Global stock markets began cautiously in September after the United States and China imposed new simultaneous tariffs, thereby raising market concerns about the slowdown in global growth.

The US imposed tariffs of 15% as of Sunday on a series of Chinese products that include footwear and some appliances such as smart watches and televisions, while Beijing imposed new tariffs on soybeans and US crude.

China reacted to the entry into force of US tariffs on Chinese exports with new tariffs on US products between 5% and 10%. However, the Asian giant has responded cautiously to Washington’s taxes, taxing only one third of the 5,000 expected products.

However, the negotiations planned for the end of September between the two countries continue. China will continue to negotiate despite the new tariffs, but the Asian nation will not be willing to meet US demands either.. Trade tensions between China and the United States are not expected to continue to deteriorate, but they are not expected to resolve easily.

This Monday’s session will be conditioned by the closure of the US and Canadian markets due to the celebration of Labor Day.

The Asian markets closed the first session of September with a fall of 0.41% in the Nikkei 225 of Japan, in contrast to the 1.31% rise recorded by the Shanghai composite index.

Chinese stocks resisted the downward trend thanks to good manufacturing data and the promise of the State Council of China to increase its support for the economy to try to counteract the impact of the tariff battle.

The China Manufacturing Purchasing Managers Index (PMI) showed on Monday that the activity of the factories expanded unexpectedly in August from 49.9 to 50.4 points, and a fall to 49.8 was expected. Note that the indicator exceeded the 50 point barrier. which separates the expansion of the contraction in the activity.

Wall Street closed the trading session on last Friday with mixed behavior. The Dow Jones rose 0.16%, the S&P 500 index gained 0.06% and Nasdaq fell 0.13%. The month of August ended with losses of 0.31% in the Dow Jones, 0.19% in the S&P 500 and 0.51% in the Nasdaq.

European indexes begin the month of September with slight increases that are around 0.15% on average in the first trading bars. However, the London FTSE 100 had a 0.67% rise to 7,255 points, driven by the relentless fall of the pound sterling. The Ibex 35 remains stable, trading at the same closing levels of last Friday and trading slightly above 8,800 points.

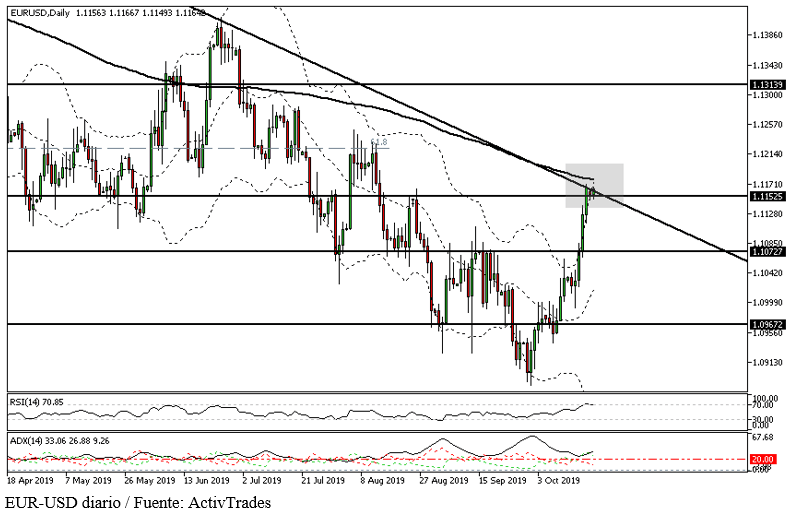

The euro continues to fall in the currency market

In the Forex markets, it should be noted that the dollar index trades at its highest level since May 2017 at 98.81 points. The euro drilled the support located at $1.1070 and is currently trading at 1.0980, while the British pound is trading at $1.2111 and is close to the lows of the year.

In the daily chart of the GBP/USD currency pair, you can see how the support located at 1.2135 dollars has just broken down.

In the commodity markets, Texas WTI oil fell 2.8%, to $ 55.10, due to the possible impact of Hurricane Dorian and information that Russia’s production cuts will be less than agreed with OPEC countries. The price of spot gold remains stable, trading at around $1,520 per ounce.

In macroeconomic front, attention will be focused on the publication of manufacturing PMIs of the main countries of the eurozone.