The trade war between the United States and China continues to be the focus of the markets. However, in the last hours a new conflict was added, of similar characteristics, but with different causes, such as the announcement that the United States will impose, from June 10, tariffs on imports from Mexico for 5% .

In this way, not only does a new dispute begin with unpredictable derivations, but the implementation of the new trade agreement between these two countries and Canada, which the United States unilaterally called USMCA, is questioned. In addition, it generates a major concern in the US business sector, given that there are many firms that have their factories in Mexican territory, and export to the United States.

The news, which caused a fall of proportions on Wall Street on Friday, maintains an important effect on Monday, although the markets are slowly trying to change their tone. Stock index futures begin to show signs of a change in direction, after a bearish opening in Asian time, and European currencies also begin to move away from their lows of last week.

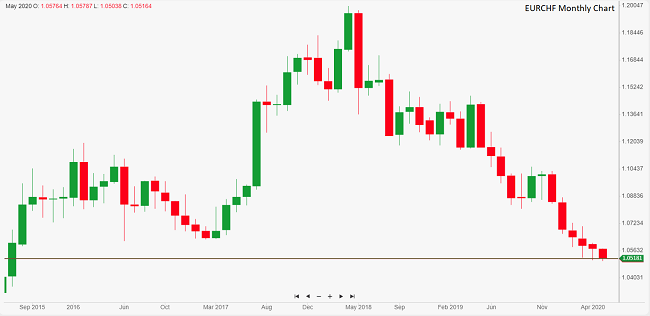

The euro, for example, approaches 1.1200, after falling to 1.1105 days ago, its minimum level in 2019.. The bullish breakout of 1.1215 would give the euro a slightly more bullish momentum, although for now that possibility looks far away. The same happens with the Sterling Pound, which moves away from its lows of 1.2554 reached on Friday, although it still maintains an important bearish tendency, which will be difficult to overcome: the Brexit does not give truce, and the aspirants to succeed Theresa May are ready to plunge the United Kingdom into chaos as soon as possible.

The yen and gold, on the other hand, go through their best hours thanks to the rise in appetite for safe haven assets. The Japanese currency touched 108.00 in the last hours, to fall slightly, although maintaining a clear upward trend. Spot gold, on the other hand, continues on its bullish path initiated last Thursday, and reaches maximums above the psychological price level of $1300

The American session will not have special attractions, beyond the ISM Manufacturing Index of United States, which will be published at 10:00 am Eastern time. However, despite what the data could tell, the question of trade war, which as seen is already extended to other latitudes, is what holds the attention of investors.

Investors focus on PMI

The PMIs were below 50 points in Japan, South Korea, Malaysia and Taiwan. In China, it remained stable at 50.2 integers. Readings below 50 points indicate contraction in the activity.

The markets fear that a global economic recession will be generated if commercial tensions are not alleviated at the G20 summit that is held at the end of June in Japan, where there is expected to be a meeting between Presidents Donald Trump and Xi Jinping.

The focus will be on the publication of European, Canadian and United States PMIs. The result could further increase concerns about global growth.

Data published this morning showed that factory activity contracted in most Asian countries last month, raising fears of a global economic recession.

It is very likely that these growth economic indicators will continue to deteriorate in the coming months, as increases in tariff rates are limiting the global trade of goods and deteriorate the sentiment of consumers and companies, with delays in purchasing decisions and investment.