- The Mexican peso recovers the levels reached before Trump launched its tariff threats.

- The MXN should lead the advances of emerging currencies this week in a context of lower risk aversion.

- Mexico will seek the ratification of its legislators in the new immigration and security agreement with United States.

MXN starts week positively

As part of the signed truce, Mexico will have to increase the presence of its National Guard on the border with Guatemala, while the immigration and security treaty will have to be ratified by the Mexican Congress. We can not rule out that any kind of delay on this front would result in additional risks to the Mexican economy and perhaps new commercial threats.

In any case, in the coming days, the greater appetite for risk assets motivated by the relaxation of commercial hostilities could boost emerging assets and create a more benign environment for the Mexican currency.

Technical analysis of the Mexican peso

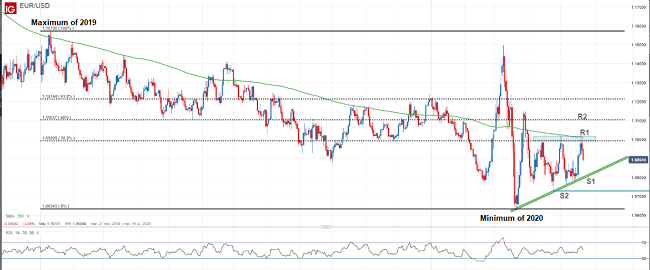

The euro loses strength and puts the 1.13 level at risk.

- The euro starts the week with moderate falls and retreats to the edge of the psychological level of 1.1300.

- The falls of the EUR/USD have a technical component, although they are mainly motivated by reports that the European Central Bank would be considering cuts in its interest rate in case economic growth continues to slow down.

- This week, market attention will focus on Mario Draghi’s speech in Frankfurt and the US inflation data.

The euro starts the week with an unfavorable sign and reverses part of its gains last Friday, in a day without major macroeconomic news. At the time of writing, the EUR/USD retreats around 0.3% and endangers the psychological threshold of 1.1300.

At the moment, the euro currency does not manage to benefit from the positive tone of the markets created by the end of the US tariff threats against Mexico and by some encouraging data from China and Japan.

The euro’s falls appear to be part of a technical corrective, after it soared about half a percentage point on Friday after disappointing NFP figures. However, the main bearish catalyst was a report published by the Reuters news agency on Sunday. According to the article, two sources familiar with the monetary policy discussions of the European Central Bank indicated that the institution would be willing to reduce its interest rate if economic growth and inflation continue to weaken.