Asian stock markets began the last week of August with sharp declines due to escalating trade tensions between the United States and China, which weighed on confidence in the global economy, caused a stampede of stock market investors, and an increase in the demand for safe assets such as government bonds and gold.

The yields of the 10-year US Treasury debt fell to their lowest level since mid-2016, while gold reached its highest level since April 2013, after China announced the imposition of new tariffs on American products worth $75 billion.

The president of the United States, Donald Trump, responded immediately by announcing additional tariffs of 550 billion dollars on Chinese products. In addition, Trump said on Twitter that he had ordered the large companies in his country to seek alternatives to China immediately and to re-manufacture their products at home.

The White House chief said that “Our country has stupidly lost billions of dollars with China for many years. They have stolen our intellectual property at a rate of hundreds of billions of dollars a year, and they want to continue doing so. I will not let that happen! We don’t need China and, frankly, we would do much better without them. ”

The last escalation of the tariff battle overshadowed the statements of the president of the US Federal Reserve, Jerome Powell, announcing that the entity will act appropriately to guarantee the country’s economic expansion at a time when there are significant risks.

At the G7 meeting in France over the weekend, Trump caused some confusion by indicating that he may have had doubts about the new tariffs. Later in the day Trump will give a press conference together with French President Emmanuel Macron.

Stock markets are down

In the Asian stock markets, the Shanghai Stock Exchange closed the session on Monday with a 1.39% decline in 2,857 points, while Japan’s Nikkei 225 collapsed 2.17% to 20,261 integers .

Wall Street closed Friday’s session with one of the biggest daily dips of the year after the resurgence of commercial tensions between the US and China. The Dow Jones fell 2.37% to 25,628 points, the S&P 500 fell 2.59% to 2,847 integers, and the Nasdaq ended up closing with a 3% drop to 7,751 units.

In Europe, the IBex 35 fell 0.24% to 8,700 points, the DAX 30 in Frankfurt fell 1.15%, the CAC 40 in Paris lost 1.14% and the FTSE MIB in Milan lost 1, 6% This Monday the main indices of the region begin the week with general falls that are around 0.30% on average.

The falls in the European stock exchanges are being moderated because this morning the Chinese vice premier, Liu He, has tried to calm the tensions by pointing out that China hopes to resolve the commercial war with the US with calm negotiations, and that it does not seek to increase tensions. On the other hand, Donald Trump has confirmed that China called his negotiating team this Sunday to restart trade negotiations.

In the Forex, the Chinese yuan fell to a minimum

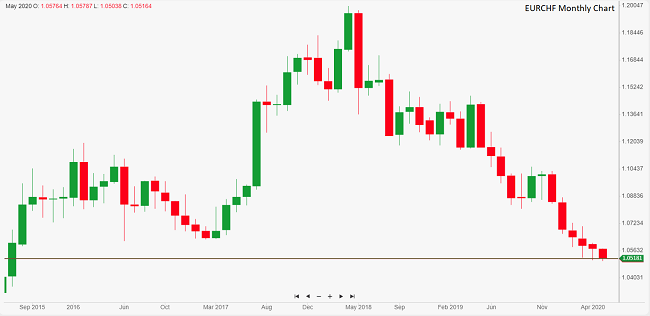

In the currency markets, the Chinese yuan fell 0.6% to a minimum of 11 years. The central bank of China set the exchange rate at 7.0570 yuan per dollar, thereby alleviating concerns that Beijing would let the currency depreciate to maintain the competitiveness of its exports against the new US tariffs.

The dollar index moved away from its annual highs by registering a fall of 0.54% to 97.53 points. In today’s Asian session it remained stable without registering significant changes. The US currency plummeted 1% against the yen and closed at 105.40 yen, at annual lows.

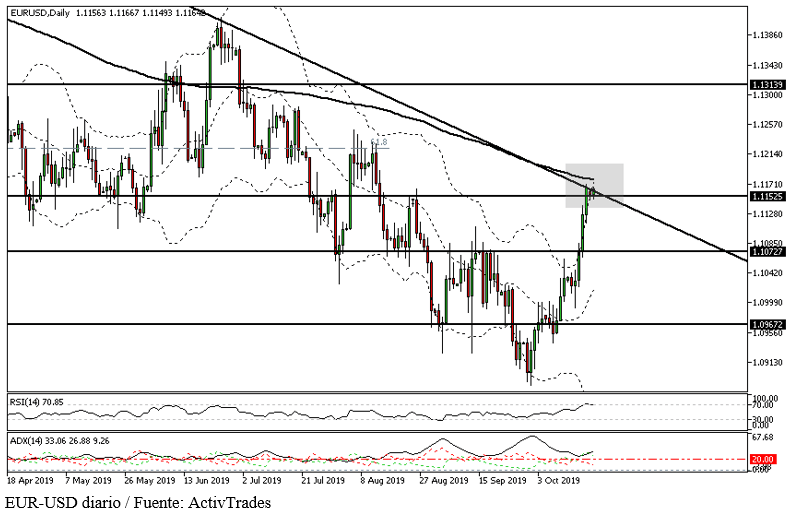

The euro rose 0.54% to $ 1,1143, while the sterling revalued 0.26% to $ 1,2283 per pound. Both currencies have yielded some ground against the dollar in the Asian session on Monday.

In commodities markets, the price of spot gold shot up 1.95% to $1,526 per ounce, driven by trade tensions, the dollar’s decline, and bond yields. The price of Texas WTI oil closed down 2.13% at $54.17 per barrel.

In the economic field, attention will be focused today on the publication of the IFO indices on the climate and business expectations of Germany, and durable goods orders from the United States.