Chinese Vice Premier Liu He said Friday that Beijing will work with the United States to address the concerns of both sides, and that it would be good to stop the trade war for its own interests and those of the entire world.

Liu He also announced that it will allow Chinese investors to have direct access to Hong Kong shares. The new measure will take effect from October 28 and could be very positive for Asian stock markets.

The president of the United States, Donald Trump, said he believes that a trade agreement between the United States and China will be signed when the Asia-Pacific Economic Cooperation meetings in Chile are held, which will take place on the 16th and 17th of November.

In Europe, it should be noted that the British parliament delayed a decisive vote on the Brexit withdrawal agreement. The British government of Boris Johnson insisted that Brexit will take place on October 31. The leader of the House of Commons plans to put the new agreement to debate and vote on Monday, but it is not clear if the president of the House will allow this to happen.

Asian markets started the week with increases of 0.26% in the MSCI index that groups Asia-Pacific shares, 0.05% in the Shanghai composite index and 0.25% in Japan’s Nikkei 225 .

In Europe, it should be noted that the British parliament delayed a decisive vote on the Brexit withdrawal agreement. The British government of Boris Johnson insisted that Brexit will take place on October 31. The leader of the House of Commons plans to put the new agreement to debate and vote on Monday, but it is not clear if the president of the House will allow this to happen.

Asian markets started the week with increases of 0.26% in the MSCI index that groups Asia-Pacific shares, 0.05% in the Shanghai composite index and 0.25% in Japan’s Nikkei 225 .

In Europe, it should be noted that the British parliament delayed a decisive vote on the Brexit withdrawal agreement. The British government of Boris Johnson insisted that Brexit will take place on October 31. The leader of the House of Commons plans to put the new agreement to debate and vote on Monday, but it is not clear if the president of the House will allow this to happen.

Asian markets started the week with increases of 0.26% in the MSCI index that groups Asia-Pacific shares, 0.05% in the Shanghai composite index and 0.25% in Japan’s Nikkei 225 .

The European indices show general increases in the first trading bars of the week that reach 0.38% in the DAX 30 in Frankfurt, 0.36% in the FTSE 100 in London, 0.25% in the Euro Stoxx 50 and 0.56% in the Ibex 35, which is close again to 9,400 points.

Wall Street closed Friday’s session with significant declines due to Netflix’s disappointing corporate results, and negative news that strongly impacted Boeing and Johnson% Johnson’s stocks.

The Dow Jones fell 0.95% to 26,770 points, the S&P 500 index lost 0.39% to 2,986, and the Nasdaq closed with a 0.83% decline to 8,089 integers.

In the currency markets, the pound fell from a maximum of five months after the British parliament forced British Prime Minister Boris Johnson to seek a postponement on the October 31 deadline for Britain’s departure from the community bloc . Right now the pound is changing to $ 1.2920.

The dollar index experienced four sessions of sharp falls that placed it at 97 points. The declines in the US currency allowed the euro to overcome the resistance at $1.1150.

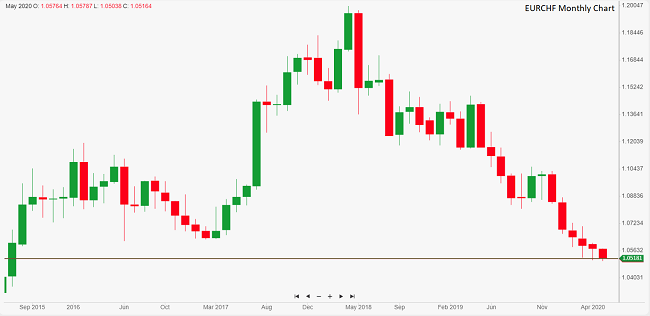

In the daily chart of the EUR/USD currency pair, we observe that the European currency is facing two key resistances for the evolution of the trend, such as the 200-day moving average and the long-term bearish trendline.

In the commodity markets, oil prices remained at around $54 due to constant concerns about economic growth and excess supply of crude.

The price of spot gold continued to trade slightly below $1,500 per ounce without registering significant changes.

In the economic space, it should be noted that the data published this morning showed that Japan’s exports fell in September for the tenth consecutive month, while South Korea’s exports fell 19.5% year-on-year. These data reflected that China’s and US tariffs are holding back world trade and have increased the risk of recession in some countries.

Later in the day the monthly report of the Bundesbank will be published and the US Treasury will issue bonds at 3 and 6 months of maturity