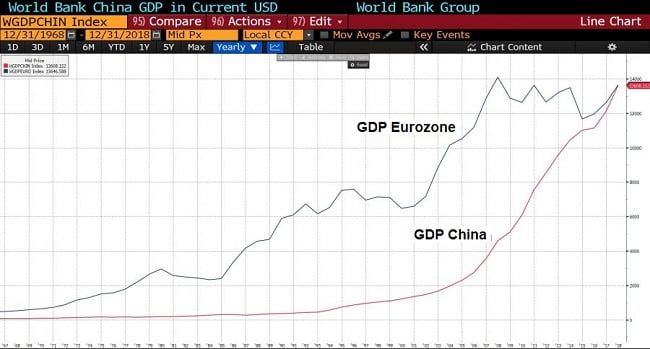

As the growth forecasts are published, the data that is being projected on the different economies indicate how the pandemic has taken its toll on the European economies and these economic data are getting worse. Such is the aggravating circumstance that, while the Bank of Spain exceeded all published forecasts, with a forecast contraction of up to 13.5% for Spanish gross domestic product (GDP), a week later the Morgan Stanley bank presented forecasts that placed the contraction at 13%, being able to reach a contraction of 22.6% in the worst case.

More chilling are these figures when we are going to talk about other macro indicators such as unemployment, debt or deficit. The Budgetary Office of the United States Congress, already predicts an increase in the unemployment rate that, after the pandemic, could further increase the alarming current unemployment rate in the country, which registered a record low a few months ago (3, 8%), considered within the parameters of full employment, up to levels of 16%. A severe shock that could cause a deficit in the country of close to 11% of GDP, which in absolute terms could be around $ 3.7 trillion.

Not even the first economy in the world has found the vaccine to remedy this economic crisis. Waiting for the injections and the stimulus packages, the countries are tense, nervous, in the face of a crisis that is exposing all those imbalances that, as we see, show the set of economies. And, although the usual thing is to talk about asymmetries between the countries that make up the global economy, the Coronavirus has accentuated those asymmetries, uncovering imbalances that, for the United States, Italy or Spain, will mean an increase in their debt to levels never previously seen.

After the decease, the debt

A few days ago, the prestigious economic newspaper The Economist opened the cover of its magazine with a headline that read: “After the disease, the debt“.

One might think that the only thing that matters to the most pessimistic economists right now is public debt. In addition, it is well-known the perception of many other economists who consider disastrous that obsession that certain economists have with reducing debt and avoiding the issuance of other debt, in scenarios where leverage is already very high. However, whether you are in favor of debt or not, that is irrelevant. The fact is that whatever it is, the debt has to be paid at some point. Sooner or later, someday, a country’s debt must be faced. And this is one of the great problems that many countries have faced in this crisis: a high level of debt that leaves countries with little working capital.

If this health and economic crisis has required anything, it has been a fiscal response by central banks. As the pandemic progressed, the Central Banks were responding with liquidity injections that were intended to stimulate the different economies, trying to alleviate, trying to mitigate, the effects of a crisis that, in the face of the supply shock derived from the blockade and the confinement measures, was causing a sharp and drastic drop in liquidity. Liquidity that the central banks tried to supply, precisely, with those injections that we mentioned.

In Europe, the European Central Bank (ECB) launched a 750,000 million euro asset purchase program that will last until the end of the year. To get an idea, more than 50% of all the liquidity injected in recent years, as well as a more extensive program, in contrast to the program implemented during the great financial crisis of 2008. The United States, for its part, intends to inject the economy more than $2.3 trillion. Another strong bet that has the same goal as the one pursued by the European Union; mitigate the effects of a harsh crisis that keeps the entire economy blocked.

Injections to which are added those provided by other countries, as well as those that will arrive in the coming months. Some injections that, in turn, in addition to mitigating the effects of this crisis, are widening those imbalances that, as we said previously, present the different countries that make up the economy. And it is that, as the different organisms already announce, as well as their forecasts, the debt levels in countries like Italy, could exceed up to 150% of GDP. In countries such as the United States, debt could skyrocket above 100% of GDP, while in Spain, another of the major affected, could end the year with debt of more than 120% of GDP.

In summary, these are debt levels that the different countries will have to face, leaving a delicate scenario for future shocks that the economy may experience, in case the debt levels are not corrected progressively after the crisis. And the problem is that, with 120% of debt over GDP, another shock in the economy incapacitates the actions of central banks, since any budgetary discipline, no matter how many crises justify indebtedness, would be cracking. The scarce fiscal buffer that many economies have, now even smaller, puts them in a situation that, if not corrected with harsh reforms and sacrifices, could lead to severe problems in the long term.

The cost of financing, a latent threat

As is well known, issuing debt, even though interest rates are at historical lows, carries a cost that countries must face. In recent years, the accommodative policies of the European Central Bank, as well as other central monetary authorities, have caused these costs to be artificially low. The intense expansionary monetary policy has led countries like Spain to present indicators that, like the risk premium or the cost of financing, in the face of the reality of an economy drowned by debt, were artificially low.

And it is that this insistence of the central banks to maintain good financing conditions have encouraged this massive increase in debt. Well, in a scenario in which issuing debt, as stated by Spanish rulers, is so cheap, why not take advantage to issue debt? With this message, the government announced to the Spanish the new debt issue that Spain was making at the beginning of the year to finance a series of expenses that, like the expenses related to pensions, continued to provoke the contracting of more debt to pay for a chronic deficit system.

However, taking into account what we mentioned previously, until now, we have not been aware of the great problem that exists with such a high level of debt. Especially in a turbulent scenario and where financing costs could skyrocket unexpectedly. Let us recall Lagarde’s message at the appearance of the ECB, as well as the reaction of the sovereign debt markets after his allusion to the unwanted responsibility of the central bank to sustain risk premiums and maintain favorable financing conditions. A statement that raised the risk premiums in a matter of seconds, worrying those European rulers, whose countries had higher levels of debt.

The message from the President of the ECB raised investors’ doubts about whether the central body would support the debt of countries that, such as Spain, Italy, France, Portugal or Greece, have such high levels of debt. And the problem is that these types of statements are quite worrying since we remember that the ability to pay the debt, in many scenarios, depends on those financing conditions. However, in a scenario in which these conditions deteriorate, a large amount of public money would be draining towards the payment of interest; a situation that, as has already happened in history, caused serious difficulties for the economy.

Although the situation has always been favorable, when we contract debt we never take into account pessimistic scenarios that, in the long run, could raise our debt without the imperative need to issue more. Spain, to get an idea of what we are trying to exemplify, pays around 3% of its GDP in debt interest. However, a deterioration in the financing conditions, in a scenario in which, in addition, interest rates rise could raise that cost, which currently represents the total cost of debt in the country. In other words, the country may have to pay interest rates in relation to GDP of around 4%, and this without the need to increase the debt-to-GDP ratio, but because of the deterioration in financing conditions.

In conclusion, these types of scenarios are the most worrying for countries that, like the ones mentioned repeatedly throughout the article, have high levels of public debt. We cannot continue raising the debt in an exorbitant way since the lack of control in matters such as this entails a great risk for those economies that at some point will have to pay this debt. I am not saying that economies should not borrow, but they should do so with control. Falling into the error that the debt is not paid, is the error that many countries have fallen and that now they are not only insolvent, but also unable to stimulate their economies in scenarios like the one we are currently experiencing.

For this reason, budgetary discipline must not only prevail in this crisis, but structural reforms to develop our economic future well must be the next step to avoid future collapses.