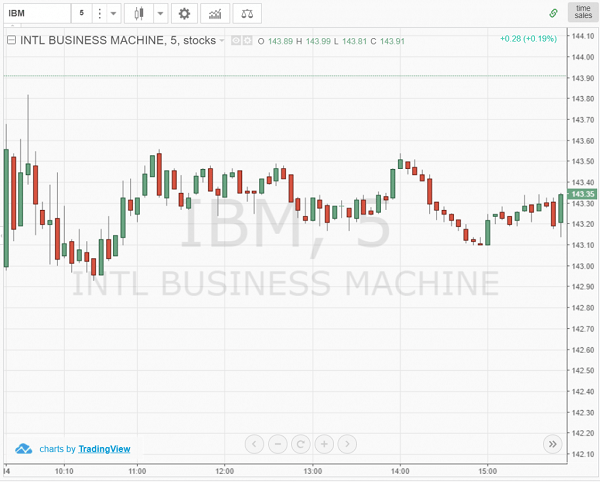

Today, I will talk about the choppy market, that is, the laterality in the market, how to approach it and take advantage of it.

Choppy means hectic or variable. The term Choppy Market, therefore, refers to when the prices of shares in the Stock Exchange or currencies in the Forex market rise and fall, or fluctuate uniformly, without following an upward or downward trend, so they remain lateral.

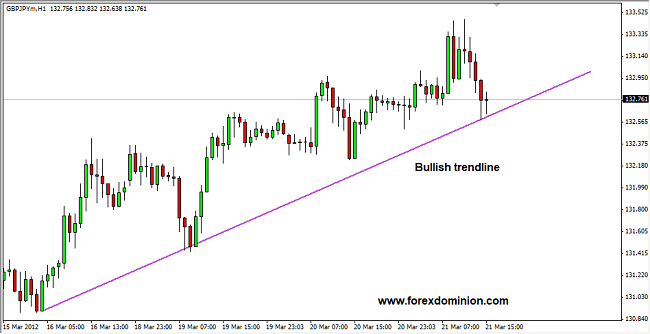

For a market to be considered “choppy”, the fluctuation can occur both in the short term, and in the long term. There are times when markets do follow a clear upward or downward trend.

But there are many times when they do not. That is why we can say that the market can enter a choppy or lateral state at any time. Or, failing that, the choppy state is one of the natural conditions of the market.

The Choppy Market Is A “Rest” in the market

In practical terms, the choppy market is conceived as a “rest” that the market takes. What is nothing more than a “rest” that investors take. These investors, big and small, are the ones who regulate the price of markets.

Therefore, the choppy or lateral market is presented after a large rise or fall in the prices of shares, currencies, commodities or any asset traded in financial markets. Choppy markets occur when investors prefer to wait for something to happen, such as a definitive breakout of an importante support or resistance.

Lateness can be maintained for minutes, hours or even days. Until there is an event that triggers the investors action or euphoria or fear take over the market and lead them to buy or sell their positions.

A fundamental indicator or unfortunate event can cause a trend change and that the market goes from laterality to trend. So that the prices continue to rise or fall depending on whether the news or the event is positive or negative.

The Choppy Market puts your nerves to the test

Therefore, as investors we must bear in mind that a choppy market puts our minds to test. Basically, because it generates uncertainty. And when it is present, we simply do not know what to do with our money.

Although for an expert investor there may also be gains in this situation for others it may not be so easy to earn money in a market like this. Therefore, this market condition forces us to evaluate our risk.

This means that we must decide if we want to invest:

- Although we do not know what trend the market will follow when the laterality is broken.

- Even though we do not have a single signal about what can happen.

- Although we feel indecisive about what we want to do or not.

Likewise, we must decide what is the expected profit percentage. It is unlikely that in a choppy market we can determine it. Because the fluctuation of prices makes this prediction impossible.

Three Tips to Keep in Mind When Investing in a Choppy Market

There are three aspects in which you must fix your attention if you want to trade successfully when the market is lateral. In this way, you can trade more peacefully and have more “insurance” to protect your money:

- Know the work environment: make sure you know the platform where you invest and that you can make quick decisions and place them on the platform. This way you will avoid making mistakes just because you do not know how to use the tool.

- Stop loss: in a choppy market there is fluctuation in prices. Therefore, when trading in these markets, you must know how to place your stop loss in every trade very well. Only in this way you can avoid losses.

- Time frame: When trading, the time frame analyzed must be considered. Short-term time frames are usually choppy than long-term ones.. A market that moves laterally in a shorter time frame will not necessarily do the same in a longer time frame. Whatever the case, the choppy markets should be avoided if the trader prefers to operate with extensive movements of the price. For example, swingtrading transactions in a choppy market should not be executed until the market exit that state since our strategies may not have as much “effectiveness” in this state.

There is no obligation to trade all the time

There are investors who invest every day. No matter how they feel or the market conditions. Because they believe that, if they do not, they are losing money. Or that they are not good investors.

But that’s not true. We do not always have to invest. If someday we do not have a winning attitude, why should we trade? If someday we see that things are happening in the market that we do not know how to handle, why should we trade?

What I want to tell you is that others can take advantage of the choppy market to earn money. But if you do not feel ready to do it, it’s fine. Now, if you are interested in this type of investment, I give you some advice.

The advice is to practice on your demo account. Or that even one day, in your real account, you look for this type of movements so that you can learn to analyze them. And when you have them dominated, you can try to invest in these sideway markets.

Learn to trade in the choppy markets

I hope you liked this post on a topic that we had not talked much about. It seems simple, but in reality not only you have to know it, but learn to manage it. Because it can be vital for us to make a profit or protect ourselves from losses as choppy markets are quite common.

Knowing what to do when the market is bullish, bearish or lateral is vital to our strategy. So I hope you can put into practice what you learned today. I will be available to answer your questions. Do you have any question?

- Did you already know the concept of choppy market?

- Have you trades when the market is lateral?

- Did you get gains or losses?

- Are you interested in learning more about investment strategies in the sideway markets

- Or do you prefer to invest when there are clear trends?