Leverage and margin call are two basic Forex concepts whose definitions may seem unrelated to each other at the beginning. Despite this, the fact is that both terms are closely related so we will explain what they are and and why they should be known by any investor interested in investing in the Forex market.

Forex Guide

The best days to trade in the Forex Market

Because it is no a centralized market, Forex is open 24 hours a day Monday through Friday. However, not all time is equally suitable to enter the market. In fact, there are periods that offer excellent earning potential while others should be avoided since they have low liquidity and movement.

Many traders know that the period corresponding to the London session is the period that has more movement compared to other sessions, however, there are certain days in the week in which markets tend to show more movement.

Usually it is best to trade during midweek, as in this period is when most of the action occurs in the market.

Friday markets remain relatively active until 12:00 pm EST and thereafter the activity falls until the closing occurs at 5:00 pm EST. This means that on Friday, traders work only half a day since most are kept off the market for the rest of the trading session.

Except for the more conservative traders who prefer the slower and less volatile markets, the most suitable periods for Forex trading are those with higher levels of liquidity and volatility as they present the most extensive movements and clearer trends. This increases the chances of success of the trader.

Forex market sessions

As every investor with some experience in the Forex market knows, one of the main advantages of this financial market is that it operates 24 hours a day from Monday to Friday, which gives the trader the opportunity to take advantage of the many opportunities offered by the market throughout the day. This is because the financial market is not centralized as is the New York Stock Exchange, for example, so at all times there are large and small traders worldwide who perform currency transactions whose total volume is much higher than any other market. This makes the Forex market an excellent investment option as there is liquidity to open and close positions at all times. In other financial markets, the smaller trading volume sometimes makes it not possible to find a counterpart to buy or sell when a trader wants to open a long or short position.

However, this does not mean that it is profitable to trade in the Forex market at all times, as there are periods in which the market is relatively calm and without any clear direction or trend so it is difficult to find good opportunities to obtain profits (these are the periods of lower trading volume for which there are relatively few investors transacting in the market).

Should we trade in the Forex Market during the opening of the main exchanges?

A question that has many traders specialized in the Forex market is whether to open a position when any of the major exchanges like the New York Stock Exchange opens its daily session.

The fact is that during these periods is when the trader can get the biggest gains since these are the moments when the main future and stock exchanges open, there is a greater market participation of companies, institutions, funds and traders, and therefore there will be a higher volume of transaction in the markets including Forex.

How affects the control of inflation the Forex market?

The increase in prices over time, which is inflation, in an economy experiencing growth is inevitable. Furthermore, it is accepted by most economists that a moderate rate of inflation is positive for the economy. In this regard, central banks try to control inflation to be kept within certain limits in order to exploit the positive effects of inflation and reduce the impact of negative effects. In this sense, monetary authorities maintain a constant struggle to control inflation and other monetary forces affecting the economy.

Increases in interest rates

Increasing interest rates is one of the main measures taken by central banks to reduce inflationary pressure when this is high. Moreover, it is easy to apply strategy whose effects are usually seen reflected faster in the economy in comparison with the effects of other methods. By raising interest rates, the central bank raise the benchmark interest rate at which commercial banks will look when granting loans to their clients.

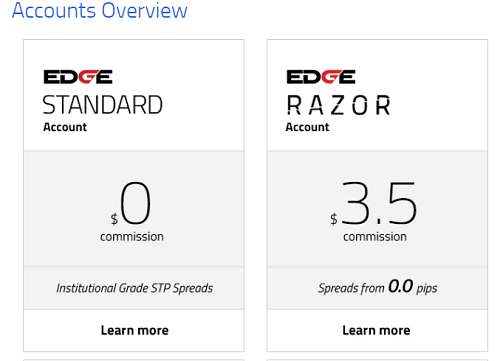

Types of Forex Trading Accounts

Standard Forex Accounts

The most common type of Forex account, this trading account has access to standard currency lots worth $100,000. Since the rules of leverage and margin are in order, this means that you don’t necessarily have to immediately invest $100,000 of capital to start a standard account. For a standard lot for trading, you only need to have $1,000 in the margin account.

Most brokers provide better perks and services to standard account bearers because of its adequate up-front capital. It is also the only type of account with each pip worth $10, meaning you get higher potential gains.

The Forex Market Requotes

When we trade in the currency markets at some point we will cross with requotes. While this does not happen all the time, it can happen and the trader should know what they are, what they mean and how to avoid them.

What is a re-quoting?

A re-quoting in the Forex market means that the broker with which we are trading is not able to provide us with an entry into the market based on the price we asked at the beginning when we send the order. Usually, this occurs in highly volatile markets in which prices move up or down very quickly, usually in the periods in which important economic or political news are announced but also can be caused by some event that had a strong impact on the market.

In essence, a trader decides to buy or sell a currency pair at a particular price and click the appropriate button on the platform to do this. By the time the broker receives the order, the market price has moved too fast for the broker to execute the order at the price. When this happens the broker shows the announcement of a re-quote in the trading platform in order to tell the trader that the price has moved and to give its client the opportunity to decide whether or not to accept the new price. Almost always the new price is worse than the price requested by the trader. That is why serious brokers ask their clients before executing the trade with the new price.

What is carry trading?

The carry trading is a strategy in which an investor sells a certain currency with a relatively low interest rate and buy another currency with a higher interest rate. The aim of this strategy is to get as profit the difference between the two interest rates, a benefit that may become attractive depending on the amount of leverage used. As the profit comes from the interest rate differential, you can make a profit even if the price of the currency does not change a single pip.

Although the Forex market operates 24 hours, is taken by consensus UTC 0 hours as the end and beginning of a new trading day. In Forex trading, at the end of each day is credited or charged to the account of the trader the spread between the interest rates of the two currencies of the currency pair in which the trader have open positions at this time (this is known as Rollover).

Forex Market vs Stock Market

Investing in the Forex market offers huge advantages over buying and selling shares in the stock market especially if you’re a small investor who does not have a large capital to invest. Here are the main advantages of the Forex market with respect to stock trading:

The Forex market operates 24 hours a day

The Forex markets operates continuously 24 hours a day, Monday through Friday. This market opens on Sunday at 14:00 hours (New York time) and closes on Friday at 16:00 hours (New York time). In this way, traders from around the world have the advantage of being able to react quickly to the main news of the market and can set their own schedules to trade as they have the possibility to trade during the trading sessions in the financial markets in United States, Europe and Asia.

How to calculate the position size in Forex trading?

Well, now that we know how to calculate the value of 1 pip, calculate the position size that will be used in a trade is really simple.

In this article we will not discuss about how much risk in a trade, which would be the subject of another article, so the first thing to calculate is the monetary amount you are willing to lose in the transaction.

Assuming for example that the size of our trading account is 2,000 EUR and we apply a monetary management in which we risk 1.5% of the account, it is easy to determine that the maximum loss we are willing to assume in a trade is 30 EUR (2000 EUR * 1.5%).

We assume also that the position opened will have a stop loss set in advance. Therefore, as the value of 1 pip is known, then would be easy to calculate the loss in the account in case the price reaches the stop loss for each contract involved in the transaction.

Let’s see some examples: