Currently there are a large number of online brokers in the market with which we can invest in all types of financial instruments such as Forex currency pairs, CFDs, stocks, stock indexes, commodities, oil, gold, silver, ETFs and more. Previously this type of investment was reserved for large investors and financial institutions but in recent years the scenario has changed radically and today anyone can become a retail trader, learning and starting to invest online from home or even from your phone mobile or tablet.

It is often difficult to know which broker to choose or what are the differences between existing companies. To try to help you in this regard, in this article we will analyze what are the types of brokers and what are the advantages and disadvantages of each of them.

(Related article: Forex brokers list)

What types of online brokers are there?

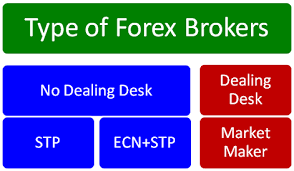

We can make a main division of the online brokers in 2 large groups according to the way in which the orders of their clients are executed:

Dealing Desk Brokers

Dealing Desk (DD) brokers are those dealers that have a “dealing desk”. Within this group we have only one main type that are Market Maker brokers:

Market Makers Brokers

These brokers are called market makers because the transactions of their clients do not really go to the market but they are executed in the broker’s trading desk. Although the prices of financial instruments are practically the same as those offered by other brokers, the buy or sale orders placed by the trader will not go beyond the broker’s trading platform. For example, if you decide to open a buy position in the EUR/USD pair, the transaction will be carried out but there is no real order in the Forex market.

Market maker brokers create an internal market for their customers and allow you to buy or sell at any time without having to wait for a reverse order to complete the transaction. It is usually the broker who acts as a counterpart of the trade, ensuring liquidity and permanent availability, even if this transaction involves a profit or a loss.

Although there is a spread (differential between the buy price and the sale price) that the broker receives as a commission, by acting as the counterpart of the client, the broker can also obtain benefits from the losses of its clients or losses of the profits of its clients. This could suppose a conflict of interests between the broker and his clients, for that reason there are traders who directly prefer other types of brokers that do not have a dealing desk and send the transactions to the market. Today most brokers (among which are some of the most prestigious) are Market Makers and are not necessarily worse than the other types that we will see below but it is important to always choose a reliable, serious and regulated broker. (Related article: How to choose the right online broker?).

The main advantages of working with a Market Maker broker are:

– They offer a maximum availability to execute the transactions requested by the client, in a fast way and without requotes. The buy and sale prices (bid and ask) tend to be more stable and less volatile. Many even offer the possibility of trading with fixed spreads instead of variable spreads.

– The minimum deposit requirements are small, you can trade with microlots and the level of leverage available is usually high. Therefore, it is an option to take into account to start with little capital. For these reasons market makers are usually brokers that are better suited to beginner traders or with small accounts.

As main disadvantages:

– These brokers do not usually allow certain strategies such as scalping (very short-term trades where the trader opens buy or sale positions that closes in a few minutes or even seconds).

– A greater prior analysis of broker reliability is required to avoid unpleasant surprises. Always choose a broker that is regulated, since your activity will be supervised and you can go to a regulatory body for any eventual problem.

As a reflection on the market maker brokers there are many opinions on the Internet about these companies, mostly negative. Surely there may be cases in which these companies have acted against the interests of their customers, but being a market maker does not necessarily imply that this type of broker uses bad practices. The main brokers are market makers and have been in the market for years, something difficult to achieve if they were dedicated to causing the losses of their customers. Unfortunately, most traders lose money on their own, which makes it unlikely that the broker needs to manipulate anything and it is always easier to think that we lose because of the broker instead of thinking that we lost because of lack of knowledge and experience, because we do not have a good trading system or because our risk and money management is poor.

Non Dealing Desk Brokers

The Non Dealing Desk (NDD) brokers are those that do not have a “dealing desk” and therefore send the clients’ transactions directly to the market. Within this group we have 2 main types:

STP Brokers (Straight Through Processing)

STP brokers send the transactions requested by the clients directly to their liquidity providers (which are usually large banks and financial institutions such as Deutsche Bank, Bank of America, Barclays, Goldman Sachs, JP Morgan, CitiBank, HSBC, …). The orders are executed directly and electronically without any manual intervention.

Spreads between the buy price and the sale price are variable since the best available price is offered at each moment by the liquidity providers. STP online brokers tend to slightly increase the spreads offered by liquidity providers and that’s where their benefit lies. For this reason, there are no conflicts of interest between the broker and the client as the company does not act as a counterpart to the transactions.

ECN Brokers (Electronic Communication Network)

ECN brokers create a network between their clients and liquidity providers (large financial institutions, banks, other brokers, …). As in the case of STP brokers, the best spread available at each moment is obtained, but in this case with a greater market depth (Level II quotes) as the broker is interconnected to a greater number of participants. There is also no possibility of conflict of interest.

As main advantages of these ECN/STP brokers without dealing desk we have:

– There is no possibility of conflict of interests between the broker and its clients.

– Spreads are variable and tend to be lower, most of the time, than with market makers.

– Any strategy is allowed (scalping, hedging, automatic trading, …) without restrictions.

As main disadvantages we have:

– Not all offer micro accounts (to trade with microlots) and the minimum deposit is usually somewhat higher than in the case of market makers (although there are fewer and fewer differences). It is also much less frequent to offer welcome bonuses for deposit or aggressive promotions.

– They tend to be ideal brokers for experienced traders or who perform a high frequency traders (day traders, scalpers, …). For a beginner it is usually easier to start with a market maker. The prices and variable spreads are more volatile, there may be re quotes, slippages…

– Some Non Dealing Desk brokers work with very low spreads direct from their liquidity providers but they apply a volume commission that is their benefit.

A combination of these types of brokers that is becoming increasingly common is the following:

Hybrid Brokers

There are a good number of brokers that are market makers and ECN/STP at the same time because they offer some trading accounts in which they act as market makers and others in which they send the orders to their liquidity providers. In our comparison tables of online brokers you can identify them using the “Broker type” column.

For the basic accounts that are intended for beginners, they usually work as market makers (they offer micro lots, the available leverage is higher, some offer fixed spreads, …) and for the most advanced accounts directed to professional traders they operate as an ECN or STP broker.