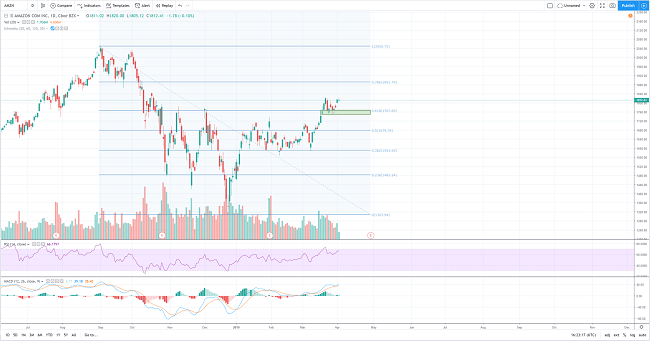

After a year-end crash that rang several alarms (there were losses of up to 30% in the fourth quarter of 2018), Amazon shares are given a good reprieve in the stock market. In fact, the largest e-commerce company in the world has marked a bullish path so far in 2019. Now, after accumulating profits of up to 24%, AMZN is approaching resistance levels that could be crucial to revisit its historical maximums.

Amazon in 2019: markets regain confidence in the giant

Or at least that is what has happened to date. The company begins to gain strength and remains solidly among the largest in the world, according to its market capitalization. According to TradingView data, Amazon capitalizes a strong figure of 891 billion dollars. With these numbers, it becomes the third public company with the highest market capitalization in the financial markets. It is surpassed only by Apple and Microsoft, whose shares also rebounded in the period in question. In the case of Microsoft, its shares reached record highs in March. But the distance between these three companies, and Alphabets (Google), is not very loose. Although MSFT leads the ranking, it surpasses Amazon by about 23 billion dollars. Meanwhile, Apple drops to 907 billion dollars after becoming the first company to reach a trillion dollars (1 TUSD) in capitalization, which was evident in clear overbought levels.

In any case, Amazon has been involved in several controversies in recent months. Its executive director, Jeff Bezos, was involved in a controversy with the US tabloid National Enquirer. In fact, he published an extensive article in Medium, accusing them of blackmail. Similarly, they announced the possible opening of a headquarters in New York. However, the plan was canceled weeks later – although it would be reconsidering, according to CNN. However, these controversies have not affected the growth of the company, whose plan to increase expenses in 2019 seems to have worked.

Amazon shares have room for further growth

The leader in technical analysis of the company Oppenheimer & Co, has given his projections to Amazon in an interview with CNBC. The expert assures that Amazon shares have room to grow and that the fundamental and technical factors are aligned.

“In the graphics, the key point for us is that this is the most tactical Amazon has been for years. We say this based on the weekly MACD indicator. This indicator is rising from its higher oversold levels since 2014. We believe that this is the resumption of the long-term uptrend, which is still at stake. “

The expert ventured to state his objectives during the interview. He assured that the $ 1730 level will now act as support. After the “resumption” of the trend, it expects the shares to touch new highs above USD 2000.

A quick look at the performance of AMZN

Although a full technical analysis is not included, we will take a look at the most important technical indicators. The data shown below correspond to those reported by the CBOE and are represented in the TradingView graphical tool. Zoom out, we see that Amazon’s stocks have been unstoppable, marking a clear bullish trend in the last 10 years, with some technical corrections, of course.

The Fibonacci retracements coincide with Wald’s assertions. In this way, resistance around 1750 ~ 1770 was overcome in March and now acts as support. Taking a look at MACD levels, Wald’s assertions are also confirmed: they reached their historical oversold levels at the end of 2018. Something similar happened for the Relative Strength Index (RSI), although in a more neutral area. In case the last support is maintained, Fibonacci shows a previous resistance to the historical maximums (above 2050 USD). We talked about the area above the 1890 USD, which could be the last resistance before AMZN launches to test new highs.