The International Monetary Fund (IMF) has released the update of its forecasts for the world economy and the effects caused by the Coronavirus. In ForexDominion we have analyzed the report published by the organization.

A few days ago we knew the forecasts on the world economy, which were published by the IMF. A highly anticipated publication, following the last one in Davos for the 50th anniversary of the World Economic Forum (WEF); including, yes, the effects of an economic and health crisis that, unlike the rest, was unprecedented. A downward revision in the forecasts, highly anticipated by analysts who, given what happened, cannot see clarity in the near future.

In this sense, the IMF communicated that same perception to analysts. Well, despite the fact that the forecasts show quite explicit results, said report highlights that uncertainty that, for the sake of the situation that is happening to us, prevents the objective measurement of variables on which, for the moment, we do not know the behavior. Variables that, given the inability to monitor and project their behavior, continue to leave an uncertain horizon for the economy as a whole.

The trajectory of the pandemic, the intensity and effectiveness of containment efforts, the degree of supply shocks, the repercussions of the drastic tightening of conditions on world financial markets, variations in spending patterns, behavioral changes, effects on the confidence and volatility of commodity prices are some of the variables that, for the moment, are a further unknown for all analysts and economics, unable to project their objective behavior in view of the possibility of that these variables may undergo changes in the very short term.

And, precisely, we are facing a phenomenon in which, as the IMF itself predicts, we cannot objectively know what will be the behavior of a virus that, until now, was a complete black swan for economists. According to various research agencies, in this sense, we are in a scenario in which the phenomena that occur on a daily basis force economists to make forecasts almost blindly, trying to predict what the level and intensity with which the economy will suffer that expected, and so feared, economic contraction.

In general terms, despite the fact that the forecasts are in the same line, we can appreciate a great diversity of forecasts and previsions. And what happens is that, depending on the calculation made and the behavior attributed to each of the variables mentioned above, the result of the infinity of models created to extract projections is different in each one of them. In other words, there are as many projections as there are models.

And despite everything mentioned so far, we could be facing the biggest contraction in the world economy since the Great Depression of 1929.

In general terms

According to the report and the forecasts that it throws, the crisis of the Coronavirus, and the effects of this in the economy, has ended up generating a double crisis: economic and health. Despite the fact that the health crisis prevails over the rest, we are in a scenario in which other types of actions would only aggravate the situation. And it is useless to contain the economic effects if we subsequently fail to dispel the effects of a health crisis that, precisely, is the cause of the great blockade and the supply shock experienced by the world economy as a whole.

Getting out of the impasse in which the economy is located is what is important, and for this, we need to get out of this health crisis, lessening the effects of a virus that, as we know, is the cause of all this disaster. However, as we said previously, we still do not know some variables as important as the trajectory of the pandemic and its behavior. Follow-up studies can be done to monitor those variables that try to estimate how the virus will behave, but how do you foresee the behavior of a virus that was not even expected to exist?

This is the main problem. For this, the IMF has chosen a calculation basis, which many economists consider as a very optimistic view, in which the virus dissipates during the first half of the year, allowing the economy to resume its activity during the second half and closing the year with a completely normalized economy; with contraction, yes, but normalized. Thus, the forecast released by the agency for the economy places the economic contraction at -3%. A contraction of 3 percentage points in the gross domestic product (GDP), which places the contraction as the worst since the Great Recession of 2008, even going so far as to overcome it.

A contraction that is nothing more than the product of a calculation basis that takes into account the resumption of economic activity during the second half of the year, but which, for the moment, we are unable to visualize. With this, in the selected scenario, world GDP would pick up its growth in the coming year, with projected growth for the world economy at 5.8%. An optimistic growth indicated by the IMF, but which is subject to that extreme uncertainty that the multilateral organization so emphasizes, given the high probability that the forecasts will deviate in the short term.

In general terms, we are facing forecasts that include a forecast that, despite being the worst since the Great Recession of 2008, is still a very early prevision. That is a forecast in which many variables still persist that could set new directions in future projections, invalidating provisions that, for the moment, are still not as pessimistic as others that show a greater contraction than that projected by the IMF. In this sense, monitoring these variables and making constant adjustments repeatedly is key to controlling the situation, because if there is something clear in all forecasts, if there is a common denominator in all projections, it is the degree of uncertainty to which they are subjected.

An asymmetric economic contraction

If we analyze the forecasts broken down into economic blocks, we quickly realize the asymmetry that the different blocks present for the IMF. Thus, the forecasts released by the organism for the different economies on the planet show this variation in the intensity of this pandemic. Variations that, on the other hand, cause this diversity of forecasts, with contractions so different in the different blocks that make up the world economy. A situation that further complicates the current scenario, since many of these economies are beginning to experience the pandemic, while others already show a slight stabilization.

According to predictions, the IMF’s forecast for the US economy shows a contraction very much in line with the emerging economies of Latin America and the Caribbean. In this sense, the North American economy would suffer a -5.9% contraction in its gross domestic product, resuming its growth next year, with a growth of 4.7%. A very worrying forecast for its President, Donald Trump, who was facing re-election at the polls this year, presenting an economy that, years ago, had reaped great growth, as well as quite favorable levels in the main macroeconomic indicators.

In this sense, the Latin American economy also shows similar behavior. Very dependent on the behavior that trade will experience and the evolution of prices in commodities, the emerging economies of Latin America continue to prepare to face a virus that, for the moment, does not know the intensity with which it will subject the Latin American economies. And it is that, a contraction of -5.2%, in a scenario in which the virus has not yet flaunted its presence in the region, can even be very optimistic. The evolution of the virus, and its containment capacity, as indicated by the IMF itself, is going to be key for the Latin American economy and its effects.

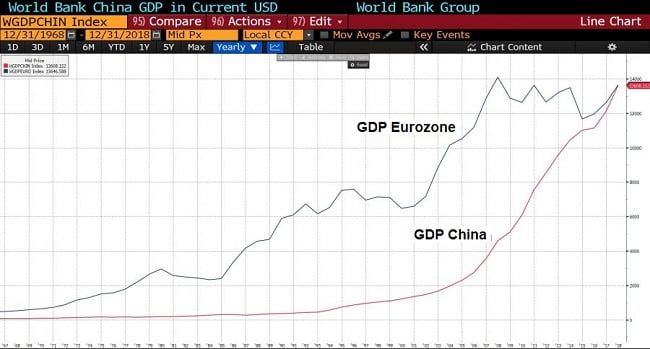

Europe, for its part, as the region most affected by the virus, shows the greatest contraction in the economy. We are talking about a contraction of -7.5%, as a result of that greater intensity and the intense confinement that the different European governments have applied. In this sense, with economies like China or Italy, paralyzed by a virus that, until now, showed its worst face in the European Union, the organism’s forecasts have focused on the European economy. However, the evolution of the virus in these countries, as well as the possibility of emerging from confinement before other countries that entered this crisis much later, could benefit these economies, placing future growth at more optimistic levels than other economic blocks.

The lower intensity at which blocks such as Africa or the set of emerging economies in Asia have had to face the coronavirus is also reflected in the forecasts issued by the IMF. Therefore, Africa, waiting for a possible contagion and with an economy dependent on the sale of commodities, shows a rather moderate contraction in the forecasts that refer to the economic bloc. In this sense, a forecast that includes, as we said, this lower intensity of the virus in continents that, like Africa, has presented fairly low levels of infection. However, the stoppage of trade and the risks of possible contagion are still very present.

For their part, the emerging economies of Asia are the ones that show the best performance, as the IMF itself shows. The agency’s forecasts do not even show a contraction in the economy. According to the IMF, it is an economic bloc that would end the year with a growth of 1% of GDP. In this sense, an economy that, as in the case of Africa, has not been so affected by the effects of a virus that, after all, is the cause of all the problems that the economy is experiencing in these moments. And we must remember that these forecasts are nothing more than the body’s translation of the effects of a viral pandemic on the world economy; thus, those less exposed countries, in this way, also present less pronounced contractions and with more limited impacts.

It is worth noting, without having mentioned it in the previous case, the situation of China regarding the Coronavirus. As this is the first economy affected, the rapid resumption of economic activity and the, a priori, recovery in “V” that the Asian giant’s economy has presented, has caused that the forecasts do not look as negative as expected at the start. However, it is still early to give a final verdict, since the new cases of contagion and a possible relapse of the Chinese economy could cause deviations in the forecasts, weighing down the growth that the agency highlights for this economic power.

Finally, we cannot forget the forecast made for the countries of the Middle East and Central Asia. Forecasts that, in the same way as in emerging Asia, show less intensity in the possible contraction. In this sense, we are facing a contraction of -2.8% for this year, waiting to see, as it happens in China, the behavior that the virus will experience in these countries, as well as the possible episodes of contagion and relapses from which, for the moment, they are not exempt. However, in summary, the forecasts show greater optimism than for other economic blocks, as a result of the fact that, as with China, these countries have experienced much more concentrated periods of confinement, but with much more limited time periods than for example in Europe.

Conclusions

In summary, the world economy is facing a general contraction of the economies, accused of an economic slowdown that haunted the set of economies, even before the Coronavirus crisis. In this sense, the world economy is optimistic, within the pessimism left by a Coronavirus that has paralyzed any economic activity that was taking place on the planet. However, we continue to witness a pandemic that continues to persist and spread throughout the planet, although with less intensity in economies that, like the European one, show a more limited contagion curve than at the beginning.

However, the extreme uncertainty to which the forecasts are subject continues to show a very uncertain scenario. Controlling and monitoring the different behaviors that variables are experiencing, such as those mentioned in the previous point, is key, and this has been indicated by the IMF, to adjust the forecasts with the reality that the situation presents. For this reason, contemplating all possible scenarios and not ruling out forecasts is the best decision that governments can take, because in the face of such uncertainty, ruling out scenarios, catastrophic as they are, could generate unwarranted complacencies that could lead to much deeper relapses.