What is the Rollover?

Every time we trade in the currency markets, all positions must be closed within two business days. Despite this, every trader has the option to renew all his open positions easily without the need for physical delivery of the foreign exchange contracts with which he is negotiating.

For example, if a trader buys $10,000 on Monday is in the obligation to make delivery of those $10,000 no later than Wednesday of the same week, unless he want to renew the position, which is called Rollover. Currently, most Forex brokers include among their services to their customers the option of renewing their open positions automatically (the rollover is credited or debited automatically if the client does not close their positions before a certain hour) or manually, which is also known as tom/next swaps a trade for the next day of the position´s settlement.

Thus, rollovers or swaps involve the application of a credit or debit in the operator’s trading account, which is based on the positions that remain open in the market at precisely 17:00 pm EST and differentials in interest rates between the currencies that make up the pairs with which we are trading. In this case, if we have an open position in which we proceeded to sell the currency that has the highest interest rate, our trading account will be debited (the account will be charged with the difference in the interest rate applied on the total volume of the position). But if in that position the same currency was bought, the account will be credited by the broker (the money deposited in the account is equal to the interest rate differential applied to the size of the position).

In this way, we can define the Rollover as the interest paid or received by the investor or trader to keep open a position in the Forex market for longer than one day or more exactly for holding a position overnight. Each currency has an interest rate associated and because in the foreign exchange market all transactions are made with currency pairs, then each transaction involves besides two different currencies, two different interest rates. In the event that the interest rate on the purchased currency is higher than the interest rate of the currency sold, then the trader receives the rollover interest (positive rollover), but if the interest rate of the currency purchased is less than the interest rate of the currency sold, then the trade must pay the rollover interest (negative rollover).

We must take into account that both the interest and the procedures in respect of rollover may vary depending on the broker. In fact, there are brokers that due to the trading volume they generate for their liquidity providers are able to offer their customers highly competitive rollover rates to both sides of each currency pair with which these companies operate regularly.

In the table below you can check the interest rate differential between the currencies that make up the main currency pairs in the Forex markets and over which the rollovers are based on:

Currently, swap rates are calculated at the interbank level and represent financial instruments. Depending on the volumen that is being traded, the swaps may or may not be taken into account by the trader. For example, if we trade with microlots (1000 units of the base currency) the rollover value is of only few cents but if the volume of our trades is much higher (lots of 100000 units of the base currency) everything changes because the rollovers increases its value in proportion. This will be easier to understand with the examples shown at the end of the article.

Because the rollover depends on the interest rates of different currencies, its value varies from one currency pair to other. For example, the Rollover for the EUR USD may be $1 per lot while the Rollover for GBP USD could be $10 for one traded lot.

We must keep in mind that for intraday traders (traders whose trades duration is less than a day therefore their positions are generally closed before the 17:00 pm EST) the rollover has no effect whatsoever therefore it should not be taken into account.

When is charged the Rollover?

The start and end of daily operations in the Forex market is considered 17:00 New York time (even though the Forex market operates 24 hours a day without interruption). Any position in the market that is hold after 17:00 is considered to be kept for an additional interbank day (in other words is considered an overnight position) and therefore is subject to rollover. However, if a position is open at 17:01 is not subject to rollover until next day because it is not considered an overnight position, while a position that is opened at 16:59 will be subject to rollover precisely at 17:00. Both debit and credit due to rollover for all open positions is charged to the account at 17:00 which will be reflected in the balance during the next hour.

In most cases, banks around the world are closed on Saturday and Sunday, which means that the Rollover is not applied directly during these days. However, the interest corresponding to those two days is cleared on Wednesday of the following week, so that day is settled the rollover of 3 days. In the case of holidays the rollover is not settled, but the interest for one day is counted 2 business days before the holiday arrives. Generally, the Rollover interest of a holiday is applied in case the country of one of the currencies in which we are trading in the market have an important festive date.

For example, during the Independence Day of the United States (July 4), the country’s banks are closed and therefore the rollover interest for that day is implemented on July 1 at 17:00 for all currency pairs that include the U.S. dollar (USD) such as EUR/USD or GBP/USD.

Rollover Calculation

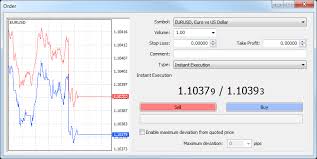

Normally, in the trading platforms of Forex brokers the credit/debit interest due to rollover appears in a column of the window where the market quotes and positions are shown. Likewise, if a trader holds open positions in the market for more than a day, the platform will tell him the amount credited or debited from the account due to rollover, which appears in the trades window.

The following examples show how rollovers are calculated for different currency pairs:

Example # 1: GBP/USD

Contract Value: 10,000 GBP (1 minilot is equal to 10000 units).

Opening Quotation: 1.8000 USD/GBP (dollars per pound).

Differential rates: GBP 5.00% – 2.00% U.S. = 3.00% = 0.030.

Calculation of daily Rollover: 10000 x 1.8000 USD/GBP x (0.030/360) x 1 day = +1.7496 USD per day.

Example # 2: USD/JPY

Operation completed: Sale of 2 lots of USD/JPY to be cleared the next day. In this sale trade the trader pays the rollover because the interest rate of the currency sold (USD) is higher than the interest rate of the currency purchased (JPY).

Differential rates: USD 2,00% – JPY 0,50% = 1,50% = (0.015).

Example # 3: EUR/USD

Operation completed: Purchase of 1 minilot of EUR/USD to be sold in three days. In this case the trader receives the rollover because the interest rate of the purchased currency (EUR) is higher than the interest rate of the currency sold (USD).

Opening Quotation: 1.35 USD/EUR (dollars per euro).

Differential rates: EUR 2,00% – USD 1,00% = 1,00% = (0.010).

The Rollover of these examples were calculated based on actual values of interest rates and currency prices. However, it is important to note that both interest rates and the prices are constantly changing so the rollvers too.

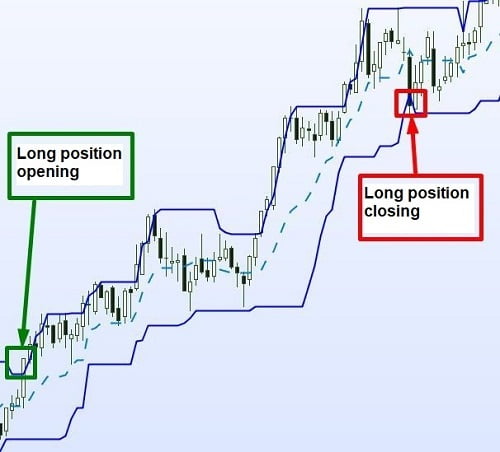

As mentioned above, if a trader has open positions at 17:00 pm EST, the system of the broker’s trading platform will debit or credit the rollover automatically directly from the trading account. Now, if a position is kept open for several days from 17:00 pm EST of the day it was opened, the amount of money credited or debited daily is equals to the rollover multiplied by the number of days that the position remained active before being closed.