Investor sentiment remains fragile due to riots in Hong Kong, tensions in the Middle East and concerns over trade negotiations between the United States and China.

The US trade representative, Robert Lighthizer, said over the weekend that the two days of talks with China were productive, while the Chinese Ministry of Commerce described the talks as constructive and noted that they had made concrete agreements to move forward in the October high-level talks.

The United States eliminated tariffs on more than 400 Chinese products in response to requests made by several US companies. But investor sentiment was affected upon learning that Chinese officials unexpectedly canceled their visit to US farms scheduled for this week.

The president of the United States, Donald Trump, confirmed that China had begun to buy American agricultural products, but stressed that it was not enough since what he is looking for is a complete trade agreement, a “great agreement”.

On the geopolitical front, it should be noted that the Pentagon ordered the deployment of more troops in the Gulf region to strengthen the air and missile defenses of Saudi Arabia, after the attack on the facilities of the state oil company Aramco.

The US Secretary of State, Mike Pompeo, said Sunday that the additional troops are only for “deterrence and defense,” and that Washington aimed to avoid a war with Iran.

In the United Kingdom, the Labor Party has started its annual conference this weekend, the party could decide on Monday between campaigning to remain in the European Union through a second referendum, or postpone the decision until after elections.

Asian markets began the week with falls, the Shanghai composite index fell 0.98% and was again below 3,000 points. The Hong Kong Hang Seng lost 0.72% after another weekend of violent protests in which protesters shattered a railway station and a shopping center. The Nikkei 225 of Japan remained closed for holidays.

Wall Street closed Friday’s session down after learning that the Chinese government delegation had canceled the visit to farms in the state of Montana that it planned to do this week before returning to China.

The Dow Jones fell 0.59% to 26,935 integers, the S&P 500 index lost 0.49% to 2,992 units, and the Nasdaq closed with a 0.80% drop at 8,117 points.

Europe has started the week following the trail left by the Asian and US markets and in the first trading bars the DAX 30 in Frankfurt is trading with a decline of 1.10%. The FTSE 100 in London falls 0.30%, the CAC 40 in Paris moves back 0.74% and the Euro Stoxx 50 loses 0.89%. The Ibex 35 trades with a 0.80% drop around 9,100 points.

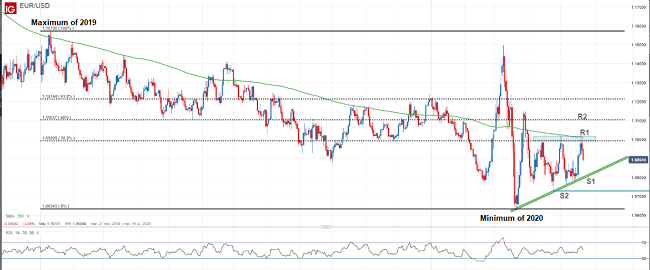

In the currency markets the dollar index resumed the upward path, in the Asian session on Monday it was again above the resistance located at 98 points. The euro is trading below $1.10 and is dangerously close to the lows of the year, while the pound is once again below $1.25.

In the daily chart of the EUR/USD we observe that the declines have slowed just in the support located at $1,0970, where the price reached annual lows recently. If the pair ends up breaking this price level, the long-term downtrend from February 2018 would be reactivated.

In commodity markets, tensions in the Middle East raised concerns about oil supply and are driving oil prices. The barrel of Texas WTI crude oil is being traded at the European opening at $68.70. The price of spot gold rises to $1,516 due to increased risk aversion.

In the economic field, attention will be focused on the publication of the manufacturing PMIs of the main European countries and the United States.