This Forex intraday system is based, mainly, on an interesting custom indicator for Metatrader 4 called ProEMAGain. This indicator consists of three exponential moving averages (EMA), and an RSI indicator. These indicators are common tools for the analysis of the Forex market, but here they are combined, originating a very profitable system. This combination gives the right and necessary information, in addition to being visually effective, to make decisions quickly and correctly.

It is recommended to trade with this trading strategy only in the major currency pairs: EUR/USD, GBP/USD, USD/JPY, USD/CHF, AUD/USD, and NZD/USD.

Characteristics of the ProEMAGain trading system

This system offers two types of entries, one conservative and another aggressive. Both entries can bring you good results if used correctly. It is recommended to operate on Forex charts of 5 minutes (M5), 15 minutes (M15), 1 hour (H1), or 4 hours (H4).

The system provides very precise entry signals for the recommended timeframes depending on the way you trade in Forex. Generally, the best retail traders in the world use the Metatrader terminal, since it offers endless possibilities to analyze the currency market.

Do not forget that to be successful in the Forex market it is essential to work with the best Forex brokers. If you have not yet chosen your broker, we recommend you read our article on choosing a Forex broker.

The ProeEMAGain technical indicator

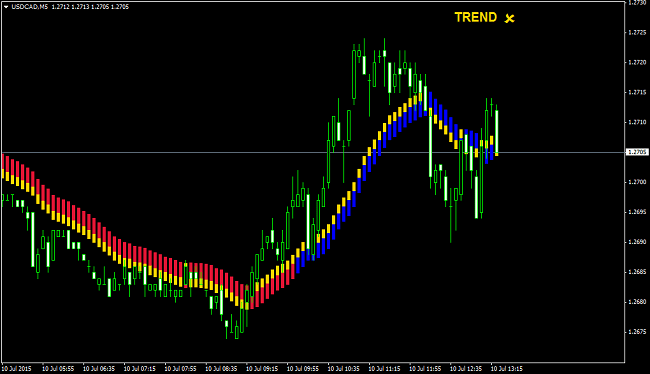

The difference between the two entries is very simple. At the top of the price chart, there is a trend indicator. For a conservative entry, you will have to take into account what the trend indicator tells you. And for an aggressive entry, it is not necessary to look at this indicator. The indicator consists of bars, which are painted red and yellow, or blue and yellow. Therefore, the ProEMAGain indicator consists of these painted bars plus the trend indicator.

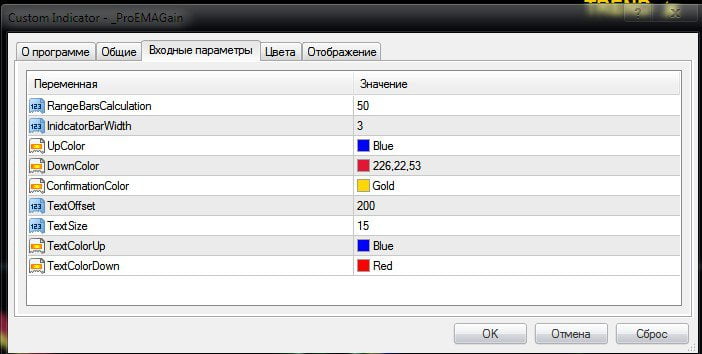

However, these colors can be customized to suit the trader’s needs. The color of the text can also be changed. The most important parameter here is the RangeBarsCalculation. The height of the bars and, consequently, the trading style depends on their value.

Rules of the Trading System

Buy trades

– Wait for at least 2-3 yellow bars to appear at the top of the bar.

– If the price is above the indicator, wait for the indicator update.

– If the price is below the indicator, wait for the first bar that closes above or very close to the indicator.

– For a conservative entry, wait for the trend indicator to indicate that we are in an uptrend.

– Wait for a bullish candle that closes above the indicator.

– If at the beginning of the next candle, the yellow bar still appears at the top of the main bar, open a buy position.

Stop loss: For good risk management, place the stop loss 2-3 points below the indicator or at the nearest local minimum.

Take profit: The take profit is recommended to place it between 1.5 or 2 times above the stop loss.

Sell trades

– Wait until at least 2-3 yellow bars appear at the bottom of the bar.

– If the price is below the indicator, wait for the indicator update.

– If the price is above the indicator, wait for the first bar that closes below or very close to the indicator.

– For a conservative entry, wait for the trend indicator to indicate that we are in a bearish trend.

– Wait for a bearish candle to close below the indicator.

– If at the beginning of the next candle, the yellow bar still appears at the bottom of the main bar, open a short position.

Stop loss: For good risk management, place the stop loss 2-3 points above the indicator or at the nearest local maximum.

Take profit: The take profit is recommended to place it between 1.5 and 2 times below the stop loss.

Considerations with trading signals

Sometimes, the trend indicator marks a neutral position, in that case, it means that the market is undecided or in range. In such a case, more conservative traders should refrain from making any entry.

You can download this indicator with the system template for Metatrader 4 using the following link: