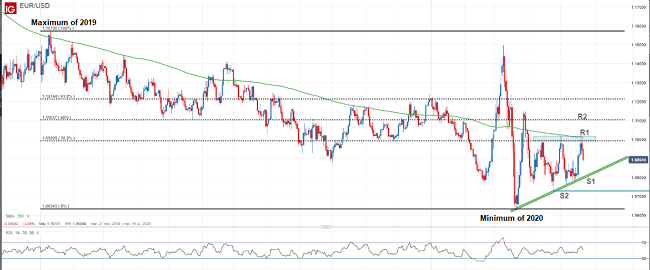

The end of the quarter has caused a volatile session in the currency market, increasing demand for the USD. Due to this, the EUR/USD fell below 1.1000, a key support to determine the trend.

The US dollar moves higher against major currencies and emerging currencies in the session on Tuesday, breaking a week of declines, as investors prepare for prolonged uncertainty and governments proceed to tighten the containment rules to fight against coronavirus pandemic.

It should be noted that we are on the last day of the first quarter of 2020, which means that the investment portfolios will be balanced, which is expected to support the dollar. Demand for the dollar was evident in the Asian session and could have been the cause of a sharp drop in the Australian and New Zealand dollars. But keep in mind that the markets may have some liquidity during the Asian session. Therefore, the focus will be on adjusting the European session at 17.00 to observe the volatility of the currencies.

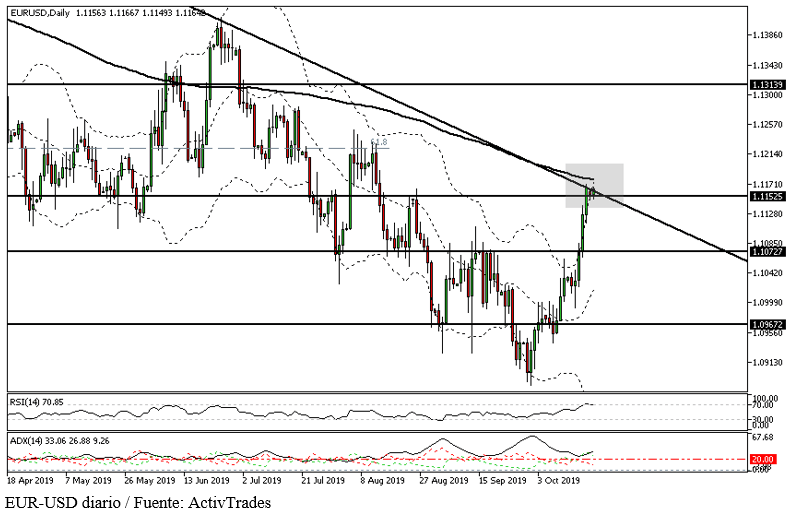

To observe the general behavior of the US dollar we look at the daily price chart of the dollar index (DYX), which measures its performance against the main currencies. The DXY has recovered the uptrend so far this week after hitting the bottom in the 98.30 region in previous sessions. Furthermore, the dollar has so far managed to stay above the 200 SMA (blue) line and thus maintains the uptrend as it tries to break the 100-point barrier. However, speculation with additional stimulus may undermine the recovery in the dollar and thus leave the upside potential somewhat limited.

The EUR/USD currency pair has noticed the increase in the demand for the dollar and is now positioned below 1.10, leaving behind the lines of the SMA 100 and SMA 200. In this context, the trend has turned bearish as that sellers regain control and manage to bypass key support points. If the drop below 1.10 is sustained, we could see more selling pressure as technical support is invalidated. On the upside, it is necessary for the pair to continue advancing above 1.1070 this week so that the price can again reach 1.1500.

AUD/USD pair breaks lateral range – Increase sellers pressure

- China’s PMI data surprises to the upside, giving riskier assets a boost

- COVID-19 cases continue to rise, which worries investors

- AUD / USD breaks the lateral range and falls below 0.61

A huge rebound in Chinese PMI readings exposed weaker markets during the Asian session, with stocks in China and Hong Kong managing to gain ground despite a broader bearish outlook in Japan and Australia. Despite continued constraints in many parts of China, March PMI readings saw both the manufacturing (52) and non-manufacturing (52.3) sector rebound after the huge declines in February. That said, these readings should be treated with caution, as the move to simply reopen a business would be taken as an expansion even though that company potentially saw minimal business activity. Oil prices rose overnight after Putin and Trump agreed that their top energy ministers would meet in an attempt to resolve the current price stalemate.

AUD/USD analysis

Monday’s session saw the AUD / USD pair maintain the bullish trend adding to the gains of the previous week. Currencies linked to growth held on to the hope offered by the data from Italy, where the lowest number of cases of coronavirus (4,050) was registered, since March 17, while Spain also marked a reduction in the number of deaths to 812 from 838. On the other hand, the United States continues to be the concern of the markets with cases rising to 164,359 from 122,653 while the number of deaths in the country rises to 3,173. Offering support for the Australian dollar also adds signs by Australian politicians of further encouragement and disappointment from United States President Donald Trump after promising he could revive the economy before Easter.

The Asian session on Tuesday has got off to a good start for AUD / USD following an unexpected improvement in China’s PMI data. Although the reading is not entirely reliable given the circumstances, a reading above 50, which marks the contraction, is positive for the Australian economy given its dependence on the Asian country in the commercial sphere. In this context, AUD / USD started the morning rising above 0.62 for the first time since March 16, but the pair has retreated during the European morning until trading below 0.61 as risk aversion remains.

The Australian dollar has also received additional support from signals from Australian politicians who speak of further stimulus and disappointment from United States President Donald Trump after promising that he could revive the economy before Easter.

The Asian session on Tuesday has started very well for the AUD / USD after an unexpected improvement in the Chinese PMI data. Although the reading is not entirely reliable given the circumstances, a reading above 50, which marks the contraction, is positive for the Australian economy given its dependence on the Asian country in the commercial sphere. In this context, AUD/USD started the morning rising above 0.62 for the first time since March 16, but the pair has retreated during the European morning until trading below 0.61 as risk aversion remains.

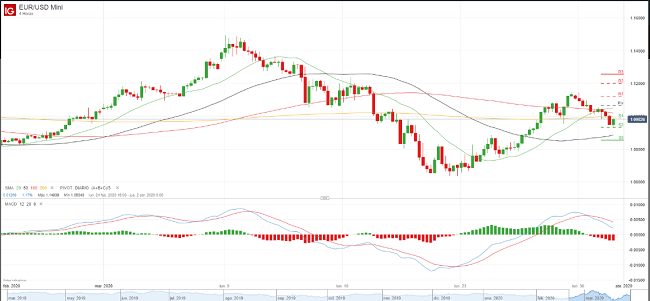

If we look at the hourly chart, we can see how AUD/USD has been moving in a lateral range since Friday afternoon, between 0.6111 and 0.6199, but this range has been invalidated in today’s session. The false breakout to 0.62 has given way to a bearish correction causing the price to drop, now showing at bearish levels equivalent to March 26.

A break below 0.6073 could reinforce the downtrend, although AUD / USD is likely to remain in a lateral range for the remainder of the week.