Historical falls for the stock market due to the coronavirus crisis. The health crisis has been joined by an economic crisis. Governments have to decide which one they prefer to focus on. And they are hardly going to stop both at the same time.

Let’s focus first on the thermometers of the global economy. The S&P 500, which accounts for almost a third of the world market capitalization, this week had its fifth largest drop in the stock market (-11.5%) since the Second World War. The MSCI World has also fallen by -11.12%. This in economic terms represents losses of almost 10 trillion dollars in the accounts of investors, that is, the sum of the GDP of Germany, the United Kingdom, France and Spain. Not bad for a single week.

The previous week, the Chinese stock market had suffered considerable falls, however, its effect had hardly been noticeable in the western stock markets. It was the previous weekend when the alarms went off, after learning that the coronavirus had spread intensively throughout northern Italy, with more than 100 infected. In South Korea the number was close to a thousand infected, confirming the ease of growth of this virus.

Opening markets on Monday saw declines of more than 4% in global indices. Throughout the week, the falls were added day after day.

This disease does not seem especially serious, but behaves very similar to the common flu: most cases have mild symptoms that do not require hospitalization.

And then why do the stock markets fall?

Stock markets are a leading indicator of the economy, trying to predict the behavior of the economic activity. We are currently facing two crises, one of health and the other of an economic nature. And nobody knows very well how the two will develop. This produces what the stock likes least: uncertainty. In other words, falls are caused by fear of the unknown.

The coronavirus crisis is a double crisis. The first, the health crisis has led to an economic crisis. Being a variation of the flu, the world tried to avoid what already seems inevitable; that the coronavirus becomes a pandemic. Its high contagion capacity is what is putting governments on edge. To prevent its spread, quarantines have been established and numerous events have been restricted. Much of China’s population has been working at half gas for two weeks.

This has caused the Chinese economy to freeze dramatically. Without going any further, yesterday the figure for manufacturing production in China came out at 35.7, being the lowest figure in history. This reflects the enormous paralysis of the main engine of world economic growth.

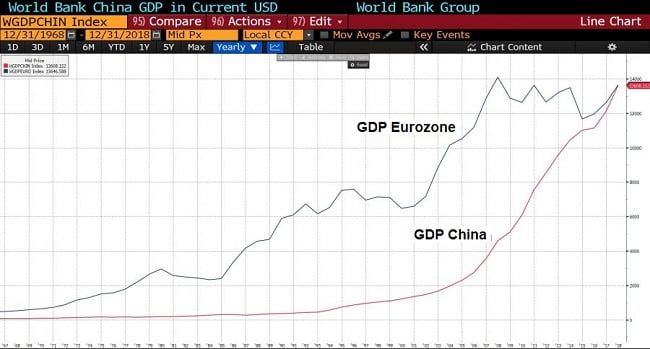

Unlike the previous health crisis in China, produced by SARS. China currently has an economic importance in the world 4 times greater. By way of comparison we see how 25 years ago the eurozone’s GDP was 10 times bigger than the Chinese, and last year, China surpassed the eurozone in production size.

The paralysis of the Chinese economy, on the one hand, has infected the world economy due to its high relevance in the world, and due to its character as the world’s leading exporter. Many intermediate products made in China to produce other products in Europe and America have stopped coming. On the other hand, the health crisis is beginning to affect Europe and is reaching America.

As the pandemic inevitably spreads around the world, with more than 1,000 cases in Italy and 3,000 cases in South Korea, in China, there are cases of people who have recovered and have become infected again. Which adds more uncertainty to the health crisis.

The spread of the virus is causing more measures to try to stop its spread. Flight cancellations, air traffic restrictions and cancellation of important events. In France, for example, all events attended by more than 5,000 people have been canceled. In Switzerland, events attended by more than 1,000 people.

So many restrictions are holding back Europe’s economy, which already had France, Germany and Italy on the brink of recession. There is even talk that the United States may go into recession or at least have a quarter of negative growth as a result of the global slowdown and the paralysis of the economy. This is one of the stock market’s biggest fears that the United States will go into recession.

Central banks and governments come to the rescue of the economy

Several central banks, led by the FED, have already hinted at stimulus measures. The market already discounts 3 interest rate drops this year in the United States. For its part, the Hong Kong Government has carried out what is known as a money helicopter, that is, sending a money envelope directly to each Hong Kong family.

In Italy, a package of urgent stimulus measures has been taken focused on the regions of the North, those most affected by the coronavirus.

What we don’t know is whether these measures will have the desired effect on the economy. The economic crisis is a crisis of supply reduction, that is, production is reduced because fewer people are going to work as a preventive measure against the coronavirus. Measures to stimulate spending cannot do much to remedy the lack of supply. Furthermore, if supply is reduced and spending is stimulated, the most direct consequence is simply an increase in the price level. This does not mean that there is no point in applying these stimuli, perhaps it serves to alleviate the economic tension. But of course, it will not tackle the economic crisis.

By contrast, the stock market does tend to like stimulus measures because they mean injections of liquidity into the market. Stock market liquidity pushes markets upward, as we have seen in the last 10 years. For this reason, many analysts believe that the recovery of the stock market will be in the form of V. Once the health crisis subsides, or it becomes a pandemic that we have already accepted, the economic stimuli will continue to boost the economy.

Several scientists have claimed that, if this rate of expansion continues, the coronavirus could affect 70% of the world population. Governments are facing the position of stopping the economic crisis or stopping the health crisis. For that they have to assess the danger of this variation of the flu.

Undoubtedly, the health crisis is a priority over the economic crisis due to the ignorance of how this flu really works and because there is still no vaccine for it. If governments have to sacrifice economic activity to stop it, logically they will. That is why the FED and the rest of the central banks will be able to do little to stop the economic crisis if they continue to restrict activity worldwide. They may be able to keep the stock market on its feet with injections of liquidity, but what they certainly cannot do is stop the health crisis.